Donald Trump has pushed the Federal Reserve again into the middle of the crypto macro narrative, telling reporters he “already” is aware of who ought to succeed Jerome Powell and triggering a pointy repricing in real-money prediction markets in favor of Kevin Hassett.

In remarks within the Oval Workplace, Trump stated: “I believe I already know my selection,” when requested in regards to the subsequent Fed chair. He added that he would “like to get the man at the moment in there out proper now, however persons are holding me again,” a transparent swipe at Powell with out naming him. Trump additionally hinted on the form of his shortlist, saying, “We now have some stunning names and now we have some customary names that everyone’s speaking about. And we might go the usual approach. It’s good to each from time to time go politically appropriate.”

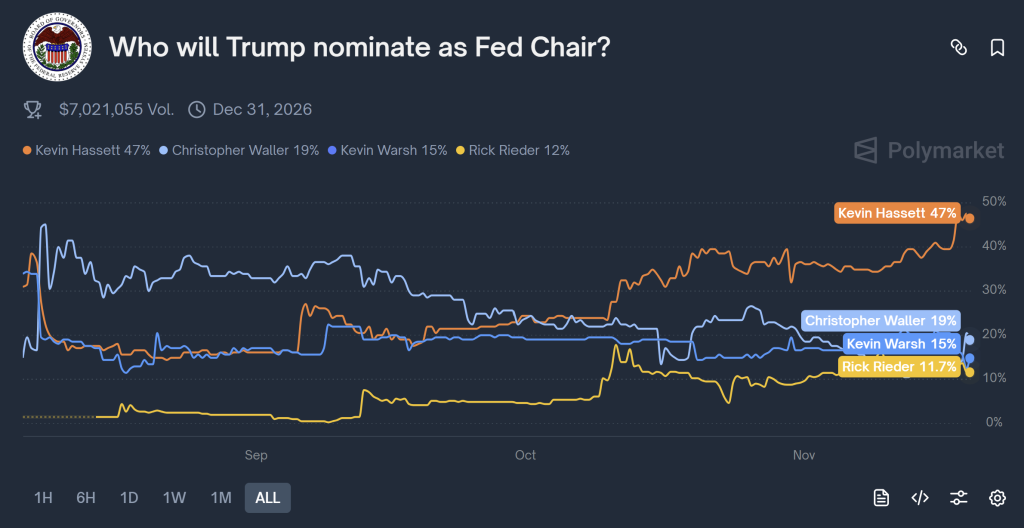

That was sufficient to maneuver markets. On Polymarket and Kalshi, contracts on “Who will Trump nominate as Fed Chair?” rapidly converged round Hassett, with odds within the mid-40s to high-40s % vary. Jim Bianco summarized the shift by writing: “He needs Bessent however will take Hassett. The remaining get to take selfies within the Oval Workplace.” In a follow-up, he famous that “Hassett (blue) is separating himself from the pack and is on the verge of being the primary individual to commerce over 50%,” as prediction markets pushed his contract nicely away from rivals.

Kalshi’s personal social media account underscored the transfer: “BREAKING: Trump thinks he ‘already is aware of’ who will likely be subsequent Fed Chair. 47% likelihood it’s Kevin Hassett.” The pseudonymous dealer Byzantine Basic zoomed out to the timeline, declaring that “Powell’s time period ends Could subsequent 12 months,” and sketching out a Q2 situation with “a FED chair that listens to Trump” and “tariff dividends for plebs,” earlier than cautioning that “you by no means know with Trump after all, however man, there might be one thing cooking.”

Associated Studying

What Hassett May Imply For The Crypto Market

For macro-oriented crypto merchants, the hot button is the coverage sign embedded in these possibilities. Hassett is broadly perceived as extra dovish than Powell and extra aligned with Trump’s choice for simpler monetary situations. That’s the reason dealer CRG (@MacroCRG), framed the second because the arrival of a “New hand picked tremendous dove as Fed chair coming quickly.”

Macro and crypto analyst Alex Krüger went additional, arguing that the Fed-chair race is the true medium-term driver for threat belongings as soon as the present FOMC noise fades. “Right here’s the following macro catalyst after the FOMC. A bullish catalyst the market is paying no heed to atm. It’s laborious to see into the horizon when confused to the marrow in regards to the current,” he wrote, including that “essentially the most bullish decisions could be Hassett (possible), Rieder (presumably) and Zervos (unlikely).”

Associated Studying

The rationale crypto merchants care is simple: crypto belongings commerce as high-beta, liquidity-sensitive threat belongings. A chair seen as extra prepared to chop charges sooner, tolerate simpler monetary situations or reply aggressively to fairness and development weak point is, in market logic, a structural tailwind for the long-run liquidity setting that underpins speculative flows into bitcoin and different cryptocurrencies.

On the identical time, Trump’s open stress on Powell and his readiness to speak about changing the Fed chair in overtly political phrases reinforce one other strand of the crypto thesis. The extra buyers fear in regards to the politicization of US financial coverage and the erosion of central-bank independence, the extra compelling the “Bitcoin as hedge towards political and institutional threat” narrative turns into for a subset of allocators.

For now, nothing has modified on the Fed. Powell stays in workplace, and all that has moved is a set of likelihood distributions on prediction markets. However as these distributions shift towards Kevin Hassett, crypto merchants are already treating the possible hand-off as a latent, probably important bullish tailwind constructing within the background.

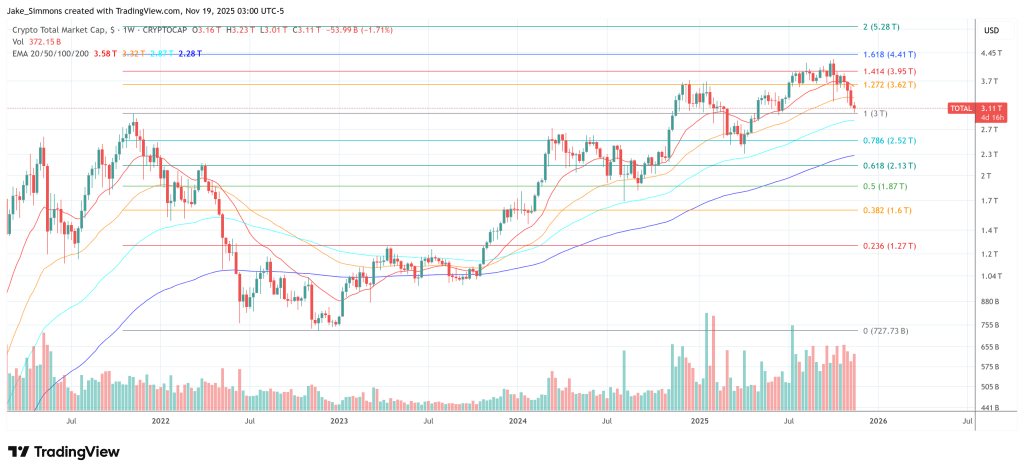

At press time, the full crypto market cap was at $3.11 trillion.

Featured picture created with DALL.E, chart from TradingView.com