2025 has been a yr of ups and downs for the cryptocurrency {industry}, with the efficiency of digital asset treasuries (DATs) an ideal instance of this pattern. Whereas Bitcoin and Ethereum treasury corporations like Technique and BitMine appear to be weathering the current storm, different corporations have succumbed to the bursting bubble of DATs.

As an example, BitMine has disclosed its plans to turn into “the primary large-cap cryptocurrency firm to declare annual dividends.” This announcement got here because the Ethereum treasury agency launched its fiscal yr outcomes on Friday, November 21.

BitMine To Pay $0.01 Dividend Per BMNR Share

In a press launch on Friday, the biggest Ethereum treasury firm, BitMine, reported a web revenue of $328 million—equal to $13.39 in totally diluted earnings per share (BMNR). The agency additionally shared its plan to turn into the primary large-cap crypto firm to pay dividends to its shareholders.

The Ethereum treasury firm intends to pay an annual dividend of $0.01 per BMNR share, because it seems to be to return some worth to shareholders amid the weakening crypto market. In line with the press launch, the payable date for the dividend is ready at December 29, 2025, with BitMine’s subsequent shareholder assembly to be held in January 2026.

BitMine’s Chairman, Tom Lee, mentioned within the launch:

BitMine continues to execute on the highest degree. The corporate is nicely positioned in 2026 and we stay up for commencing ETH staking with our MAVAN, or Made in America Validator Community, in early calendar 2026.

The crypto treasury firm defined its plans to launch the Made in America Validator Community (MAVAN) to stake its Ether holdings. After vetting a number of native staking suppliers, BitMine revealed that it has chosen three preliminary pilot companions to check out their staking capabilities utilizing a small portion of its ETH.

The BMNR inventory is presently valued at round $26, reflecting an over 25% decline prior to now week. In the meantime, the share worth is considerably away from its 2025 excessive of $135, reached shortly after Bitmine introduced its Ethereum acquisition technique.

The industry-wide struggles of those digital asset treasuries could be attributed to the pullback of the crypto market within the second half of the yr, particularly within the fourth quarter. Whereas the worth of Ethereum continues to indicate weak point, not too long ago falling to round $2,650, BitMine’s chairman believes {that a} market restoration is inevitable.

BitMine Continues ETH Shopping for Spree

BitMine’s religion within the eventual restoration of the Ethereum worth could be seen in its relentless acquisition technique. As Bitcoinist reported, the agency bought about 21,054 ETH (price about $66.57 million) on Wednesday, November 19.

As of a Thursday report, the unrealized losses of BitMine’s Ethereum holdings had been nearing $4 billion. Notably, the DAT firm holds roughly 3.55 million ETH tokens—price about $10 billion—acquired at a median value of round $3,120.

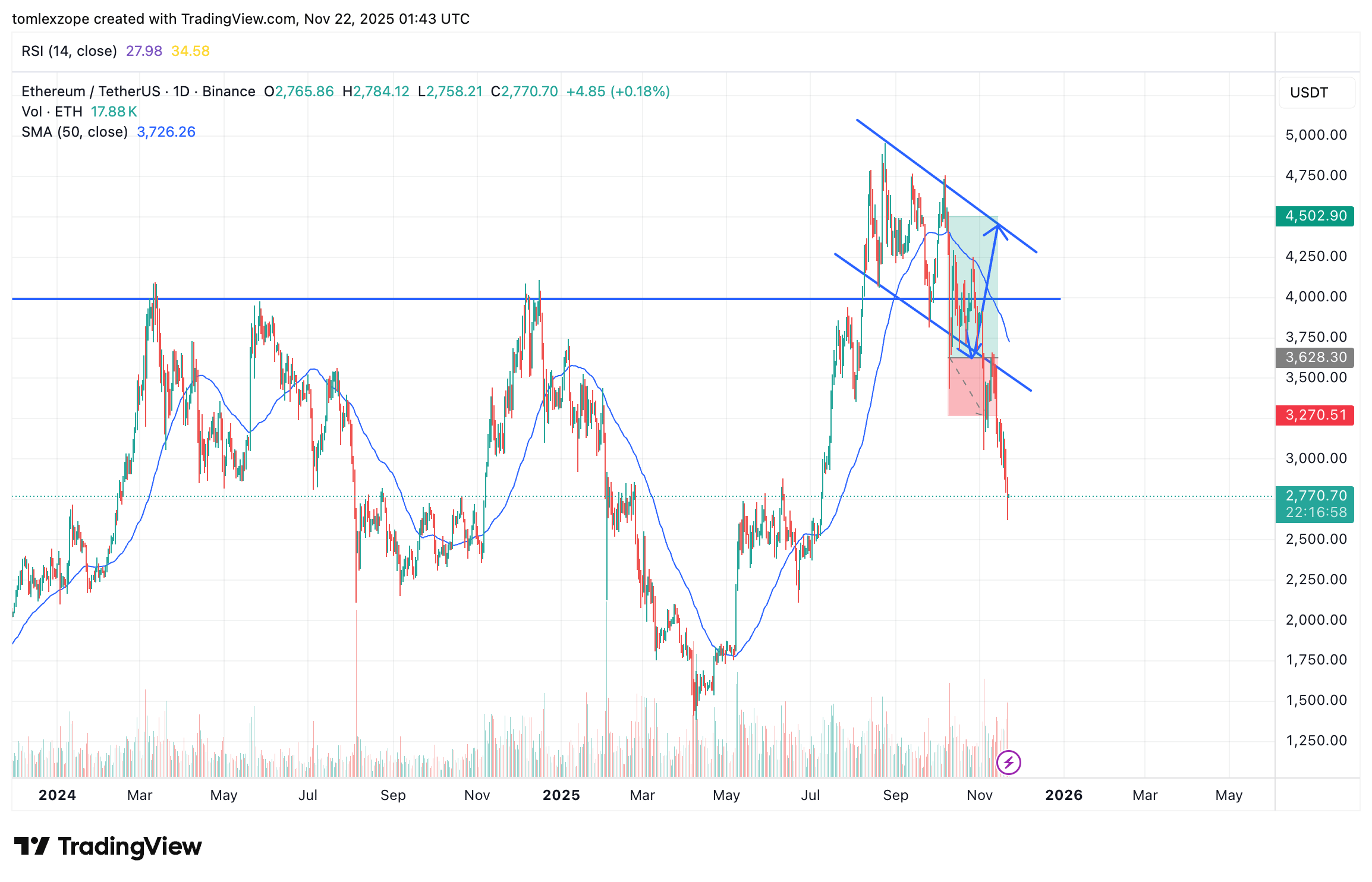

The value of ETH on the day by day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.