- Grayscale’s Sui Belief started buying and selling on OTCQX beneath the ticker GSUI, providing regulated publicity to the Sui community.

- GSUI isn’t an ETP but as a result of Sui doesn’t presently meet SEC Generic Itemizing Requirements.

- Regardless of SUI’s latest worth dip, Sui is increasing its financial system with new infrastructure like USDsui.

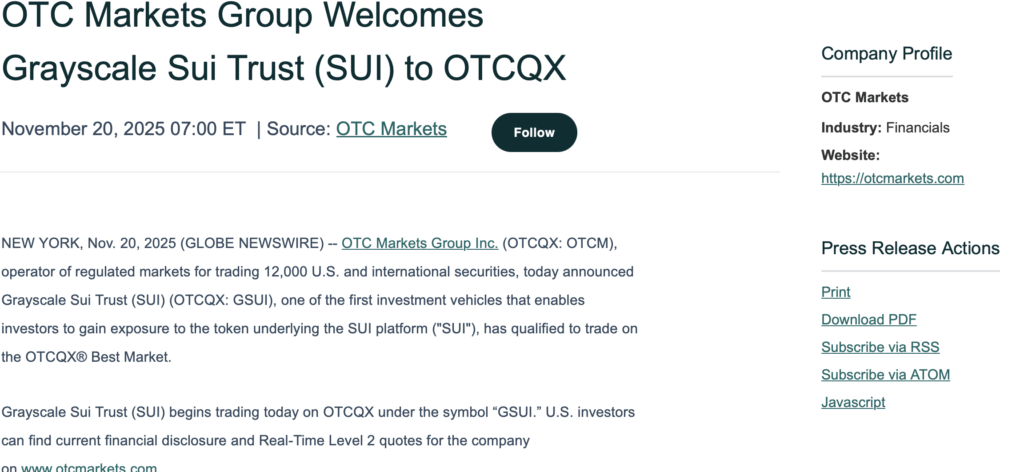

Grayscale simply added one other piece to its increasing lineup of institutional crypto merchandise. The agency’s Grayscale Sui Belief (GSUI) has formally certified to commerce on the OTCQX Finest Market, one of many highest tiers of over-the-counter buying and selling within the U.S. Beginning November 21, GSUI provides traders a option to achieve publicity to the Sui community with out truly holding the token itself — a giant deal for establishments that favor compliance, custody safety, and a cleaner reporting construction.

OTCQX provides firms a less expensive, simpler option to attain U.S. capital markets, due to simplified itemizing guidelines and lighter operational overhead. However that doesn’t imply it’s a free cross; issuers nonetheless want sturdy financials, governance, transparency, and tight regulatory alignment to get listed. Grayscale clearing that bar alerts confidence on either side.

Why GSUI isn’t an ETP but

One query popped up rapidly: Why didn’t Grayscale convert GSUI into an exchange-traded product already?

Craig Salm, Grayscale’s Chief Authorized Officer, addressed it bluntly — Sui doesn’t but meet the SEC’s new Generic Itemizing Requirements for commodity-based trusts. As soon as it does, Grayscale plans to transform GSUI to an ETP, simply because it did with merchandise tied to Bitcoin, Ethereum, and different digital property.

Rayhaneh Sharif-Askary, Head of Product & Analysis, additionally praised Sui’s technical progress, saying Grayscale needs to present traders entry to “this subsequent technology of innovation” because the community retains pushing boundaries in scalability and efficiency.

SUI worth dips because the Belief goes stay

GSUI’s debut occurred throughout a shaky stretch for Sui’s worth. On the time of the announcement, SUI traded round $1.47, down roughly 9% in 24 hours — a part of a broader market pullback that dragged whole crypto capitalization to $2.92 trillion.

Even so, the Sui ecosystem has been busy.

On November 12, the community launched USDsui, its personal native stablecoin constructed by way of Bridge’s Open Issuance platform. This marks a shift away from counting on exterior issuers like Circle or Tether, giving the Sui protocol its personal core greenback infrastructure.

In the meantime, the RSI hovering in overbought territory suggests SUI could also be gearing up for a pattern reversal — although with the present volatility, merchants are being cautious to not name it too early.

Grayscale expands its crypto footprint

GSUI isn’t the one huge transfer Grayscale has been making. The agency is deep right into a broader push towards institutional-grade crypto merchandise, together with:

- A deliberate Dogecoin ETF

- A pursuit of a public NYSE itemizing

- Staking added to their ETH and SOL ETFs

- A rising portfolio of regulated belief automobiles

Every step reinforces Grayscale’s position as one of the crucial energetic first-movers in regulated U.S. crypto markets.

The underside line

GSUI’s arrival provides establishments a clear, compliant gateway into the Sui ecosystem. Whereas Sui hasn’t but met SEC necessities for an ETP conversion, the Belief’s OTCQX itemizing exhibits investor demand is already materializing. And with Sui increasing its on-chain financial system — and Grayscale broadening its ETF and staking lineup — the stage is ready for greater developments as soon as regulatory doorways open.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.