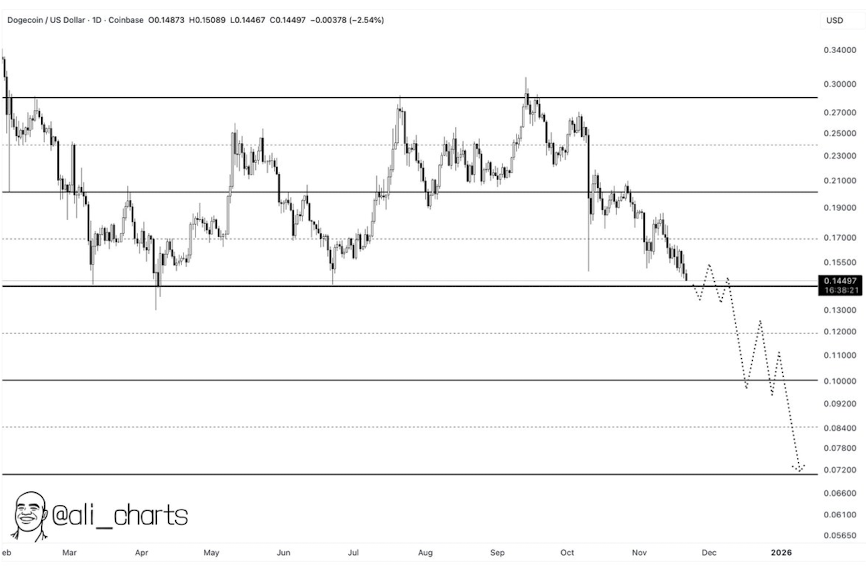

- DOGE is consolidating beneath $0.15, with a weekly shut underneath $0.14 risking a deeper fall towards $0.07.

- Lengthy-term symmetrical triangle construction and month-to-month Ichimoku help nonetheless provide an opportunity for reversal if patrons step in.

- A breakout above $0.18–$0.20 would verify restoration, whereas failing help might ship worth towards multi-year lows.

Dogecoin has been wobbling its approach by a fairly tense consolidation part, with worth nonetheless caught underneath $0.15 and urgent deeper into long-term help territory. Merchants are mainly watching each candle at this level, making an attempt to determine whether or not DOGE can by some means rebound towards $0.18, or if the market is gearing up for one more leg down.

Proper now DOGE trades round $0.138, slipping about 3% in 24 hours. Every day quantity sits at $6.17B, a bit softer than its 30-day common — signaling a slowdown in participation because the market kinds itself out. The stress isn’t remoted both; most main property have been underneath heavy promote quantity all week.

A weekly shut beneath $0.14 might get ugly

Analyst Ali (@ali_charts) warned that if DOGE fails to carry $0.14 on the weekly timeframe, the door opens to a brutal slide towards $0.07, a macro help that hasn’t been examined in ages.

That projection assumes continued promoting, fading greater lows, and a construction that simply refuses to flip bullish. However Ali did word that if RSI slips into oversold territory — beneath 30 — a rebound might construct from that $0.07 zone… assuming patrons don’t vanish.

An enormous symmetrical triangle nonetheless defines DOGE’s long-term construction

On the weekly chart, DOGE has been forming an enormous symmetrical triangle since 2021:

- Greater lows counsel accumulation, not a breakdown

- Decrease highs replicate long-term promoting stress

- Quantity retains tightening — traditional pre-breakout compression

DOGE is now retesting the rising help line from its 2021 lows. If it breaks above the triangle apex with robust quantity, the transfer could possibly be explosive. But when it loses help? The bearish state of affairs towards $0.07 turns into much more sensible.

Quick-term: DOGE is trapped in a decent $0.1300–$0.1350 vary

Every day charts present Dogecoin chopping inside a tiny vary that’s beginning to appear to be accumulation — however in a bearish context. The upside lid stays at $0.1500–$0.1550, and nothing significant occurs except DOGE clears that zone.

Worst case, month-to-month construction factors to a retest of $0.0900–$0.0950.

Greatest case, a clear break above $0.18 begins flipping the development.

Month-to-month Ichimoku exhibits DOGE sitting on main historic help

Analyst Cantonese Cat (@cantonmeow) identified that DOGE is hugging the decrease fringe of the month-to-month Ichimoku cloud — a zone that has acted as multi-year dynamic help.

He additionally highlighted:

- The 0.5 log Fibonacci degree

- The 200-week SMA

Each act as heavy long-term helps that would assist DOGE rebound towards $0.133 if macro circumstances cool off. With a little bit of humor he added, “Canine’s nonetheless in the home,” at the same time as long-term construction will get examined arduous.

Essential ranges to look at

Upside:

- $0.1500 → should reclaim to keep away from deeper bother

- $0.18–$0.20 → breakout zone if momentum returns

Draw back:

- Weekly shut < $0.14 → opens path to $0.07

- Breakdown confirmed if quantity expands and multi-year trendlines fail

The whole lot now relies on quantity, volatility, and whether or not bulls can lastly defend the next low.

Last ideas

Dogecoin is in a fragile consolidation zone, with each bullish and bearish eventualities nonetheless very a lot alive.

At press time, DOGE traded round $0.14, down 6.48% within the final 24 hours. A rebound towards $0.18–$0.20 is feasible — however provided that DOGE breaks resistance with momentum behind it.

Lose the present help, although, and the market could possibly be staring down far decrease macro ranges. Merchants ought to control the triangle help, weekly shut ranges, and quantity developments, as these will resolve which course DOGE takes subsequent.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.