Whereas the entire market cap has entered its fourth consecutive week of decline and the market has misplaced practically $1 trillion in November, knowledge reveal a notable divergence in how traders are withdrawing capital. Mid- and low-cap property present a surprisingly constructive sign.

What is that this sign, and what does it imply within the present context? The next report supplies an in depth clarification.

Sponsored

Sponsored

3 Optimistic Alerts for Altcoins because the Market Turns into Most Pessimistic

The market sentiment index has stayed in “excessive concern” for many of November. Even so, a number of constructive indicators nonetheless emerge, appearing as glimmers of hope for altcoins.

First, a report from CryptoQuant compares the market-cap efficiency of Bitcoin, giant caps, and mid- and small-cap altcoins. It reveals important resilience within the lower-cap phase.

In keeping with the comparative market-cap chart, Bitcoin skilled the sharpest drop in November. Giant caps, which embody the highest 20 altcoins, additionally fell, however to a lesser extent. Mid- and small-cap altcoins declined solely barely and suffered much less injury.

“Giant caps are struggling, however not as a lot as BTC, whereas mid–small caps are exhibiting actual resilience,” analyst Darkfost famous.

The truth is, the chart reveals that solely the market caps of Bitcoin and huge caps have shaped new all-time highs. Mid- and low-cap property have but to return to their late-2024 peaks. From a psychological perspective, as soon as altcoins drop too deeply — usually dropping 80–90% of worth — holders are likely to view their property as “already misplaced.” They then have little motivation to panic promote.

This results in the second notable issue: a divergence between Bitcoin Dominance and OTHERS Dominance.

Sponsored

Sponsored

Bitcoin Dominance (BTC.D) measures Bitcoin’s share of the entire market cap. OTHERS Dominance (OTHERS.D) measures the share held by all altcoins excluding the highest 10.

The chart reveals that in November, OTHERS.D rose from 6.6% to 7.4%. In the meantime, BTC.D dropped from 61% to 58.8%.

This divergence implies that altcoin traders are now not as simply panic-selling, even whereas sitting on losses. As an alternative, they’re holding their positions and ready for a restoration.

Traditionally, when BTC.D declines and altcoin dominance will increase, the market usually transitions into an altcoin bull cycle.

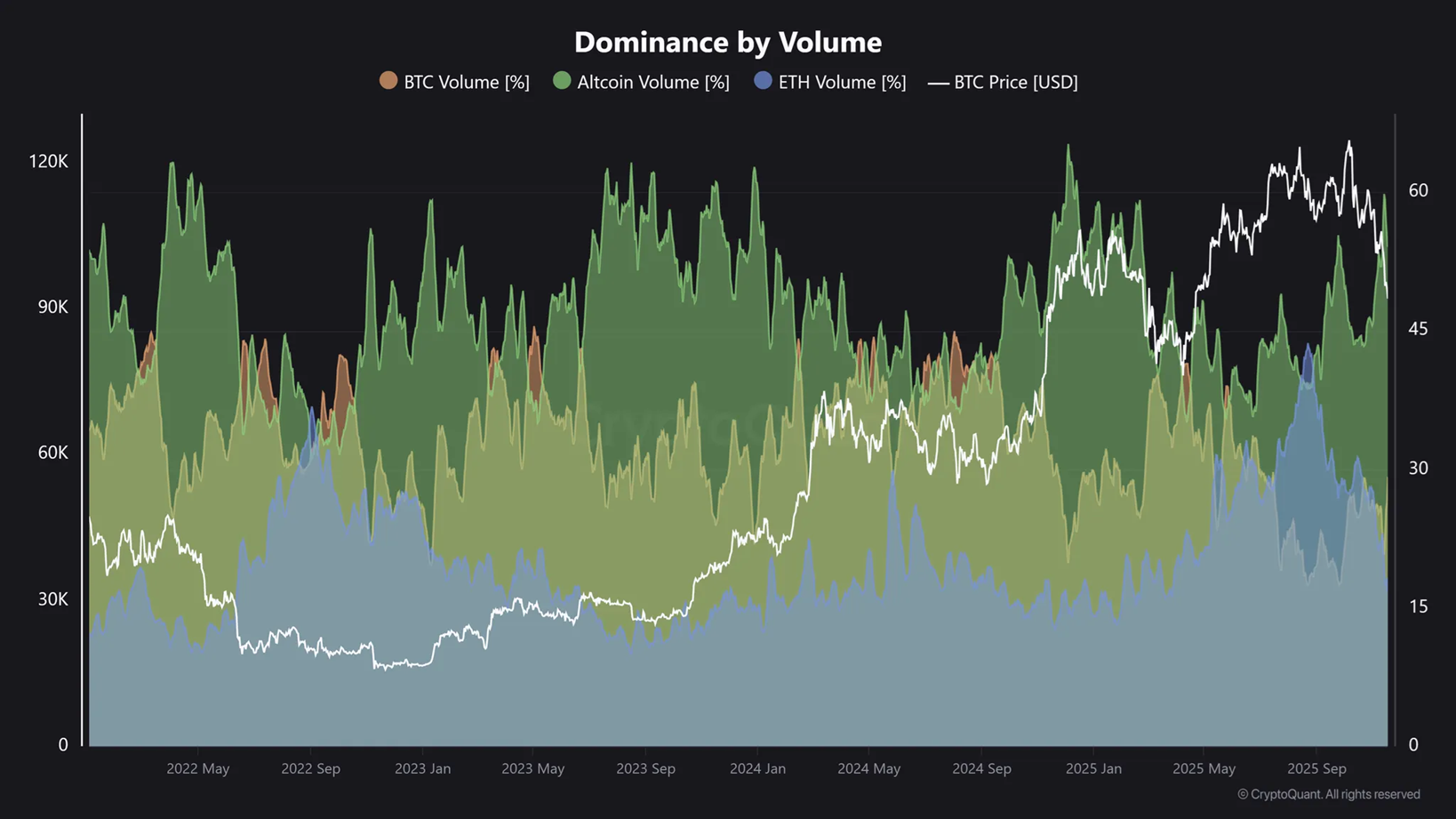

Moreover, Binance knowledge point out that 60% of the present buying and selling quantity now originates from altcoins. That is the best stage since early 2025.

Analyst Maartunn believes this knowledge highlights the place precise buying and selling exercise is going on. At present, exercise is concentrated closely outdoors main cryptocurrencies. Altcoins have as soon as once more turn into extremely standard buying and selling automobiles on Binance.

“Traditionally, an elevated share of altcoin buying and selling quantity usually coincides with elevated hypothesis out there,” maartunn stated.

In abstract, mid- and low-cap altcoins are receiving sturdy liquidity inflows. In addition they exhibit higher worth efficiency and better market share ratios. These components point out that altcoin holders maintain sturdy expectations for a restoration from the underside area.