The Dogecoin market construction has tightened round a single, extremely watched assist zone close to $0.138, and analyst Kevin (@Kev_Capital_TA) is framing that space because the pivot that decides whether or not the meme coin’s broader bull case survives its present drawdown.

Is Dogecoin About To Break?

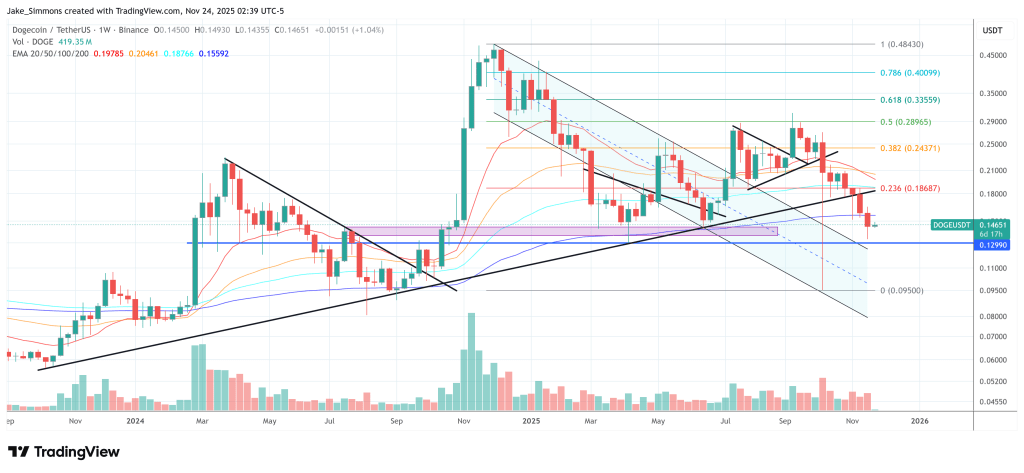

Sharing a weekly DOGE/USD chart on X, Kevin described the extent as a uncommon multi-factor confluence: “$0.138 cents on Dogecoin is a mix of the macro .382 Fib, the 200W SMA, and this upsloping trendline.” In his learn, the cluster of a macro Fibonacci retracement, the 200-week easy transferring common, and an ascending trendline rooted within the bear-market base and late-summer 2024 lows creates a assist shelf that isn’t merely native, however structural to the cycle.

The chart he posted, timestamped Nov. 23, exhibits DOGE buying and selling across the mid-$0.14s after a steep weekly selloff, with worth urgent straight into that circled confluence area. Notably, Kevin’s warning is much less about intraday volatility and extra about higher-timeframe acceptance beneath assist.

In an earlier put up he summarized the danger in blunt phrases: “$0.138 is very large assist on Dogecoin… you actually don’t wish to see that misplaced on 3D-1W closes.” The emphasis on three-day to one-week settlements displays his view that DOGE’s trendline and long-cycle averages matter provided that the market begins to shut decisively beneath them.

Associated Studying

On the chart, that $0.138 space sits slightly below present worth and aligns with the purple 200-week SMA and the rising yellow trendline. Above, Kevin has additionally mapped a band of overhead provide across the high-$0.18s to ~$0.20, whereas a deeper horizontal assist line close to the mid-$0.09s marks the following main draw back waypoint seen on his weekly framework.

His level is that the bull pattern remains to be technically intact so long as DOGE holds the rising base, however that the slope can flip quick if the market begins treating $0.138 as resistance as a substitute of assist.

The Macro Backdrop Wants To Align

Kevin explicitly situates DOGE’s destiny inside a wider liquidity and Bitcoin-led regime, quite than as an remoted meme-coin story. Within the Nov. 22 put up he wrote, “Clearly BTC’s efficiency would be the determiner to that consequence so focus there first together with USDT D.

His longer macro word expands that context by contrasting the current Bitcoin technical posture with the coverage and sentiment backdrops of earlier breakdowns. Kevin recalled that “In 2022 when BTC misplaced the 50W SMA and the 2D 200 ema/sma we additionally have been confronted with 4+% inflation that was headed to 9% on a freight practice, we had probably the most hawkish Fed in 40 years… together with quantitative tightening at a fee by no means seen earlier than.”

He additional described the psychological setting then as “max euphoria the place if you happen to even hinted {that a} prime was in you’ll be ridiculed by the herd.” In opposition to that, he argued that the present cycle is nearly the mirror picture in macro phrases even when a number of the BTC chart indicators rhyme: “In 2025 you might have the identical technical setup on BTC through a lack of these key MA’s however by way of financial coverage, sentiment and the general macroeconomic setting it’s utterly the other.”

Associated Studying

He listed the pivots he sees: “The Fed is ending QT… charges are getting nearer to impartial and can proceed to return down,” whereas “PMI’s have been contractionary for years however are prone to begin increasing in 2026,” and “key inflation metrics are seeing decrease highs.” He additionally emphasised that this macro shift is going on alongside a sentiment excessive quite than a mania peak, saying, “we shaped a excessive in pure utter pessimism.”

That mix of technical fragility and macro easing is why Kevin thinks this section is unusually arduous to commerce and why singular confluence ranges acquire significance. As he put it, “This feels similar to 2019 by way of the macro setting whereas the technical setup seems to be extra 2022.”

He referred to as the second “probably the most debatable/complicated time in historical past for the #Crypto markets,” including that whereas Bitcoin has been “very predictable this 12 months,” he doubts that persists: “I’ve a humorous feeling everyone seems to be in for a significant curveball over the following 1.5 years… The 2011-2021 period is over. International economics and developments have been derailed put up covid.”

Inside that framing, Dogecoin’s $0.138 shelf turns into the type of stage the place the market decides which facet of the 2019-style macro versus 2022-style technical stress is dominant. Kevin’s quick message to merchants, nevertheless, is easier than the macro philosophy behind it: the bull run “rests on” this zone as a result of it’s the first place the place DOGE’s long-cycle trendline, its 200-week imply, and its macro Fibonacci construction all agree.

At press time, DOGE traded at $0.146.

Featured picture created with DALL.E, chart from TradingView.com