- JPMorgan warned Technique may resist $8.8B in index-related outflows, sparking group backlash.

- Grant Cardone, Max Keiser, and others accuse the financial institution of concentrating on MSTR and fueling panic.

- Some merchants say a GameStop-style retail squeeze may emerge if sentiment escalates.

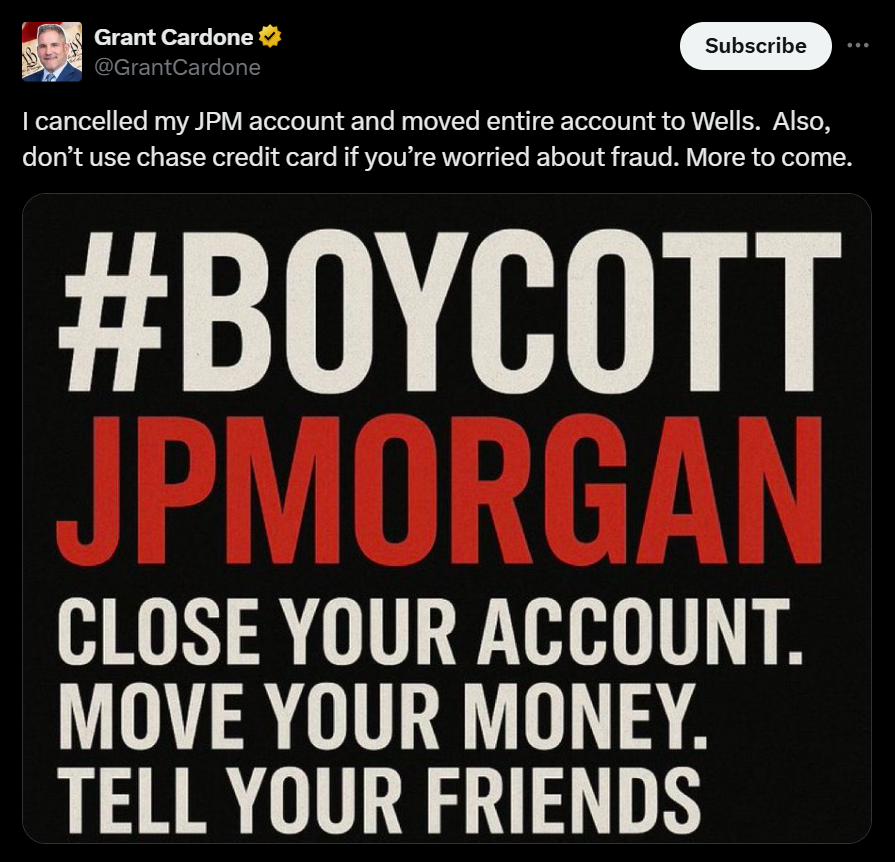

Outstanding actual property investor Grant Cardone has joined a rising refrain of crypto group members calling for a boycott of JPMorgan. The backlash erupted after the banking big warned that Technique may resist $2.8 billion in pressured outflows if faraway from MSCI indices. JPMorgan analysts additionally mentioned complete withdrawals may attain as excessive as $8.8 billion if different index suppliers take related motion, a situation that rattled Technique shareholders and crypto advocates.

Technique Inventory Falls Sharply After MSCI Outflow Estimates

Following JPMorgan’s report, Technique inventory dropped beneath $200 on Wednesday and continued sliding into the week’s shut, hitting a brand new yearly low close to $170. This marks a dramatic reversal from mid-July when MSTR traded above $450. As soon as one of many S&P 500’s standout performers, MSTR is now down 41 % year-to-date and roughly 57 % during the last twelve months, amplifying fears that pressured index promoting may deepen the decline.

Crypto Advocates Accuse JPMorgan of Concentrating on Technique

Bitcoin supporters argue that JPMorgan’s be aware was not merely evaluation however an intentional hit on Technique shareholders. Cardone, Max Keiser, and pro-XRP lawyer John Deaton all declare the financial institution is intentionally upsetting panic. Some locally even allege JPMorgan is shorting MSTR, although no public proof has surfaced. The criticism intensified as JPMorgan confronted renewed scrutiny over its historic ties to Jeffrey Epstein, fueling mistrust amongst crypto-aligned retail merchants.

Rumblings of a GameStop-Type Retail Rebellion

As tensions rise, some imagine the scenario may morph into one other GameStop-style revolt. Deaton mentioned that if retail merchants turn into satisfied JPMorgan is betting in opposition to MSTR, they might rally across the inventory in an effort to squeeze out quick sellers. The dynamic mirrors the early days of the GME frenzy, with merchants framing the narrative as a battle between Wall Avenue establishments and a grassroots group decided to defend a high-conviction asset.

A Rising Divide Between Banks and Crypto Holders

The battle highlights a widening cultural and monetary rift between the crypto group and conventional banking giants. Supporters see JPMorgan’s warnings as an assault on Bitcoin-aligned firms, whereas critics insist the market dangers outlined by the financial institution are reputable. With Technique’s inventory now below extreme stress and Bitcoin itself buying and selling far beneath its peak, the opportunity of a retail-driven counterattack stays firmly on the desk.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.