In keeping with the most recent on-chain information, traders have been excessively betting on the Bitcoin worth in current weeks, resulting in its total struggles.

Longs Vs Shorts Imbalance — How This Induced Value Crash

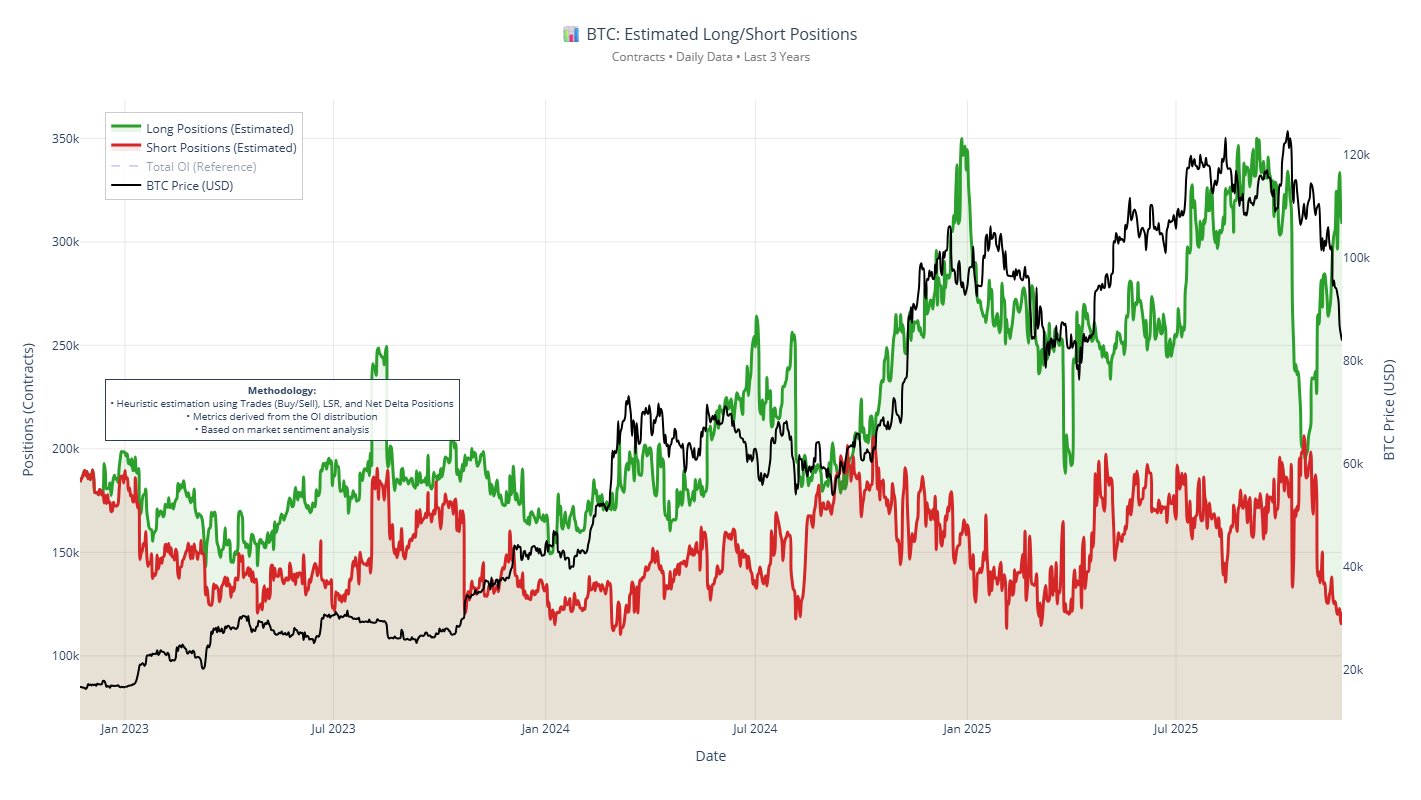

In a November 22 put up on social media platform X, Alphractal CEO and founder Joao Wedson revealed the underlying dynamics behind Bitcoin’s current unchecked fall. In deciphering this downward development, the crypto pundit evaluated the Estimated Lengthy/Brief Positions metric, which estimates how a lot of the Open Curiosity throughout exchanges is devoted to lengthy positions relative to quick positions.

Wedson reported that, throughout 19 exchanges, there are about 71,000 BTC positioned in longs, whereas a comparatively smaller quantity of BTC (27,900) is devoted to shorts. Whereas this remark doesn’t embody information from the Chicago Mercantile Alternate (CME), the discrepancy between longs and shorts stays unusually massive.

Associated Studying

This imbalance is important as a result of when there are clusters of lengthy positions at comparable worth ranges, the market tends to lean right into a extra fragile state. Average pullbacks beneath these clusters typically result in a cascade of pressured liquidations (generally known as an extended squeeze) — an occasion which might in flip push costs additional south.

Notably, Wedson identified that merchants should have been satisfied that $100,000 was Bitcoin’s worth backside — a hypothesis that quickly turned null after its failure. Afterwards, $90,000 got here into focus, with one other collection of liquidations following go well with. For the time being, $84,000 appears to be the value majority of Bitcoin’s speculative merchants goal as the brand new worth backside.

These liquidation occasions that occurred after the $100,000 and $90,000 helps had been breached supplied extra buy-side liquidity for the Bitcoin worth to topple. On the similar time, most vital quick positions have been closed off, making it troublesome for a extra outlined worth restoration to happen, as there may be barely any sell-side liquidity to ship the Bitcoin worth to the upside.

For Bitcoin to get well, Wedson defined that there must be a big lower in lengthy positioning, whereas quick publicity goes on the rise.

Watch Out For $81,250 — Analyst

In one other put up on X, technical analyst Ali Martinez famous that Bitcoin’s 2-year transferring common, which stands at roughly $81,250, is a crucial landmark for the longer term trajectory of the flagship cryptocurrency.

The analyst defined that historic failures of the 730-day SMA have typically marked the beginnings of bear markets. Thus, within the situation the place the Bitcoin worth slips previous its present 2-year common worth, we might be witnessing the beginning of an extended bearish cycle

As of press time, Bitcoin holds a valuation of $86,251, reflecting an over 3% worth bounce prior to now 24 hours.

Associated Studying

Featured picture from iStock, chart from TradingView