Bitcoin has entered one among its most important phases of the yr as intense promoting strain briefly pushed the value beneath the $90,000 degree, shaking market confidence and triggering widespread worry. Bears argue this breakdown marks the start of a deeper bearish cycle, with liquidity worsening and threat sentiment collapsing throughout world markets.

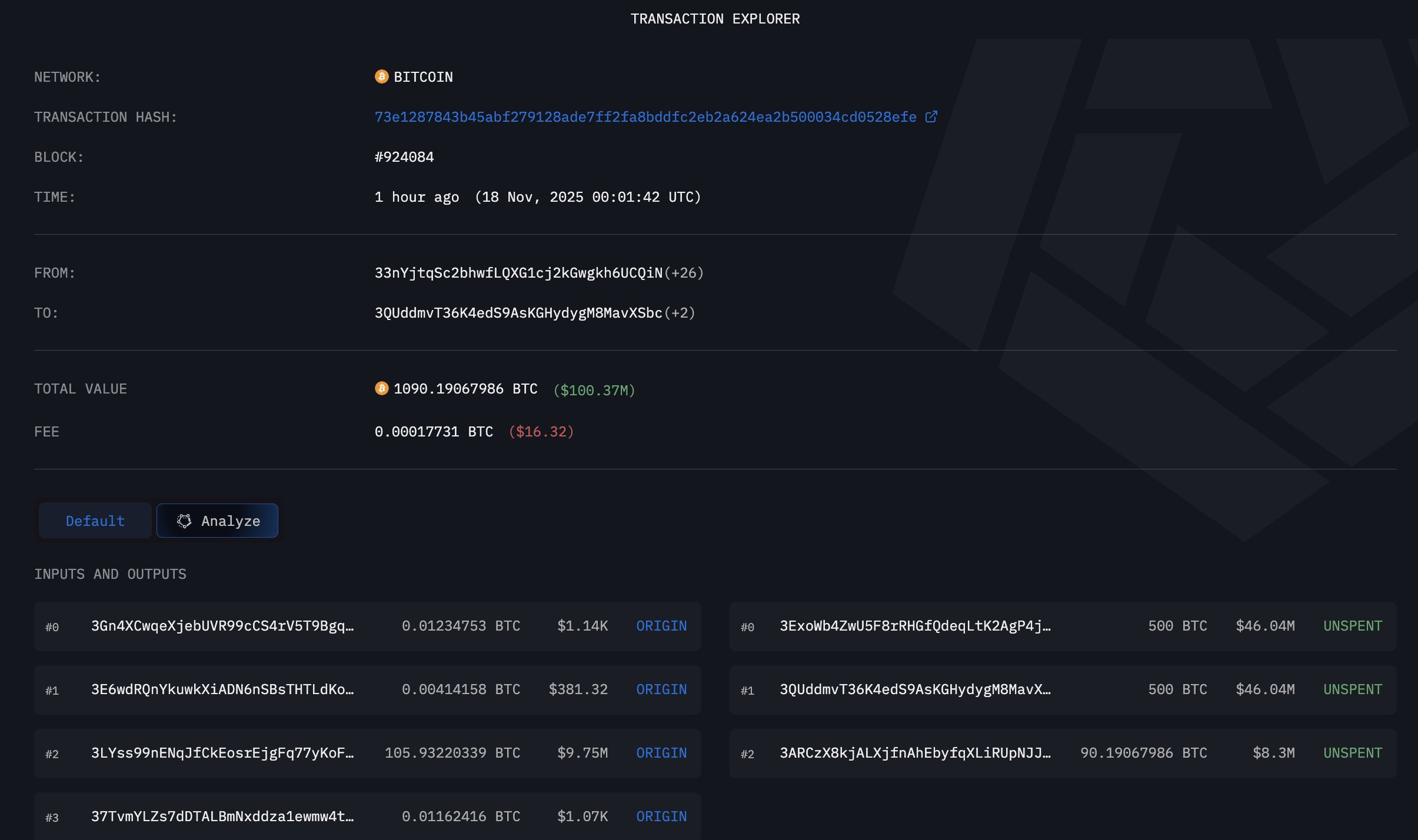

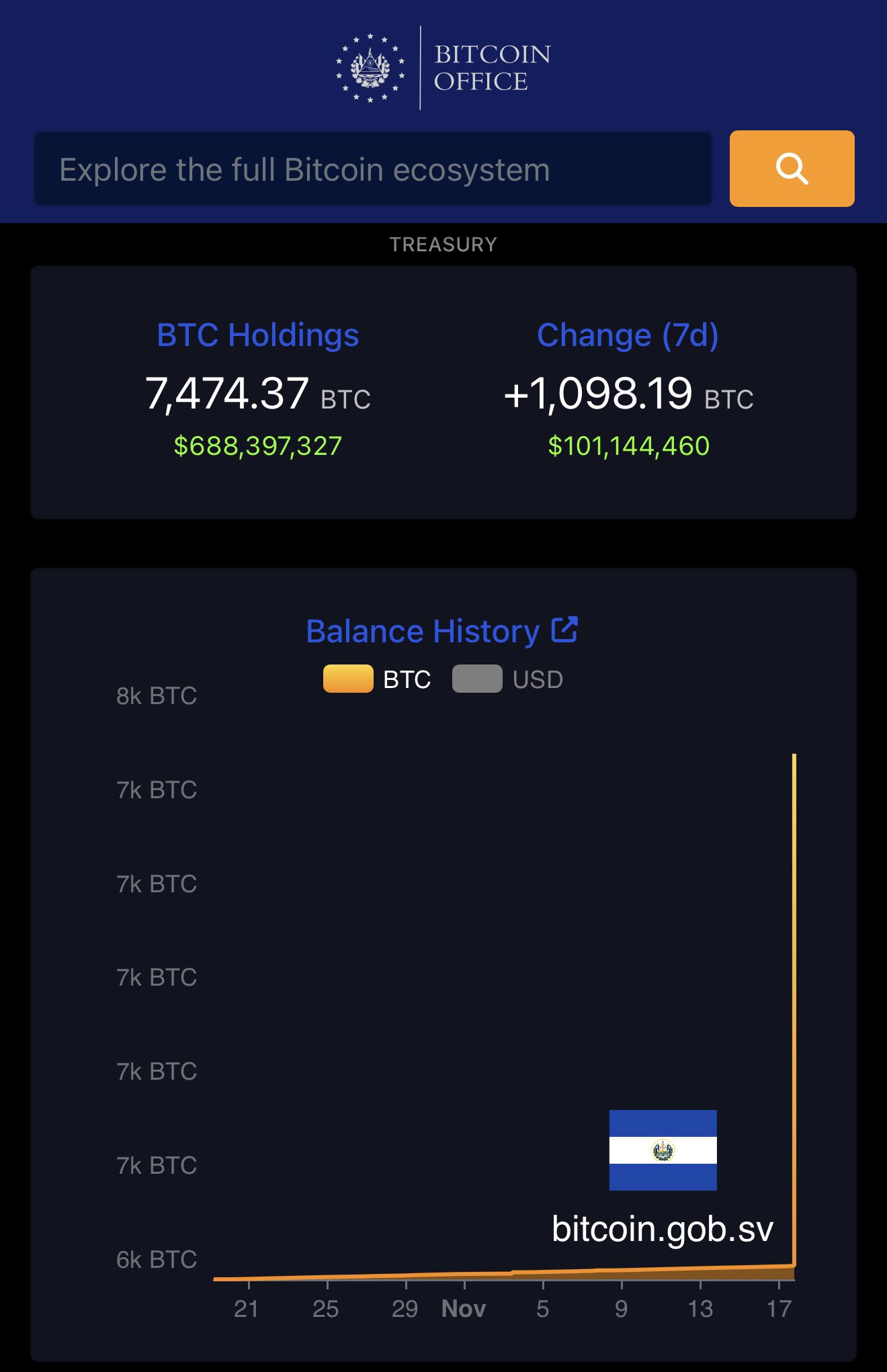

But, regardless of the rising bear-market narrative, main gamers are signaling the other — long-term conviction. In keeping with Lookonchain, El Salvador is aggressively shopping for the dip, reinforcing its dedication to Bitcoin at the same time as volatility surges. Past its ongoing program of buying 1 BTC per day, the federal government executed a big purchase just some hours in the past, including 1,090.19 BTC price roughly $101 million to its holdings. This sudden accumulation stands in stark distinction to the broader market panic.

Whereas retail sentiment stays fearful, strikes like this spotlight the rising divide between short-term merchants reacting to cost swings and strategic patrons specializing in long-term worth. As Bitcoin hovers close to key assist ranges, the market now faces a defining second: capitulation or accumulation.

El Salvador’s Daring Transfer Amid Panic

El Salvador’s sudden Bitcoin buy has added a dramatic twist to an already tense market atmosphere. President Nayib Bukele shared a screenshot of the transaction and BTC holdings (7,474.37 BTC) on X, accompanied by a easy however telling caption: “Woa.”

The message, transient but highly effective, immediately captured the eye of the crypto group. At a second when worry is dominating sentiment and merchants are scrambling for security, Bukele’s response displays a markedly totally different mindset — one grounded in conviction reasonably than panic.

With Bitcoin breaking beneath $90,000 earlier as we speak, many market contributors interpreted the transfer as affirmation of a looming bear market. Liquidations surged, volatility spiked, and social sentiment hit extremes not seen since earlier corrections this yr.

Sturdy arms — long-term buyers, sovereign entities, and institutional accumulators — are more and more framing the latest pullback as a strategic entry level. This stands in stark distinction to short-term merchants capitulating below strain. Traditionally, such divergences have marked pivotal cycle moments the place distribution flips to accumulation.

Bitcoin Worth Evaluation: A Important Breakdown Close to Multi-Month Lows

Bitcoin’s newest value motion exhibits a pointy deterioration in market construction, with BTC now buying and selling close to $91,000 after a steep rejection from the $110K–$115K area. The chart displays a transparent lack of momentum: decrease highs, accelerating promote quantity, and a decisive breakdown beneath the important thing 200-day transferring common, a degree that had acted as macro assist all through most of 2025.

Essentially the most regarding sign is the clear break below $95K, a zone that beforehand served as a powerful demand area throughout a number of pullbacks. Shedding this degree has opened the door to deeper draw back, and BTC is now testing the subsequent vital assist space between $88K and $90K, marked by the 300-day MA and prior consolidation construction from early 2025.

Quantity has spiked on the sell-off, confirming that this isn’t a low-liquidity dip however a broad risk-off transfer. The sample resembles a cascading liquidation occasion, with consecutive lengthy squeezes intensifying the decline.

Regardless of the bearish strain, BTC stays above the broader bull-market base construction shaped round $80K–$85K, which means the macro pattern isn’t absolutely damaged but. Nonetheless, bulls should reclaim $95K shortly to stop momentum from slipping additional.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.