Coinbase Derivatives will launch 24/7 futures for main altcoins on Dec 5. This expands steady buying and selling past BTC and ETH for US merchants.

Coinbase Derivatives plans a major growth. Particularly, they are going to be increasing the 24/7 buying and selling of their listed altcoin futures. Certainly, these are Avalanche, Bitcoin Money, Cardano, Chainlink, Dogecoin, Hedera, Litecoin, Polkadot, Shiba Inu, Stellar, and SUI. This transfer represents a major enchancment of their choices. It satisfies the rising market demand.

Nonstop Buying and selling for Key Altcoins Goes Dwell December 5

Continuous buying and selling for these belongings will start on December 5. Due to this fact, this data is from a Coinbase put up by Coinbase Markets. Consequently, this contributes to Coinbase Derivatives already having 24/7 assist. This present assist has already confirmed widespread amongst merchants.

Associated Studying: Crypto Information: Coinbase to Launch New ‘DeFi Mullet’ Providing in Brazil Quickly | Dwell Bitcoin Information

Moreover, this current assist is for Bitcoin, Ethereum, Solana, and XRP merchandise. Notably, it contains nano in addition to “perp-style” futures merchandise. This can be a large step for opening the market. It provides extra alternatives for lively portfolio administration.

December 5 marks a key date. Particularly, 24/7 buying and selling launches for all alt coin month-to-month futures. These are supplied by Coinbase Derivatives. December 12 will see new US perpetual fashion futures to be launched. This is applicable to all altcoins. This staggered launch is to make sure clean integration.

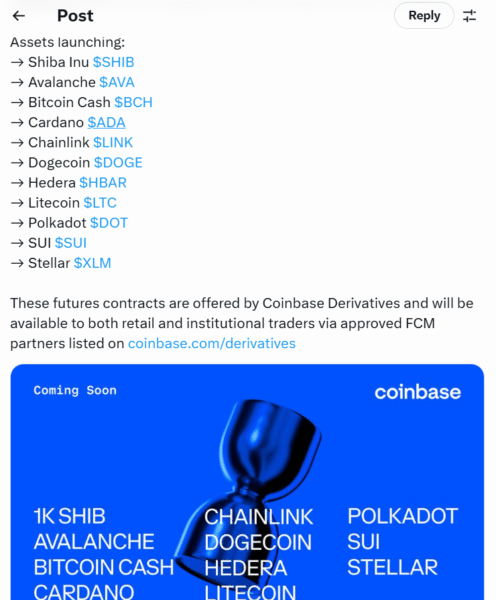

Belongings launching embody Shiba Inu ($SHIB), Avalanche ($AVAX), Bitcoin Money ($BCH), Cardano ($ADA), Chainlink ($LINK), Dogecoin ($DOGE), Hedera ($HBAR), Litecoin ($LTC), Polkadot ($DOT), SUI ($SUI) and Stellar ($XLM). This intensive checklist contains loads of top-tier altcoins.

These futures contracts can be found from Coinbase Derivatives. Moreover, they are going to be out there to retail and institutional merchants. This entry is obtainable by way of accredited FCM companions. This widespread availability democratizes subtle monetary devices.

Coinbase’s perpetual-style contracts for the US market are totally different from the normal perpetuals. The truth is, they’ve a lifespan of 5 years. Conventional perpetuals don’t usually expire. This construction gives a singular profit for threat administration functions.

Coinbase’s Increasing Derivatives Foothold within the US Market

This strategic transfer is aimed on the steady nature of the cryptocurrency market. Furthermore, it lets the U.S. merchants deal with threat effectively. They’ll additionally commerce in response to market occasions that happen outdoors of conventional buying and selling hours. This flexibility is essential in risky crypto markets.

Coinbase gives as a lot as 10x leverage for its perpetual futures. Due to this fact, this permits merchants to amplify their positions. This excessive leverage may end up in excessive positive factors or losses. It attracts the skilled merchants.

In line with Coinbase, the worldwide crypto derivatives market is big. Crucially, it’s a substantial portion of worldwide crypto buying and selling quantity. This suggests that there’s excessive demand for such merchandise. The growth is aimed immediately at this demand.

As well as, Coinbase’s CFTC-regulated derivatives arm has been up and working. Particularly, this revealed Bitcoin and Ethereum futures buying and selling 24/7 in Could. Perpetual-style futures have been launched in July. These earlier launches made essential groundwork.

These product launches have been instantly following a serious acquisition. Certainly, Coinbase’s historic $2.9 billion acquisition of Deribit was accomplished. This vastly elevated its derivatives capabilities. This acquisition was an influence play calculated for the long run.

Finally, this transfer by Coinbase represents a broader development. Institutional and retail traders search for extra regulated crypto merchandise. The provision of 24/7 altcoin futures will seemingly enhance liquidity. It would additionally improve the method of worth discovery for these essential digital belongings. This additional helps embed crypto into the mainstream monetary panorama.