Bitcoin is buying and selling in a fragile state after slipping beneath $90,000 and now within the mid-$80,000s. This worth motion has induced some analysts to grapple with the likelihood that the following main rally could also be additional away than many anticipate.

A current technical outlook from outstanding crypto analyst Tony “The Bull” Severino provides weight to this concern. His evaluation focuses on the 6-week LMACD momentum indicator, which has simply crossed bearish for the primary time in years.

Associated Studying

Momentum Turns In opposition to Bitcoin On The 6-Week LMACD

The technical outlook highlights a robust warning from Severino, who argues that Bitcoin is nowhere near staging the form of explosive restoration many are ready for.

Severino’s message revolves round momentum, which he says is now firmly pointed downward. The momentum is cited utilizing the current crossover on the 6-week LMACD, which is thought for its decisive crossovers that affirm long-term development adjustments.

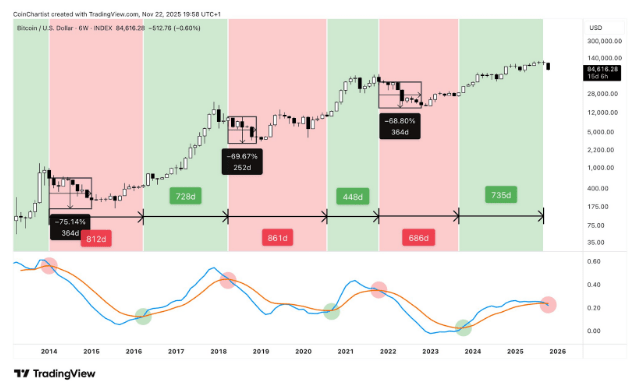

The 6-week LMACD is a lagging sign, which means that by the point it flips bearish, Bitcoin is already properly right into a downturn. The chart confirms this with a number of examples: Bitcoin entered prolonged pink phases lasting 812 days, 861 days, and 686 days following earlier bearish crossovers.

As a result of the sign lags worth motion, Bitcoin sometimes bottoms lengthy after the crossover happens. Severino famous that bear-market lows at all times seem between 250 and 12 months after the bearish flip, not inside a number of weeks. Due to this fact, merchants anticipating a backside solely 40 days after the brand new sign are ignoring how constantly gradual this indicator behaves.

The chart additionally highlights how extreme every downturn turns into as soon as the LMACD flips bearish. Earlier cycles noticed drawdowns of roughly 69% to 75% from the second the cross occurred, though Bitcoin had already fallen considerably earlier than the indicator flashed.

Please take note of this submit if you wish to perceive why Bitcoin is extremely unlikely to all of a sudden spring again right into a bull run

One phrase: Momentum

The 6-week LMACD has among the cleanest crossovers representing pivotal development change affirmation factors. The sign lags,… pic.twitter.com/mq9uR2Fqec

— Tony “The Bull” Severino, CMT (@TonyTheBullCMT) November 22, 2025

A Potential Lengthy Street Earlier than Any Important Restoration

Though the LMACD sign simply crossed bearish, the present crossover remains to be unconfirmed for one more 15 days, and the resemblance to previous cycles is one thing to bear in mind.

Severino famous that he’s not predicting the tip of Bitcoin’s long-term prospects, however he’s urging merchants to cease anticipating fast upside. Previous habits doesn’t assure the identical outcomes, and there’s no certainty that Bitcoin will drop one other 70% from right here like earlier cycles.

Associated Studying

The 6-week LMACD is a high-timeframe sign, and the shifts it captures replicate deep structural traits quite than short-term fluctuations. This implies Bitcoin may nonetheless be months away from its true cycle backside.

On the time of writing, Bitcoin is buying and selling at $85,670, down by 11% and 23% up to now seven and 30 days, respectively. Severino’s evaluation signifies that the Bitcoin worth may spend a chronic interval hovering round these ranges or expertise an extra decline earlier than any significant restoration into a brand new bull section begins.

Featured picture from See The Wild, chart from TradingView