- Solana faces renewed bearish stress because it approaches a key help degree at $123.

- EMAs trace at a doable Demise Cross, which traditionally preceded deeper declines.

- Realized revenue/loss is at its lowest since 2023—earlier dips this low led to sturdy rebounds.

Solana has been grinding decrease once more, and the decline is pushing the altcoin proper again right into a vital help degree it hasn’t touched in additional than seven months. The transfer isn’t taking place quietly both—market weak spot is deepening throughout the board, and SOL is feeling the total weight of it. Except the tone shifts quick, the chart is hinting at extra hassle forward.

Heavy losses pile up as a doable Demise Cross varieties

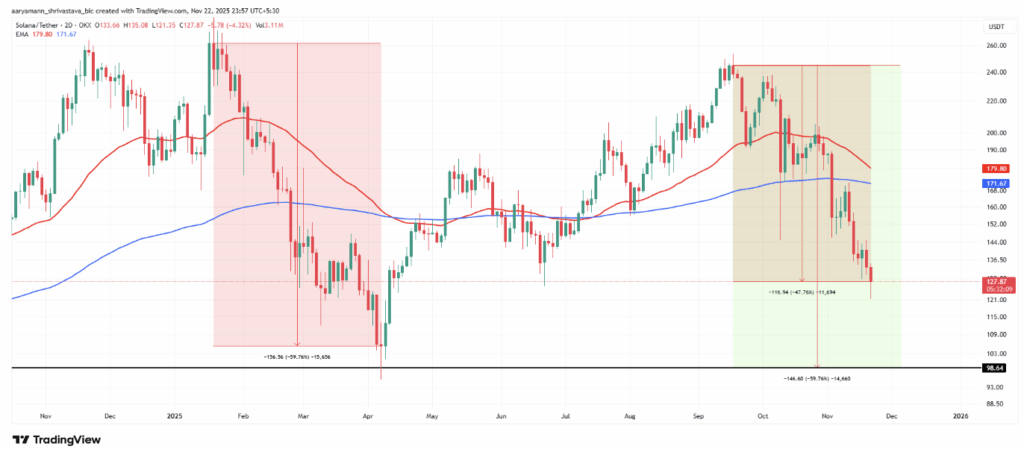

Buyers are hurting. Solana’s exponential transferring averages are starting to trace at a possible Demise Cross, which varieties when a short-term EMA dips under a longer-term one. It’s normally a warning signal of a protracted downtrend, and Solana has seen related setups earlier this yr.

Again in Q1 and Q2, SOL dropped 59% from the native prime earlier than the Demise Cross absolutely shaped. The present decline is already down 47% from the height, and if historical past repeats itself, SOL may slide towards $98—a degree that may affirm deeper bearish stress.

Sentiment is clearly softening. The market seems to be drained, and so do the holders.

Realized losses hit their lowest level in over a yr

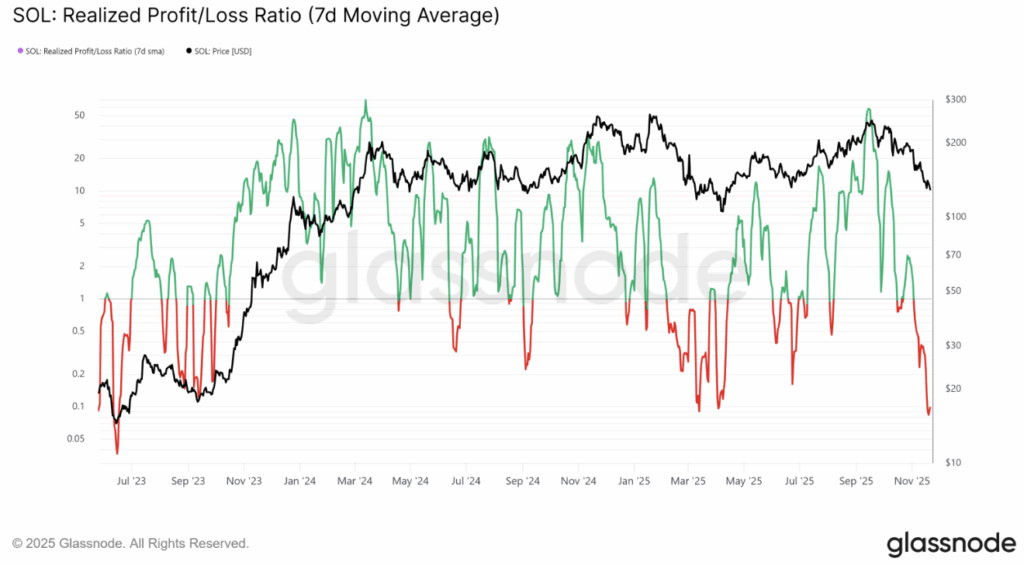

Solana’s internet realized revenue/loss ratio simply fell to its lowest degree since June 2023. Meaning holders have been locking in some severe realized losses throughout this downturn. This metric usually indicators worry, capitulation, or only a broad reevaluation of danger.

However oddly sufficient, there’s a silver lining right here.

At any time when the ratio dipped under 0.1—because it has now—the market traditionally rebounded. This occurred in March, April, and September of 2023, every time marking the beginning of a restoration as promoting stress started to chill off.

If that sample repeats, SOL won’t be as doomed because the decrease timeframes recommend. Typically the market has to flush out sufficient ache earlier than it might bounce.

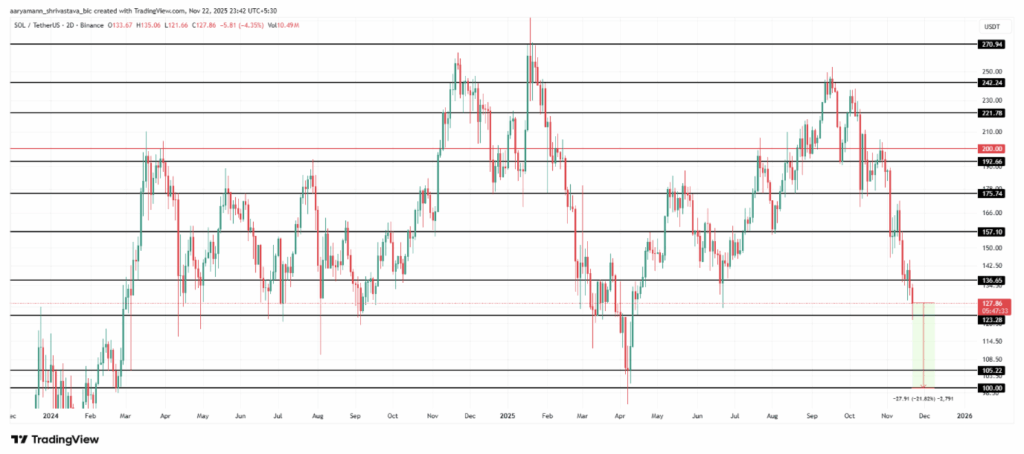

SOL holds $127… however barely

Proper now Solana trades round $127, clinging simply above the $123 help zone. The chart is mainly ready for the broader market to cease bleeding. If confidence returns, SOL may maintain this degree and rebound.

However the danger aspect nonetheless dominates the image.

If the Demise Cross confirms and weak spot persists:

- A break under $123 opens the door to $105

- A deeper slide towards $100 turns into doable

- That might mark roughly a 21.8% drop from present ranges and revisit value territory final seen in March

It’s not the prettiest state of affairs, but it surely’s more and more lifelike if the market retains sinking.

What may save the development?

If realized losses start to stabilize—one thing already hinted at by the revenue/loss ratio—Solana may bounce off $123and try a transfer again towards $136. Clearing that degree would shift the short-term outlook and open a path towards $157, successfully invalidating the bearish construction and giving bulls one thing actual to work with.

For now, SOL sits in a fragile pocket: one sturdy bounce away from restoration, or one dangerous candle from one other massive leg down.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.