- LTC rises 4% however fundamentals and ETF demand stay weak.

- Destructive funding charges present shorts gaining management in derivatives.

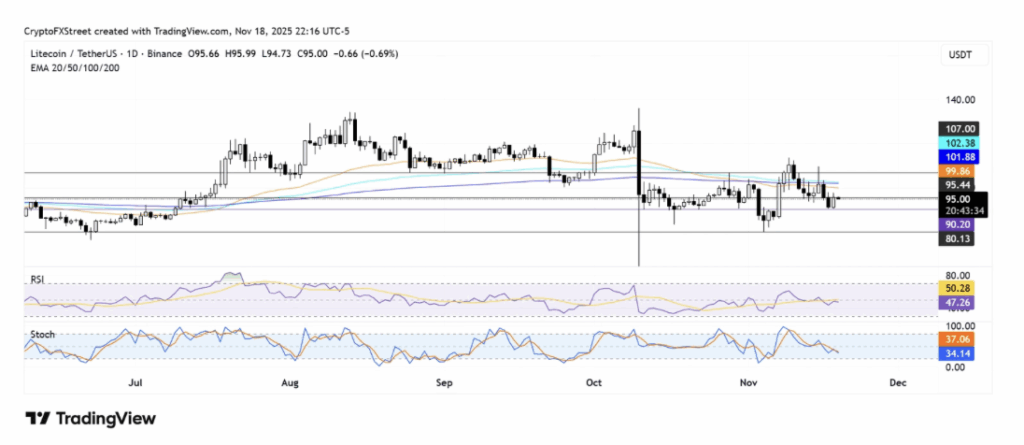

- Litecoin should break $95.4 and a number of EMAs to flip bullish; shedding $90 dangers a drop to $80.

Litecoin is up round 4% throughout the early Asian session on Wednesday, bouncing together with the broader crypto market after three straight pink days. It’s a good restoration, although nothing dramatic, and the basics behind the Bitcoin fork nonetheless look… nicely, cautious at finest. Santiment knowledge reveals that the entire provide of LTC in revenue fell to 57%, and as soon as that occurred, promoting strain ticked up. Traders have been locking in losses and grabbing what revenue they will — largely those that purchased inside the final two months and at the moment are reshuffling their positions.

Apparently, when the provision in revenue retains dropping, older cash traditionally begin becoming a member of the sell-off. That makes this metric one to look at carefully, as a result of it will probably let you know if long-term holders are getting nervous or in the event that they’re nonetheless holding regular.

Litecoin ETF Demand Stays Weak as Derivatives Flash Warning Indicators

Weak spot isn’t simply on-chain — you may see it within the ETF market too. U.S. spot Litecoin ETFs have failed to collect significant traction since launching final October. In line with SoSoValue, they’ve attracted simply $7.26 million in cumulative web influx. For context, that’s extraordinarily low, and Canary’s LTCC remains to be the one LTC spot ETF obtainable within the U.S. The dearth of demand hints that conventional traders aren’t speeding towards Litecoin the best way they’ve with Bitcoin and even Solana.

Derivatives inform an identical story. Litecoin funding charges turned damaging twice up to now two days, which means brief merchants are slowly gaining management within the futures market. Destructive funding charges imply shorts are paying longs — an indication that bearish strain isn’t going wherever simply but. Open curiosity has recovered a bit to five.57 million LTC, however it’s nonetheless miles under the 8.80 million LTC seen earlier than the October 10 leverage flush.

LTC Struggles With Main Resistance as Momentum Weakens

On the worth chart, Litecoin bounced cleanly off help at $90.2 however is now urgent in opposition to resistance at $95.4. If LTC can break above that, it’ll run straight into one other problem — the confluence of the 50-day, 100-day, and 200-day EMAs, all stacked collectively like a wall. Breaking via that cluster would lastly flip momentum bullish, however for now it’s appearing as a ceiling that LTC can’t fairly crack.

To the draw back, shedding $90.2 opens the door to a deeper fall towards $80, a stage that held throughout earlier corrections. Each the RSI and Stochastic Oscillator sit under impartial territory, signaling that bearish momentum remains to be the dominant drive. Even with the small bounce, Litecoin wants stronger demand — ideally each on-chain and in derivatives — earlier than any significant development reversal can kind.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.