The ultimate buying and selling day of the week turns into essentially the most punishing session of November as Bitcoin’s relentless slide locks in an irregular low at $82,000, triggering a violent liquidation chain throughout all main belongings. Practically $2,000,000,000 in lengthy positions evaporated in 24 hours, based on CoinGlass, forming one of many largest destruction waves since early October.

TL;DR

- BTC tags an actual $82,000 backside after dropping over $10,000 this week.

- XRP falls to $1.8467, however month-to-month Bollinger Bands preserve bullish bias alive.

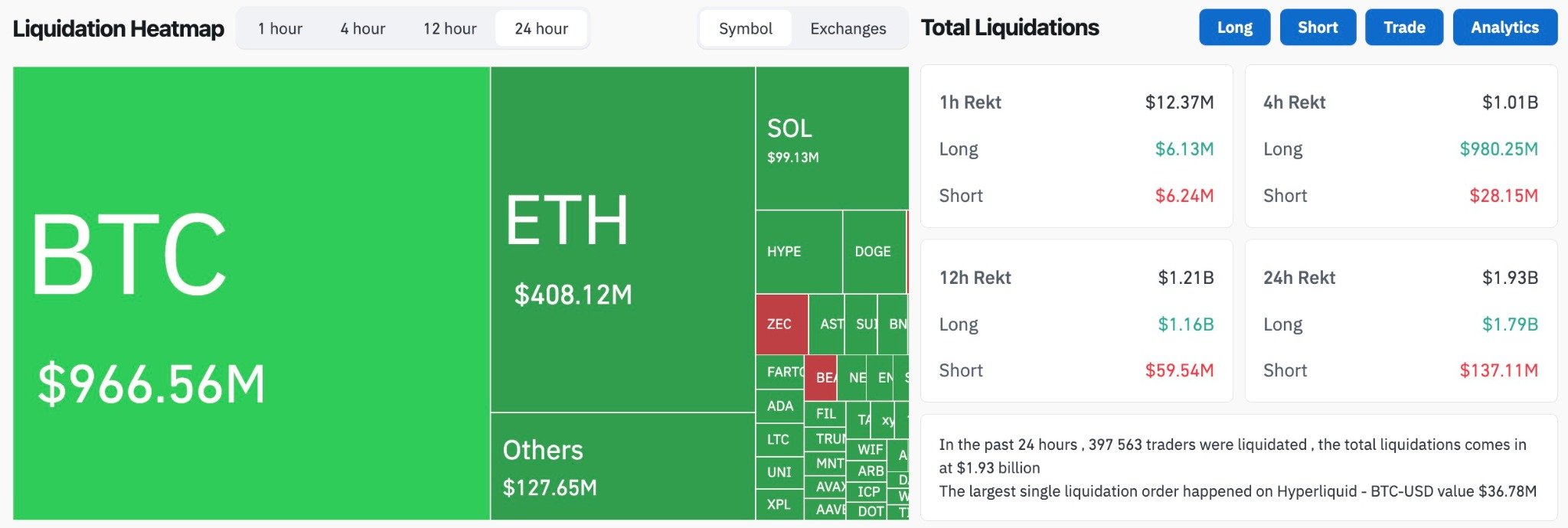

- Liquidations hit $1.93 billion in 24 hours, virtually fully long-sided.

Bitcoin finds irregular $82,000 backside

For the reason that begin of the week, Bitcoin has misplaced greater than $10,000, however essentially the most brutal second got here this morning. Inside a single hour, BTC collapsed by 5%, slicing immediately right into a mathematically good $82,000 backside — not a cent much less, not a cent extra, throughout Bybit spot and Binance futures.

Such round-number inflection factors hardly ever seem with this precision, which makes the wick notable quite than unintentional. The five-minute chart reveals a fast cascade from $85,000 into the mid-$83,000s adopted by a vertical flush into $82,000. This degree held on first contact, indicating that both a big resting bid absorbed the dump or the liquidation engine exhausted itself at that actual depth.

Whether or not this turns into a textbook closing capitulation wick or just the midpoint of a deeper slide is determined by instant recapture makes an attempt. A return to the $84,000-$85,000 space would sign market stabilization.

The weekly context stays extreme. Merchants face a Friday shut with BTC caught close to the underside of the multiweek downtrend. The Oct. 10 shock continues to echo throughout leverage markets, and at the moment’s flush seems like its delayed aftershock.

XRP loses $2, however there’s a silver lining

XRP lastly slipped underneath the symbolic $2 degree throughout the morning flush, hitting $1.8467 at peak stress. The transfer was anticipated given Bitcoin’s fall towards $82,000, although the magnitude stayed comparatively average in comparison with BTC’s collapse.

The important thing level comes from XRP’s month-to-month Bollinger Bands, which stay structurally bullish even underneath strain.

Regardless of the purple candle, XRP didn’t break the midband. The value stays within the higher Bollinger area, that means broader development classification has not deteriorated. The asset nonetheless must lose one other 10% to breach the structural threshold, and that has not occurred.

Volatility expanded massive time on the month-to-month chart, however the absence of a midband breakdown makes this pullback a correction, not a development reversal. If BTC stabilizes above $82,000, XRP’s rebound path begins instantly on the $2-$2.10 resistance pocket.

$2 billion liquidation tsunami stuns crypto market

CoinGlass confirms $1.93 billion liquidated in 24 hours. BTC alone noticed $966.56 million liquidated. ETH added $408.12 million. Solana contributed virtually $99 million, whereas smaller belongings crammed the remaining $127 million. The BTC/ETH focus tells the whole story: majors snapped first, and every little thing else adopted.

The most important single liquidation got here on Hyperliquid, the place a whale lengthy in BTC/USD was erased with a $36.78 million order. However the carnage extends past futures.

Twitter circulates claims of a number of crypto funds collapsing underneath the burden of the October wipeout and November continuation. Allegedly, giant gamers are “liquidating belongings price billions” to cowl inner losses. Affirmation is absent, but the value motion aligns with pressured deleveraging.

On the identical time, Bloomberg reviews that JPMorgan sees a excessive likelihood of Technique (MSTR) being faraway from the MSCI and Nasdaq indices as a consequence of digital belongings being over 50% of its steadiness sheet. That situation might trigger $2.8 billion in capital outflows from MSTR. A choice is predicted on Jan. 15, 2026.

Crypto market outlook

Friday’s session turns into a leverage-clearing occasion, and future path relies upon now on whether or not the intraday stabilization above the mid-$83,000s turns into sustained bidding or slips again into the week’s decrease stress zones. The $2 billion liquidation wave resets positioning throughout the market, and the weekly shut will inform whether or not the worst is behind us or the following leg decrease will begin instantly.

Bitcoin (BTC): Buying and selling round $83,800 with strain at $85,000-$86,500 and assist at $82,000, then $79,500.

XRP: Sitting close to $1.94 with a ceiling at $2.00-$2.10 and assist at $1.86, then $1.74 (month-to-month midband).