- The memecoin market plunged to its lowest degree of 2025, wiping out over $5B in a single day as danger urge for food collapsed.

- Broader crypto markets additionally fell sharply, with whole market cap dropping $800B in three weeks and main property like BTC and ETH sliding double digits.

- NFTs mirrored the decline, falling 43% in a month, with most prime collections posting heavy losses aside from a few outliers.

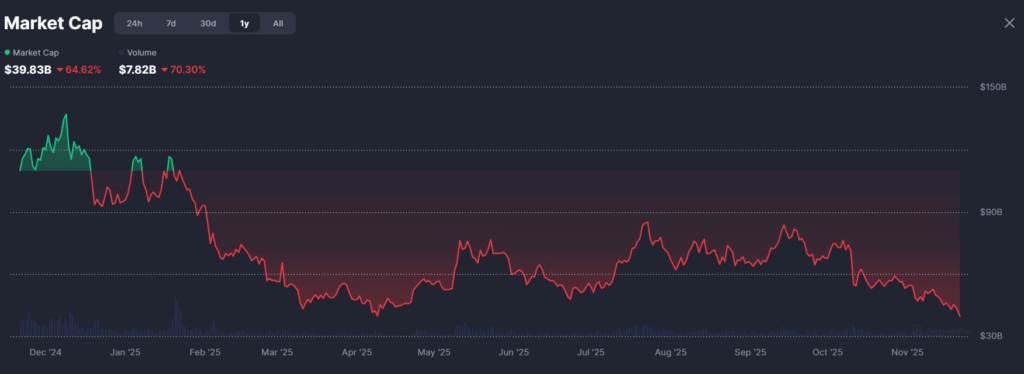

The memecoin market took a tough hit on Friday, sliding to its lowest level of 2025 as merchants abruptly stepped away from speculative property. Based on CoinMarketCap, your entire sector fell to a mixed worth of about $39.4 billion — which is fairly wild contemplating it was sitting at $44 billion only a day earlier. Which means greater than $5 billion evaporated in 24 hours, despite the fact that buying and selling quantity truly jumped by 40%, which kinda exhibits panic greater than curiosity. In comparison with the excessive again on Jan. 5, when the market touched $116.7 billion, this drop marks an enormous 66.2% drawdown and indicators that sentiment round memecoins has cooled quick.

Broader Crypto Market Suffers Heavy Losses

This wasn’t an remoted meltdown both. The remainder of the crypto market has been bleeding closely over the previous few weeks. CoinGecko information exhibits the worldwide market cap tumbling from $3.77 trillion on Nov. 1 to $2.96 trillion by Friday — that’s roughly an $800 billion wipeout in simply three weeks. Even the majors aren’t escaping the sell-off. Bitcoin, the market big, traded round $82,778 after falling 14.7% over the week, and Ether adopted with its personal 16% decline right down to $2,688. Threat urge for food appears to have evaporated throughout the board, not simply in memecoins.

High Memecoins Report Steep Losses Throughout All Timeframes

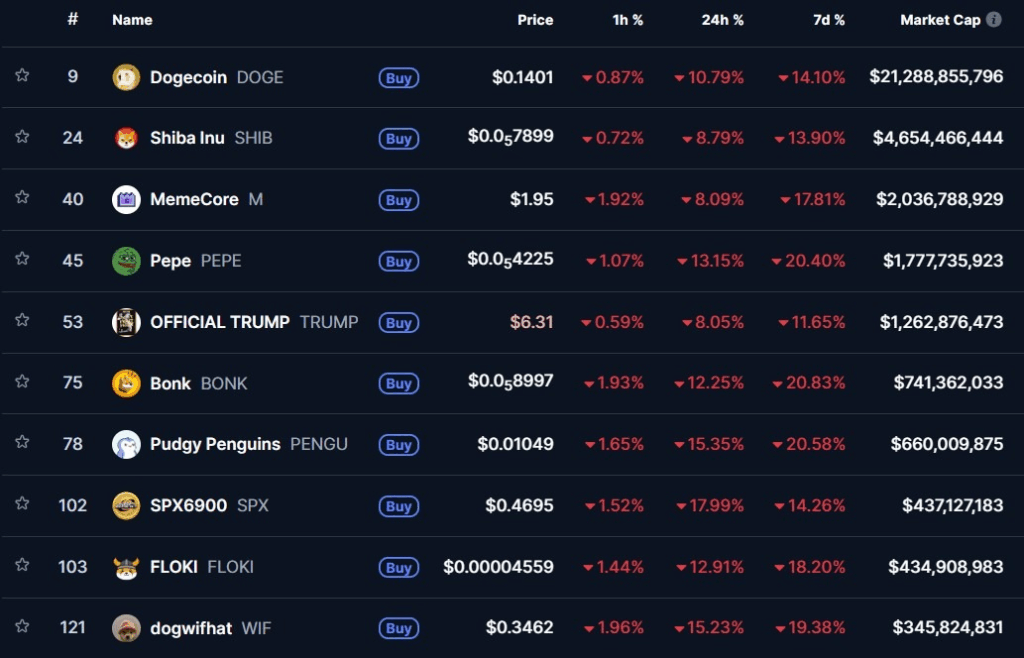

Wanting on the sector’s prime tokens, the image doesn’t get any prettier. The highest 10 memecoins are deep within the pink throughout each main timeframe — the 1-hour, 24-hour, and seven-day charts — exhibiting how broadly merchants have stepped again from high-volatility property. Dogecoin and Shiba Inu each posted double-digit drops, whereas tokens like Pepe, Bonk, and Floki sank even tougher. Weekly losses ranged from round 11% at the most effective to greater than 20% for these hit the worst, which is a fairly brutal week for such a speculative nook of the market.

Curiously, Trump’s “Official Trump” memecoin was the least broken, dropping 11.65% — nonetheless tough, however lighter than others. Dogecoin adopted with a 14.10% decline, and SPX6900 slipped 14.26%. On the opposite finish, Bonk, Pudgy Penguins’ PENGU token, Pepe, and Dogwifhat all recorded heavy 20% drops, placing them among the many worst performers of the week.

NFT Market Additionally Hits Multi-Month Lows

The NFT market wasn’t spared both, struggling one other wave of steep valuation losses. CoinGecko information exhibits the NFT market cap tanking to $2.78 billion — down an enormous 43% from $4.9 billion simply 30 days in the past. That’s its lowest degree since April and fairly clearly displays fading curiosity in digital collectibles as hypothesis cools down. Many of the prime 10 NFT collections noticed double-digit declines, with Hyperliquid’s Hypurr NFTs collapsing 41.1% in a single month. Moonbirds and CryptoPunks adopted with declines of 32.7% and 27.1%, whereas Pudgy Penguins dropped about 26.6%.

Nonetheless, not every little thing was pink. Two collections stood their floor: Infinex Patrons truly gained 11.3%, making it the lone standout performer, whereas Autoglyphs managed to slide only one.9%, which — on this setting — is sort of a win. Even so, the broader pattern is evident: each memecoins and NFTs at the moment are sitting at their weakest factors of the yr, with speculative urge for food falling sharply as your entire market recalibrates.

The submit Memecoin Market Sinks to 2025 Low as $5B Vanishes in a Single Day — Right here Is Why Hypothesis Simply Hit a Wall first appeared on BlockNews.