Be a part of Our Telegram channel to remain updated on breaking information protection

The Solana worth plunged 3% previously 24 hours to commerce at $136.60 as of 4:29 a.m. EST on buying and selling quantity that surged 69% to $9.5 billion.

This comes as VanEck launched its Solana ETF (exchange-traded fund) on Nasdaq. VanEck is waiving its sponsor payment for VSOL at launch for the primary $1 billion in property or till February 17, 2026, whichever comes first.

VSOL turned the second spot SOL ETF within the US and presents a staking yield of 6.57%.

🚨BREAKING: VanEck’s @Solana ETF goes dwell for buying and selling, seeding with $7.32 million.pic.twitter.com/4LbSnyZRVG

— SolanaFloor (@SolanaFloor) November 17, 2025

The fund trades on the Cboe BZX Change with a 0.30% sponsor payment waived. In the meantime, SOL Methods additionally agreed to waive its 0.28% staking supplier payment throughout the identical interval.

Gemini Belief Firm would be the major custodian, and Coinbase Custody Belief Firm will present further custody companies.

State Avenue Financial institution and Belief Firm deal with money custody and fund administration. Van Eck Associates Company offered $10 million in seed funding on Oct. 29.

With the ETF opening up an area for establishments to speculate, will the Solana worth surge?

Solana Value Drops Into Key Assist Zone As Bearish Strain Intensifies

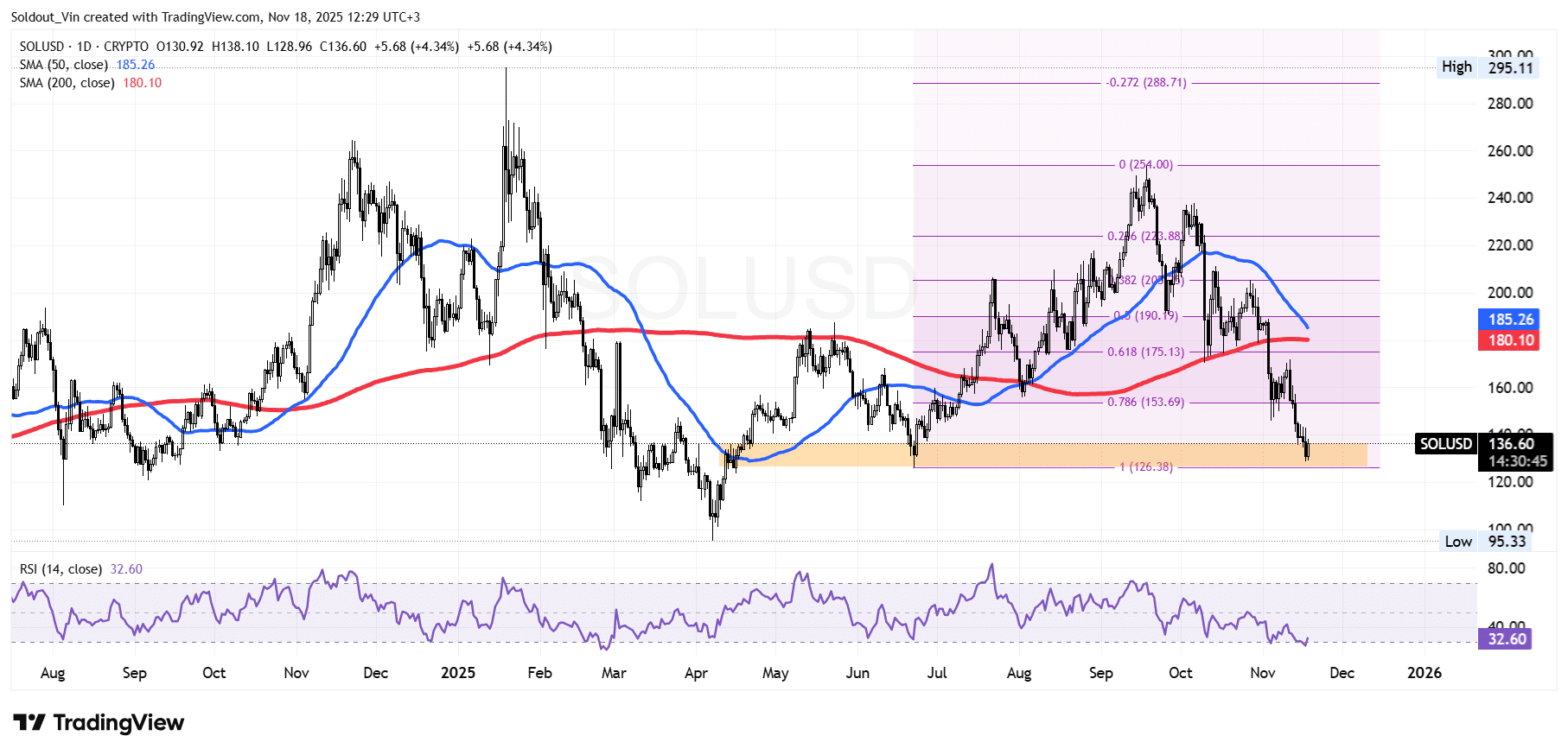

After rallying strongly from the $126 zone in June, the SOL worth pushed upward towards the $254 area in September.

Nevertheless, the Solana worth encountered some resistance at this degree, with the rejection initiating a multi-week corrective part during which SOL traded inside a step by step weakening construction, transferring from delicate consolidation right into a deeper bearish retracement.

Bulls tried to defend the 0.382 and 0.5 Fibonacci ranges in October, however persistent promote stress pressured the value under the 0.618 degree at $175 and later beneath the 0.786 retracement close to $153.

This downward stress has now pushed the value of SOL immediately into the foremost demand zone between $126–$135. Solana worth motion within the final classes exhibits a transparent contact of this zone following a speedy drop, which cements the general market uncertainty.

Additional strengthening the bearish narrative, the 50-day Easy Shifting Common (SMA) has curved sharply downward and presently sits barely above the 200-day SMA.

Furthermore, the Relative Power Index (RSI) has dropped in the direction of the 30-oversold degree, presently at 32. This exhibits the depth of the bearish momentum but in addition means that SOL could also be approaching circumstances the place reduction bounces are frequent.

SOL Value Prediction

Primarily based on the SOL/USD chart evaluation, the Solana worth is exhibiting agency bearish momentum because it trades under each the 50-day and 200-day SMAs and has damaged beneath every main Fibonacci retracement degree.

If bearish stress continues and SOL closes decisively under the $126 degree, the subsequent doubtless draw back goal sits close to $110, with additional decline doubtlessly extending towards $95.

Nevertheless, if oversold circumstances set off a buyback for the bulls, preliminary resistance lies round $153, close to the 0.786 Fib degree. Additional restoration would require reclaiming the $175 zone and breaking above the 50-day SMA, which might weaken the bearish outlook.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection