Abstract

The asset adjustments palms round 3,000, beneath all key each day shifting averages, which factors to a tender however not but capitulated pattern. Day by day momentum is weak, with RSI leaning towards oversold territory whereas MACD stays in damaging territory, but with out an aggressive draw back acceleration. Furthermore, Bollinger Bands present worth hovering nearer to the decrease band, hinting at persistent draw back stress but in addition rising mean-reversion odds. Common true vary on the each day chart highlights elevated however manageable volatility, leaving room for each sharp squeezes and renewed selloffs. On the similar time, the broader crypto market is barely down on the day, whereas Bitcoin dominance close to 57% confirms that capital at the moment favors the benchmark over giant altcoins. Lastly, sentiment is deeply pessimistic, which traditionally can precede robust countertrend rallies but in addition justifies ongoing warning.

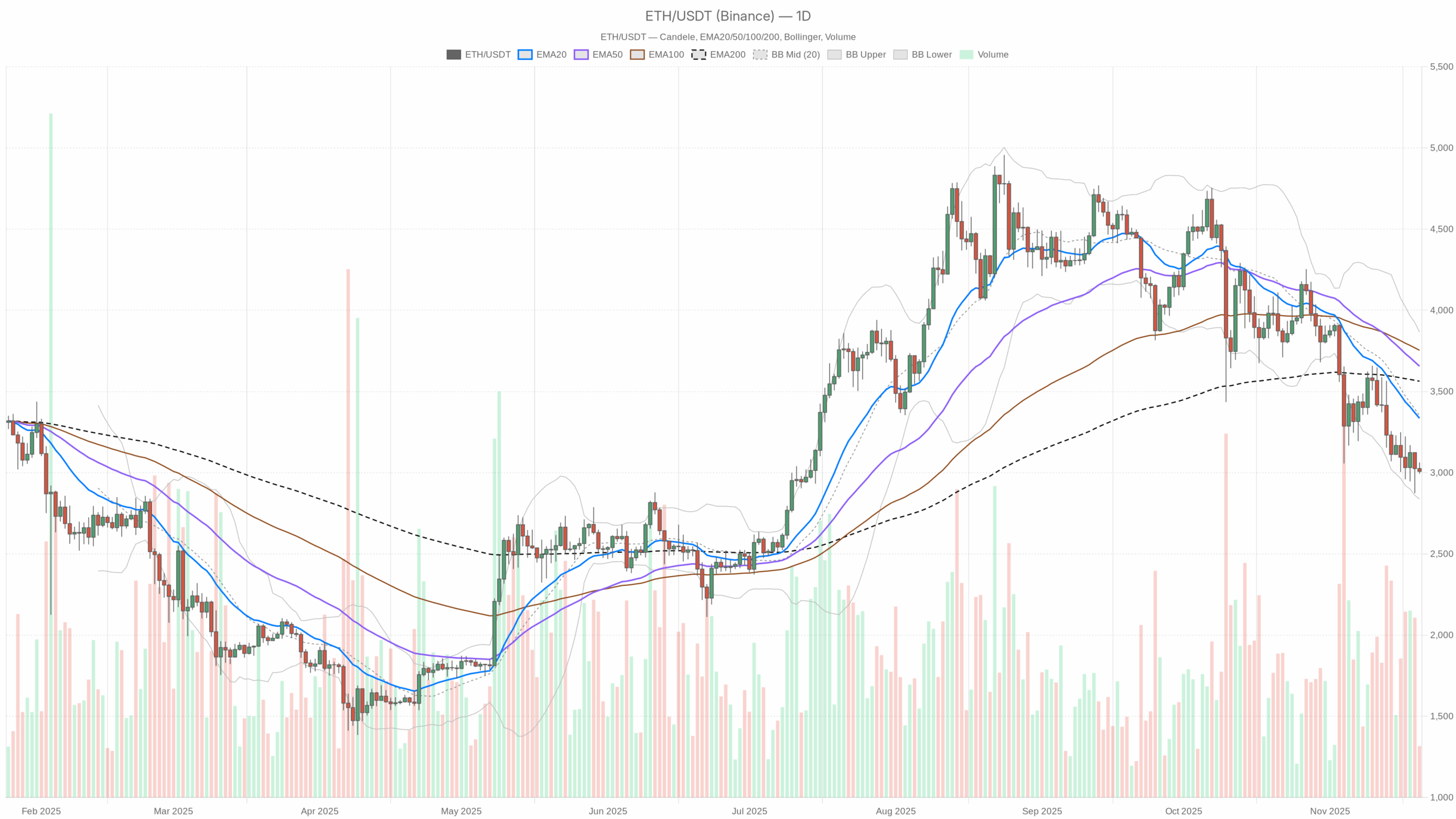

Ethereum worth usd: Market Context and Course

The broader market backdrop is blended: complete crypto capitalization sits close to 3.21 trillion {dollars}, with solely a small damaging transfer over the previous 24 hours. Nonetheless, Bitcoin instructions roughly 57% market dominance, a configuration that often interprets into underperformance for the remainder of the market, particularly for giant sensible contract platforms. On this setting, this token’s incapacity to commerce above its predominant each day averages reinforces the concept that buyers at the moment favor the relative security of BTC.

On the sentiment aspect, the Worry & Greed Index stands at 11, labeled as Excessive Worry. That stage of tension typically seems late in a down or corrective section, when many short-term individuals have already de-risked. That stated, excessive worry can last more than anticipated, and it typically coincides with uneven worth motion the place rallies are offered rapidly. In consequence, the market context suggests a cautious stance: the primary pattern isn’t aggressively bearish, however consumers clearly lack conviction.

Technical Outlook: studying the general setup

On the each day chart, worth at 3,007 is beneath the 20-day exponential shifting common at 3,335, the 50-day at 3,656, and even the 200-day at 3,563. This configuration of stacked shifting averages above worth signifies a dominant corrective regime, the place rallies into the three,300–3,600 space are prone to encounter robust provide. Till at the least the 20-day common is reclaimed with conviction, the first state of affairs stays impartial to bearish.

The each day RSI at 32.8 confirms this image. It isn’t but in excessive oversold territory, nevertheless it clearly alerts fatigued bullish momentum and an ongoing desire for promoting power quite than shopping for dips. If RSI stabilizes and turns increased from this band with out making a brand new low, it may mark the beginning of a extra sturdy consolidation.

MACD on the each day timeframe additionally sits in damaging territory, with the road at -222.7 and the sign at -204.5, producing a modestly damaging histogram. This exhibits that bearish momentum remains to be in management, but there isn’t any signal of an aggressive waterfall. The slight damaging histogram hints at a slowing draw back impulse, typically a precursor to sideways ranges quite than fast reversals.

Bollinger Bands add one other layer: the midline is at 3,351, with the decrease band round 2,837 and the higher band close to 3,866. Worth is buying and selling nearer to the decrease band, signaling an ongoing draw back skew and compressed optimism. Nonetheless, when candles hug the decrease band with no sharp breakdown, it typically evolves into imply reversion towards the center band over time.

Day by day ATR stands at about 218, which is sizeable relative to the three,000 deal with. This means expanded however nonetheless orderly volatility: single-day swings of roughly 7% are doable, but the market isn’t in full panic mode. Merchants ought to subsequently anticipate quick strikes in each instructions, particularly round key technical ranges.

Intraday Perspective and ETH token Momentum

In the meantime, shorter time frames paint a extra balanced image. On the hourly chart, worth hovers close to 3,006, slightly below the 20- and 50-period EMAs however properly beneath the 200-period common. This retains the intraday regime labeled as bearish, but the gap to the 200 EMA exhibits how prolonged the prior down transfer has been. Hourly RSI round 46 is impartial, illustrating a tug-of-war between short-term dip consumers and opportunistic sellers.

The hourly MACD has turned marginally constructive on the histogram, a refined signal that intraday promoting stress is easing. In consequence, the decrease time frames try to stabilize, even when they haven’t but reversed the broader construction. On the 15-minute chart, worth stays beneath its predominant shifting averages and the regime can also be bearish, however RSI round 43 and modest damaging MACD echo the thought of cooling draw back momentum quite than contemporary panic.

Taken collectively, each day and intraday readings recommend a market that has already undergone a big correction and is now flirting with short-term basing conduct, with out clear proof of a brand new uptrend.

Key Ranges and Market Reactions

The each day pivot sits close to 3,022, very near the present spot worth, making this space a right away battleground between bulls and bears. A sustained transfer beneath this zone may expose the primary help close to 2,980, the place volatility might briefly spike as short-term stops get triggered. If that flooring fails, the decrease Bollinger Band round 2,837 emerges as the subsequent notable draw back zone, the place the chance of mean-reversion fashion bounces would enhance.

On the upside, the primary resistance cluster lies simply above 3,050 on intraday charts. A transparent hourly shut above that stage would open a path towards the three,100 space after which the each day mid-Bollinger area round 3,350. Nonetheless, each step increased towards the 20-day EMA is prone to be examined by sellers. Solely a decisive break above that shifting common, accompanied by enhancing RSI and a bullish MACD cross on the each day timeframe, would trace at credible pattern restore quite than only a aid rally.

Future Situations and Funding Outlook

Total, the Ethereum worth usd setup at the moment factors to a neutral-to-bearish bias, with draw back threat nonetheless current however more and more balanced by the potential for sharp countertrend squeezes. Persistent excessive worry and subdued however stabilizing intraday momentum recommend that aggressive new shorts might face diminishing marginal returns, even when the trail of least resistance stays sideways to decrease within the quick time period.

Strategically, medium-term individuals might favor to attend for both a transparent breakdown beneath the decrease band area, which might create a extra enticing high-risk reward bounce setup, or a restoration above the 20-day EMA, indicating that consumers are lastly regaining management of the tape. Till considered one of these eventualities materializes, the asset is prone to commerce as a range-biased market, rewarding disciplined threat administration greater than directional conviction.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding choices.