Bitcoin has simply undergone one in every of its sharpest declines in current reminiscence, plunging to just about $80,500. Whereas dramatic, seasoned market contributors will acknowledge that this pullback is modest in comparison with the 77% crashes seen in earlier cycles.

The downturn has sparked a combination of worry and alternative, with giant entities shifting aggressively.

Over $377 million price of Bitcoin was amassed through the sell-off, at the same time as main institutional holders like BlackRock, Wintermute, Binance, and others reportedly offloaded greater than $10 billion in Bitcoin, serving to drive costs sharply decrease.

Market sentiment has flipped to excessive worry, with retail buyers reacting way more emotionally than in previous cycles. This dynamic opens the door for sensible cash to capitalize on errors made by newer contributors.

Crypto Massacre Intensifies With Bitcoin Nearing Key Investor Threshold

The overall worth of the crypto market has fallen by roughly $1.2 trillion over the previous six weeks, based mostly on figures from CoinMarketCap. This sharp downturn comes alongside heightened turbulence in inventory markets, with main synthetic intelligence equities being hit particularly exhausting.

Shares of Hong Kong-listed bitcoin exchange-traded funds (ETFs) have been additionally affected, sliding nearly 7% on Friday. Specialists be aware that this sample factors to a wider retreat from high-risk property.

Bitcoin’s newest decline follows a powerful surge earlier within the 12 months, when its value climbed above $120,000 in October as a consequence of supportive regulatory information. However a historic crash final month, which triggered $19 billion in liquidations, has left merchants cautious and sentiment unsettled.

Market observers at the moment are watching the $80,000 degree carefully, because it aligns with the typical entry value for bitcoin held by ETFs, making it a key focal point for buyers.

Supply – Jacob Crypto Bury YouTube Channel

Bitcoin Value Prediction

Based on Jacob Bury, Bitcoin’s current drop to $80,500 marks a 36% correction, and he believes that whereas a short-term reduction bounce is feasible, the general construction seems bearish.

He notes that Bitcoin closing under the 50-week shifting common suggests the bull market could also be ending, and if the downtrend continues, the value might fall towards the 200-week shifting common within the $60,000–$70,000 vary.

He additionally mentions that Bitcoin could not see a brand new peak this cycle and expects probably months of sideways or downward motion much like earlier market cycles.

Bitcoin Technical Alerts Level to Bear Market, however Specialists See Future Rally

Bitcoin’s current dying cross has revived speak about a potential bear market, with the cryptocurrency falling under each its 50-day and 200-day shifting averages. This technical sample, usually related to extended downturns, has created divided viewpoints amongst analysts.

Benjamin Cowen notes that previous dying crosses have marked native bottoms, including that if the present cycle remains to be intact, Bitcoin ought to start a rebound inside the subsequent week.

If no rebound seems, he expects one other drop earlier than a bigger transfer again towards the 200-day SMA, which might type a macro decrease excessive.

Ted Pillows talked about that Bitcoin practically touched $81,000 and should reclaim $88,000 quickly to keep away from sliding towards its April lows.

On November 21, Peter Brandt, identified for his correct calls on Bitcoin tops and bottoms, shared a placing long-term projection.

He acknowledged that the newest crash is the most effective factor that would occur for Bitcoin and believes the value might attain $200,000 within the subsequent bull market, with the transfer anticipated round Q3 2029.

With differing outlooks from analysts, Bitcoin’s subsequent main transfer will depend upon how the market reacts within the coming weeks. For now, all eyes stay on whether or not Bitcoin rebounds towards key resistance ranges or confirms an extended bearish part because the cycle continues to unfold.

Why Analysts Consider This New Crypto May Thrive Amid Market Turmoil

Regardless of the turmoil, the market stays wealthy with alternative for individuals who can handle volatility. Buyers at the moment are turning to early-stage presales reminiscent of Bitcoin Hyper (HYPER), which just lately surpassed the $28 million funding mark.

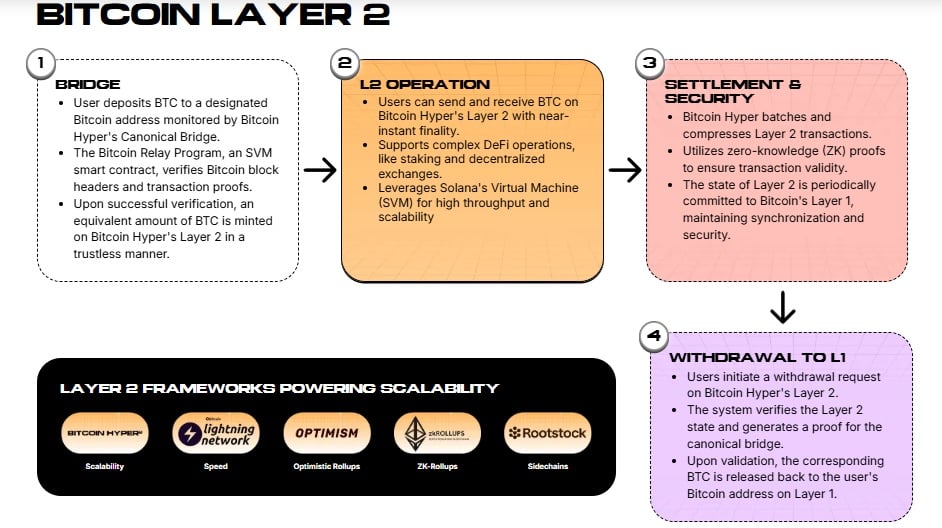

Bitcoin Hyper is an upcoming layer-two undertaking on Bitcoin that mixes Solana’s velocity and suppleness with Bitcoin’s safety, supporting decentralized functions and token creation totally built-in with the Bitcoin community.

Analysts counsel that new hyped cryptos like Bitcoin Hyper could carry out nicely even throughout a broader market downturn, as their launches can generate speedy value actions unbiased of the general market.

The token is predicted to launch within the first quarter of 2026, with alternatives to purchase and stake early, providing potential rewards for long-term holders. On the time of writing, the $HYPER token is priced at $0.013315 and could be acquired utilizing a financial institution card or crypto by way of the Greatest Pockets app.

Its rising neighborhood and anticipation place it as one of the notable layer 2 initiatives within the crypto area. Early adoption and participation might be key for buyers searching for publicity to rising blockchain know-how.

Go to Bitcoin Hyper

This text has been supplied by one in every of our business companions and doesn’t replicate Cryptonomist’s opinion. Please bear in mind our business companions could use affiliate packages to generate revenues by the hyperlinks on this text.