The crypto market heads into the ultimate full week of November with a setup that appears nothing just like the exhaustion you’ll count on after two months of stress and as a substitute resembles a type of uncommon transition factors the place historic seasonality, ETF inflows and liquidation imbalances collide to provide circumstances merchants are inclined to underestimate till they see the big-time transfer.

TL;DR

- DOGE and SHIB present statistical circumstances for a “Santa Rally.”

- XRP ETF absorption locations a path towards $5 on the desk.

- Bitcoin bulls recaptured $37 million in liquidations regardless of a troublesome week.

Value historical past for DOGE and SHIB hints at “Santa Rally” alternative

Historic seasonality for DOGE and SHIB is a type of issues everybody stops speaking about till it out of the blue turns into related once more. DOGE, being the older and extra “grown-up” meme asset, normally enters December with probably the most dependable year-end patterns on all the retail facet of the market.

CryptoRank’s desk reveals the identical factor each cycle: the November-December block delivers inexperienced way more usually than it doesn’t, with a number of years printing triple-digit strikes or not less than very clear recoveries from no matter harm the autumn did earlier than that.

That is necessary as a result of DOGE spent most of 2025 shifting sideways inside a protracted, uninteresting construction whereas nonetheless managing to maintain a year-to-date acquire of round 23%. Traditionally, this precise a part of the calendar is the place DOGE both snaps upward with an actual transfer or resets simply sufficient to let new capital in, which is precisely what occurred final yr when it ran for a number of weeks straight and solely cooled off as soon as January arrived.

SHIB has the identical timing however a totally totally different volatility form. Its excessive month continues to be October 2021 with that absurd +833.6%, but even in calmer years the again finish of This fall tends to tilt constructive. The Shiba Inu coin is down about 57% this yr, which implies it doesn’t want a lot — only a slight enchancment in liquidity or a small sentiment shift — to flip right into a restoration leg.

Put each charts collectively and the image is apparent. DOGE held inexperienced throughout the yr, SHIB bled nonstop, however each opened their rally home windows on the identical second 12 months in the past. That’s the reason the “Santa Rally” concept is being taken significantly once more.

XRP to $5? Here is how XRP ETF demand could make it actual

XRP continues to carry the $1.90 zone, which capped all the 2021 bull run and has since grow to be one of many fundamental liquidity bases of this cycle. The market has pushed XRP into this space 4 occasions this yr, and every time, the bounce was quick sufficient to display substantial assist, fairly than the superficial assist that merchants fake to care about.

The ETF angle adjustments the entire construction: spot ETFs might take away 4-5 billion XRP from circulation by the tip of the yr if inflows proceed. Canary Capital picked up greater than $281 million price of XRP in its first week. Which means that the subsequent issuers — Franklin Templeton, Grayscale and 21Shares — will doubtless take up way more as soon as their merchandise launch.

Mixed, ETF flows might exceed Canary’s by roughly tenfold. Below that setup, the trail towards $5 turns into the principle restoration state of affairs, not a very optimistic prediction. A weaker influx part retains XRP close to $3.20, whereas a really robust influx opens the door to costs above $6.00.

The chart helps this concept. RSI sits round 37, inserting XRP on the decrease fringe of its long-term channel with out breaking any main development. With the important thing liquidity flooring at $1.90 and ETF demand rising, XRP enters December with one of many cleanest uneven setups within the large-cap group.

Bitcoin bulls set off $37 million liquidation imbalance

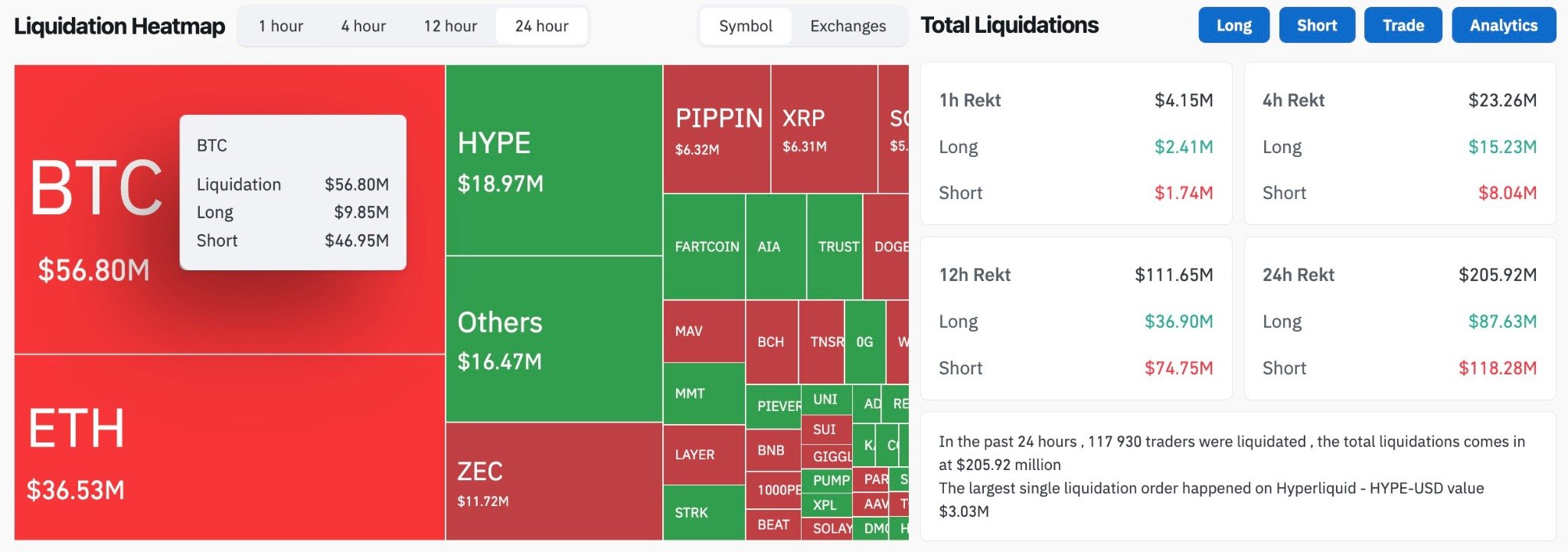

Based on CoinGlass, Bitcoin noticed $56.8 million in liquidations during the last 24 hours, with solely $9.85 million coming from longs and all the things else hitting shorts, which is a wierd final result contemplating the asset spent all the week underneath stress, dropped 8.78% at one level and even touched $80,600 earlier than the market caught its breath once more.

Regardless of all of the stress, headlines and purple candles, bulls nonetheless walked away with about $37 million reclaimed by way of quick liquidations, and the value managed to rebound towards $85,900 in the identical window, turning what appeared like one other heavy week right into a setup the place the decrease $80,000 space acts extra like a liquidity lure for aggressive shorts than an precise breakdown.

The general image is that short-side stress is much extra fragile than the chart suggests, and the liquidation map reinforces that by displaying clusters constructing precisely the place shorts hold coming into and getting flushed. Although Bitcoin nonetheless sits inside a tough setting, this sample — bullish liquidations right into a purple weekly construction — hardly ever comes with out some form of positioning reset underneath the floor.

Crypto market outlook

DOGE and SHIB proceed to indicate seasonal patterns that always result in cleaner rallies late within the yr, XRP reacts extra to ETF mechanics than sentiment, and Bitcoin’s liquidation profile leans barely in favor of consumers even after a troublesome week. These components form the ultimate stretch of November and set the early-December tone.

- Bitcoin (BTC): Holding $85,900 rebound whereas $80,600-$82,000 stays within the liquidity zone. Wants $90,000 to flip bias.

- XRP: Buying and selling close to $2.03-$2.10 after defending $1.90 once more. ETF flows hold $2.20-$2.24 as the primary upside gate.

- Shiba Inu (SHIB): Sitting round -57% YTD, any transfer by way of $0.00000890-$0.00000900 opens its seasonal restoration window.