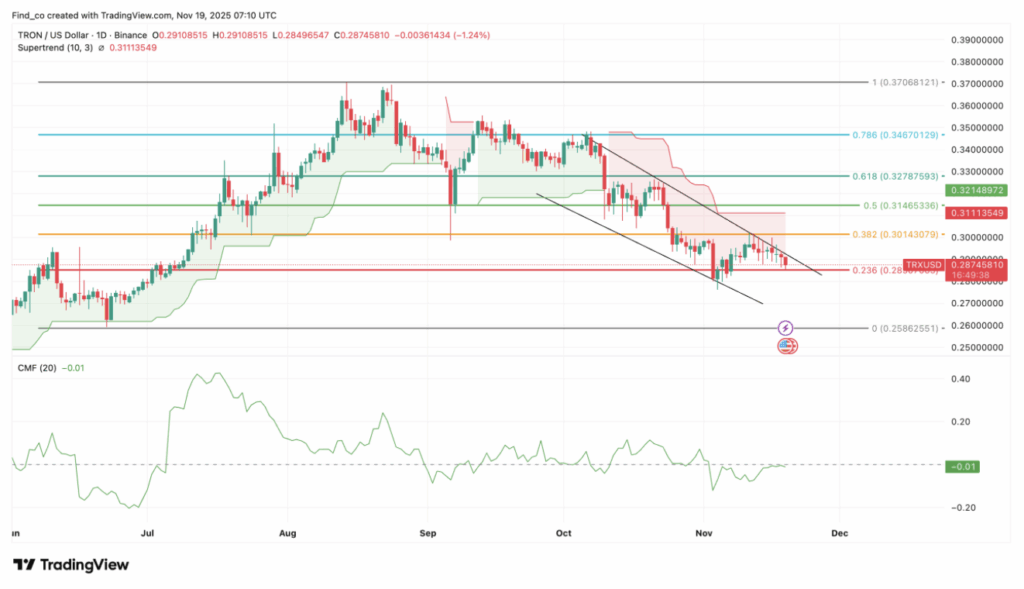

- TRX sits inside a descending triangle with weakening momentum and heavy promoting stress.

- Unfavourable funding charges point out bears dominate and quick squeezes are unlikely.

- A restoration requires a trendline breakout and quantity surge; draw back targets lie at $0.25, $0.22, and presumably $0.21.

The previous few months haven’t been variety to altcoins… and Tron is correct in that pile. Over the past 90 days, TRX has dropped almost 20%, maintaining that long-hyped $1 goal far, far out of attain. Some analysts nonetheless float the concept TRX may hit $1 this cycle, however whenever you zoom out and really have a look at the construction, the percentages really feel fairly skinny.

Tron appears trapped — and never simply in value, however in momentum.

A Robust Rally… and Then a Sudden Entice

Between June 23 and August 18, TRX printed 9 straight inexperienced weekly candles, considered one of its most spectacular runs in years. Hype exploded, social sentiment turned bullish, and merchants began convincing themselves a parabolic transfer was coming. Some even claimed Tron was about to interrupt into the “majors.”

However momentum flipped. Arduous.

Value motion reversed right into a descending triangle, a sample that often hints at weakening energy and rising draw back threat. Assist close to $0.29 continues to be holding, however the construction above it’s falling aside — decrease highs forming repeatedly, sellers stepping in at each bounce. MACD? Bearish crossover. Momentum? Weak. Confidence? Slipping.

If this pattern continues, TRX may drop to $0.25, and in a deeper slide, even $0.22.

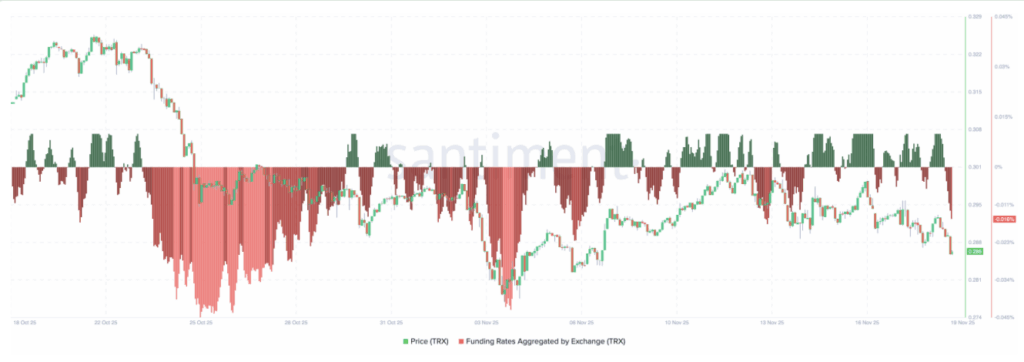

On-Chain Information Provides One other Pink Flag

Santiment’s knowledge confirmed TRX’s funding charge flipped detrimental — and stayed there.

Unfavourable funding + falling value = shorts are crowding the market.

Sometimes, when there’s an excessive amount of quick publicity after a protracted decline, quick squeezes turn out to be much less probably, no more. Bears aren’t overextended; they’re comfortably in management. Until demand abruptly reveals up, TRX may break down beneath $0.25 before bulls count on.

Every day Chart Confirms the Strain

On the each day timeframe, TRX is trapped inside a falling channel, and the Chaikin Cash Circulation (CMF) has slipped under zero — which means capital is flowing out, not in.Supertrend? Bearish. Resistance is sitting proper overhead. Demand is weak.

All indicators level the identical route: until one thing adjustments quick, TRX may retest $0.26, and if sentiment worsens, even $0.21 isn’t off the desk.

Is a Restoration Even Doable? Sure… however With Situations

A turnaround isn’t unimaginable — simply unlikely with no main shift. TRX would want to:

- Break above the descending trendline,

- On robust quantity,

- Reclaim the 0.382 Fibonacci at $0.30.

Solely then does a transfer towards $0.35 turn out to be reasonable, the place it’ll hit previous resistance once more.

And solely in a extremely bullish market — the type of surroundings the place all the things is ripping — would TRX have any believable path towards $1. Proper now, although? The chart isn’t exhibiting something near that setup.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.