Be part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth is down 15% within the final week and 1.1% over the previous 24 hours to commerce at $3,024 as of two:33 a.m. EST on buying and selling quantity that rose 16% to $38 billion.

This comes as fund administration titan BlackRock registered in Delaware for a staked ETH ETF (exchange-traded fund), one of many first steps {that a} fund issuer must take to file for a brand new ETF earlier than a proper regulatory submission.

BlackRock is planning to file for a Staked Ethereum ETF, as per the Delaware identify registration. ’33 Act. Submitting coming quickly. pic.twitter.com/NmAsQhcq5D

— Eric Balchunas (@EricBalchunas) November 19, 2025

The transfer alerts sturdy institutional confidence in Ethereum regardless of its current slide and would unlock a brand new alternative for traders in search of publicity to crypto property that provide staking returns.

The sharp decline within the ETH worth got here amid rising uncertainty over financial coverage, with the Federal Reserve’s October 28-29 assembly minutes displaying a slim majority of Fed officers towards a December price reduce.

Yesterday, the Minutes of the Federal Open Market Committee had been launched. On the assembly, many members favored reducing the goal vary for the federal funds price, though some indicated they might have supported leaving charges unchanged, whereas a number of opposed a reduce. When… pic.twitter.com/XEaC2whw8z

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) November 20, 2025

Ethereum Worth Indicators Sign A Continued Bearish Stance

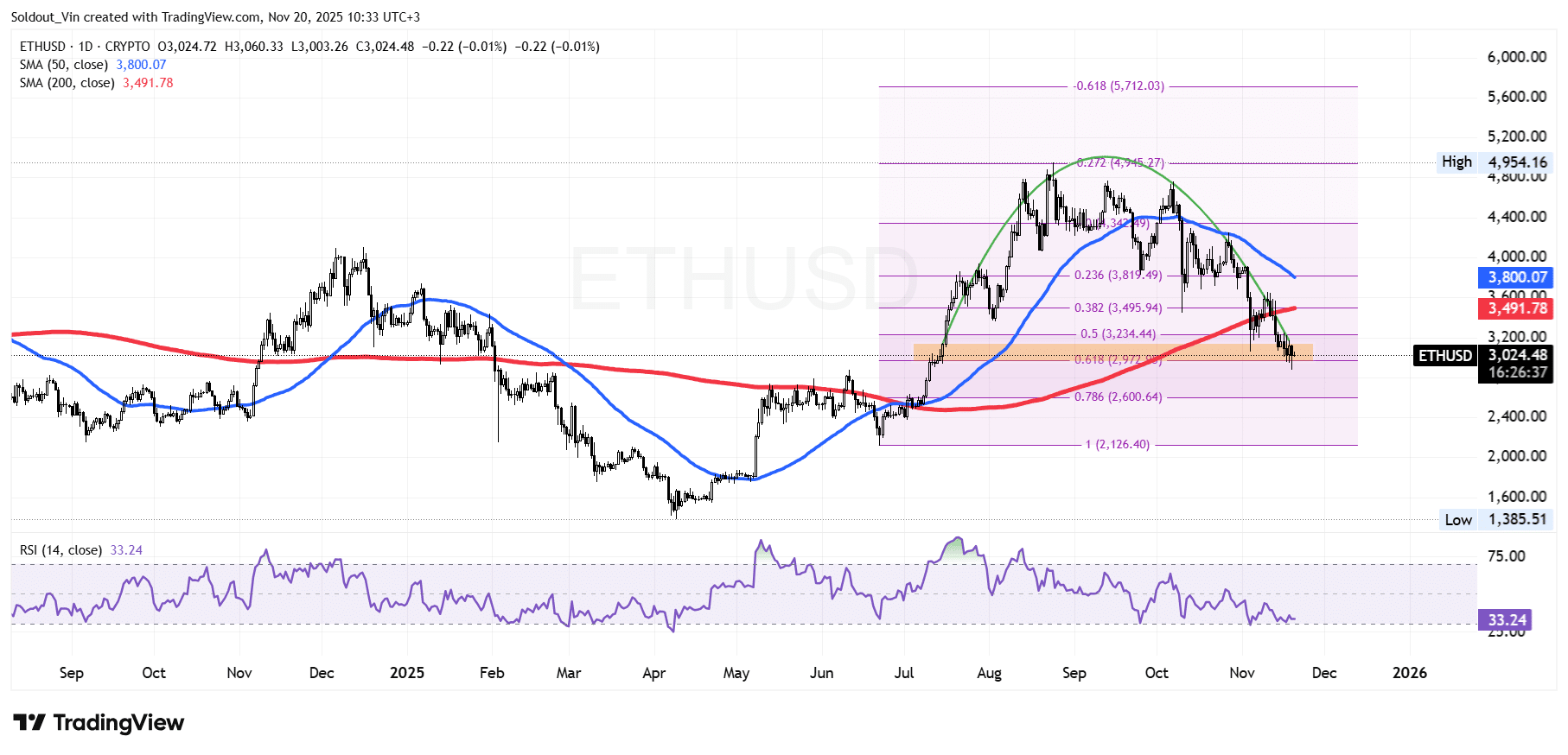

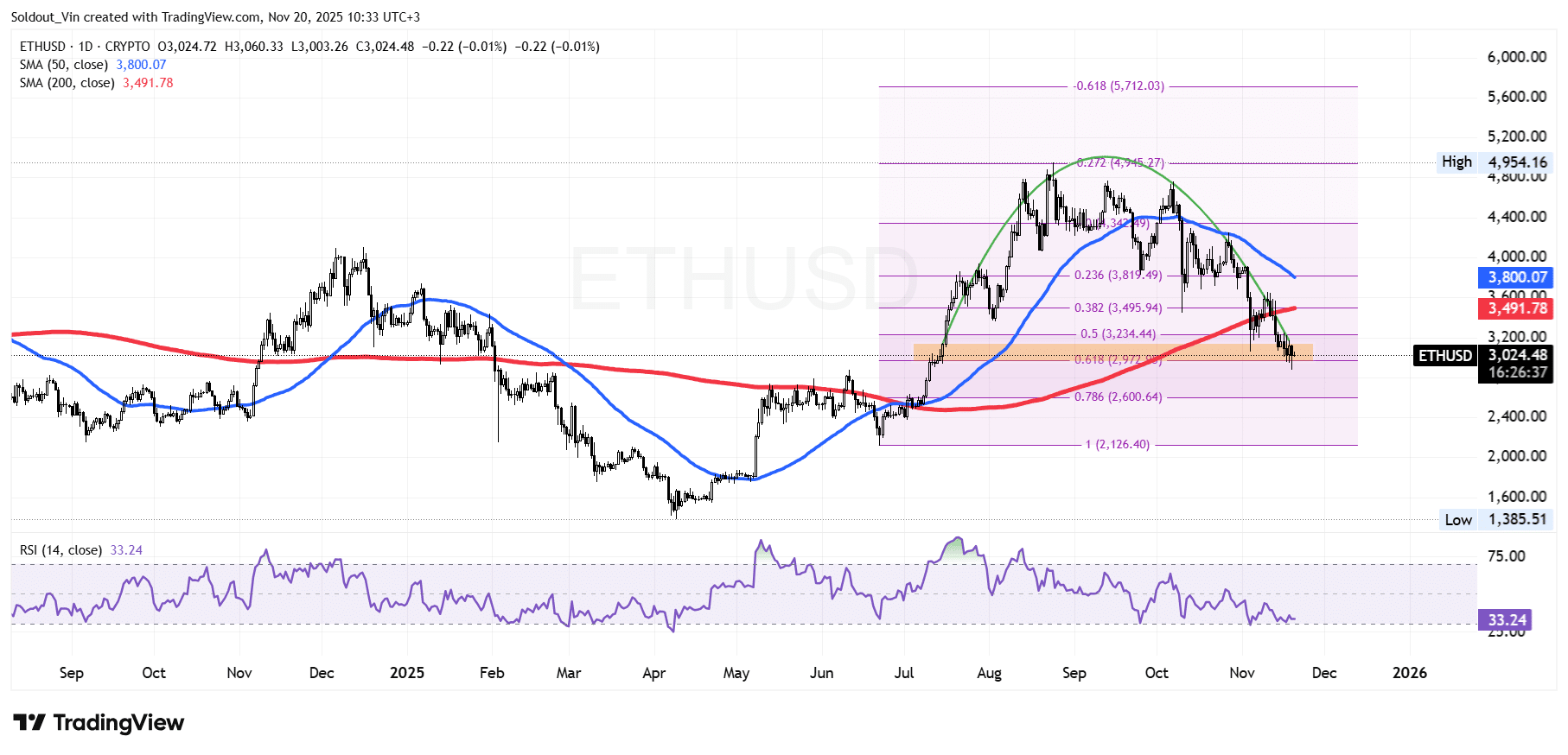

After going by a correction firstly of the 12 months, the ETH worth bulls used the help round $1,560 to push the asset by a restoration to a brand new all-time excessive in August of $4,954.

Nevertheless, the bulls had been unable to maintain this resistance, with the Ethereum worth retesting the $4,736 resistance a number of occasions. In consequence, the bears lastly took cost, forming a rounded prime sample.

In the meantime, the worth of Ethereum continued to drop again to the neckline on the $2,972 help on the 0.618 Fibonacci retracement stage.

Because of the continued downtrend, ETH has now dropped beneath each the 50-day and 200-day Easy Transferring Averages (SMAs), $3,800 and $3,491, respectively, which act as resistance ranges on the upside.

Furthermore, promoting stress remains to be intense, with the Relative Energy Index (RSI) nonetheless transferring throughout the 30-oversold zone, presently at 33.24.

ETH Worth Prediction

Primarily based on the present ETH/USD chart evaluation, the ETH worth is testing a important confluence zone close to the 0.618 Fibonacci retracement stage across the $2,970–$3,050 zone.

This space has traditionally acted as a powerful response stage, and the worth of ETH’s means, or failure, to carry above it should possible form the following directional transfer.

A sustained shut again above the 200-day SMA might open the door for a restoration towards the $3,230 (0.5 Fib) and $3,495 (0.382 Fib) areas, which can act as resistance throughout any aid bounce.

Nevertheless, with momentum weakening and the RSI hovering close to oversold territory, downward stress stays influential. Ought to the worth of Ethereum lose the present help, the following main Fibonacci stage sits close to $2,600, adopted by a deeper retracement towards $2,126 if promoting stress intensifies.

Regardless of the turbulence within the Ethereum worth, community fundamentals stay resilient. ETH staking hit a report excessive in November 2025, with over 33 million tokens now locked, in line with Milk Street.

ETH staking simply hit a brand new all time excessive… once more.

Worth has been messy, and sentiment has been worse.

However the one factor that hasn’t moved is the quantity of $ETH persons are keen to lock away for years.

Only a regular climb towards 33M+ ETH locked.

That’s long run alignment… pic.twitter.com/HycnZ4gtk1

— Milk Street (@MilkRoad) November 19, 2025

Milk Street noticed that though sentiment has been weak, the excessive stage of staked ETH signifies sturdy long-term confidence within the community.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection