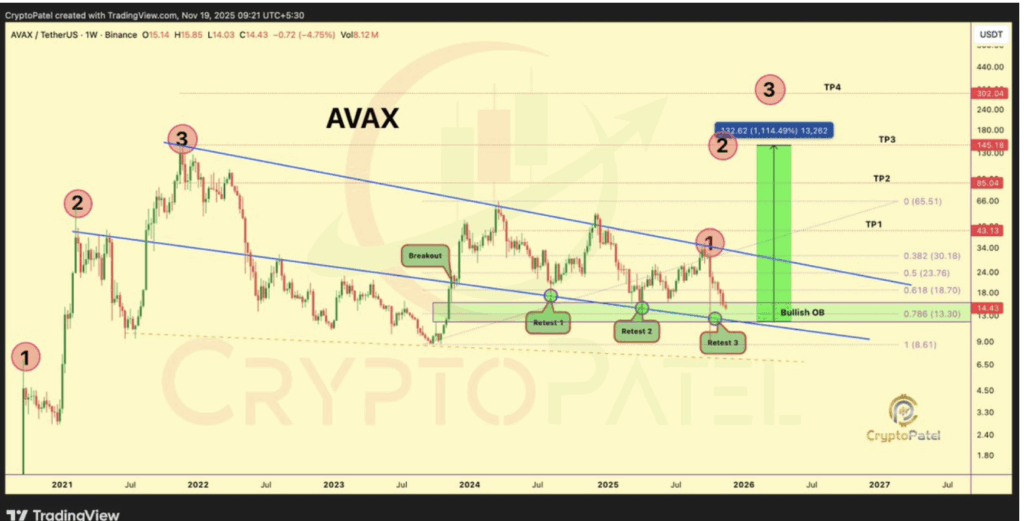

- Avalanche sits inside a multi-year wedge close to a 4-year assist cluster, hinting at a attainable long-term accumulation space.

- Crypto Patel’s chart notes repeated retests and deep compression, with potential upside targets based mostly on historic construction.

- AVAX stays down almost 90% from its peak, and this zone has change into a key space merchants are looking ahead to any signal of enlargement.

Typically a chart doesn’t shout… it simply type of hums within the background, giving off small clues lengthy earlier than an actual transfer even thinks about forming. Avalanche sits in a type of calm pockets proper now, the place worth motion slows down simply sufficient for the sample to begin making extra sense. Crypto Patel shared a chart on X that blends long-term construction with a decent assist cluster, virtually like a market narrative inching towards a turning level. Every candle appears to push nearer to a zone that has held agency for years, hinting that one thing may be brewing below the floor.

A uncommon assist cluster constructed from a number of long-term indicators

On Patel’s chart, AVAX is tapping what he calls a closing accumulation zone—mainly the place the place long-term patrons are likely to reappear if the market continues to be wholesome beneath the noise. A 4-year assist degree, the 0.786 Fibonacci retracement, and the underside of a multi-year wedge all stack collectively on this similar space. Setups like this don’t type by chance, and worth has returned to this zone a number of instances during the last 12 months, virtually prefer it retains checking the ground to ensure it’s nonetheless stable. Avalanche is already down about 90% from its 2021 peak, and Patel marked $15 to $11 as a possible area for anybody learning accumulation patterns—zones the place bigger gamers generally begin quietly rebuilding positions.

Wedge retests reveal a sluggish however regular combat between patrons and sellers

Patel’s chart highlights three clear retests of this zone. The primary retest confirmed the wedge boundary, the second bolstered it once more, and the third pulled worth proper again into the identical liquidity pocket created earlier within the cycle. It offers the chart a form of push-and-pull storyline—sellers drove worth down, patrons defended, sellers made one other try, patrons stepped again in. Now worth is sitting at the exact same flooring as soon as extra. This type of repetitive testing usually hints {that a} base is forming, particularly when the broader market nonetheless feels unsure or kinda burnt out.

Because the wedge tightens, the compression often builds strain that finally forces a breakout. AVAX sits close to the decrease fringe of this multi-year wedge, and Patel’s chart lays out projected targets far above—round $43, $85, $145, and even $302. These aren’t ensures, simply technical projections pulled from historic ranges and previous construction. However a breakout from a multi-year wedge hardly ever occurs quietly; it sometimes follows lengthy stretches of sideways drifting, emotional dips, or sluggish declines… all issues Avalanche appears to be dwelling by way of proper now.

AVAX sits deep beneath its peak as merchants search for accumulation clues

Avalanche trades far beneath its previous highs, and when a token falls this a lot, the chart usually turns into extra fascinating than the sentiment surrounding it. Patel emphasised that the present zone aligns with a long-term viewpoint slightly than short-term noise, which is why so many merchants hold revisiting the setup. Value hovering close to $14.42 places AVAX at a steep low cost in comparison with its peak, and that alone is sufficient for analysts to begin re-examining multi-year constructions. When worth compresses into a decent nook of a long-term sample like this, endurance turns into an important piece of the puzzle.

Patel’s projection field reveals a possible transfer increasing upward from the wedge flooring towards the upper goal zones, all mapped from historic structural factors. Merchants aware of Fib ranges and multi-year pattern strains will acknowledge this method immediately. AVAX has been drifting inside this wedge for an extended whereas, tagging the identical construction repeatedly. Patterns like this have a tendency to separate opinions—some merchants see a dangerous entice, others see alternative slowly constructing. And truthfully, the chart leaves sufficient house for each readings to really feel legitimate proper now.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.