Stellar (XLM) is as soon as once more buying and selling close to a stage that has triggered sturdy rallies up to now. The token is priced round $0.243 at press time, exhibiting a slight restoration as merchants study historic patterns and technical alerts.

Consideration is targeted on whether or not the help zone close to $0.23 will produce one other transfer like these seen earlier this yr.

Value Returns to Key Help

Analyst Ali Martinez identified that XLM has bounced 3 times from the $0.23 stage this yr. The token rose 33% in March, 48% in April, and 133% in July after reaching this help. It’s now again in the identical zone, and the market is anticipating indicators of an analogous response.

$XLM has bounced 33%, 48%, and 133% the final 3 times it touched $0.23.

Will it occur once more? pic.twitter.com/IlM5oz2NNh

— Ali (@ali_charts) November 23, 2025

Notably, the present setup reveals the value testing the help after a gradual decline from the $0.40 vary. The broader development has been down, and momentum is weaker than throughout earlier touches of this stage. Whereas the previous reveals a sample of sturdy rebounds, there isn’t a affirmation but that the identical consequence will comply with.

As well as, Elite Crypto famous that XLM has fashioned a second falling wedge sample much like one seen earlier this yr. The primary wedge led to a breakout and a powerful rally. Now, the asset is as soon as once more close to the wedge’s higher boundary. The construction features a collection of decrease highs compressing towards help.

The analyst said that if the breakout mirrors the sooner transfer, a 100% rise from the present stage “will likely be extremely attainable.” The sample is being watched, however a breakout has not but occurred.

Technical Circumstances Present Weak point

On the day by day chart, XLM trades beneath all key exponential shifting averages. The 20-day EMA is at $0.26, whereas the 50-day sits close to $0.29. The value would want to maneuver above these ranges to point out early power. The Relative Energy Index (RSI) is close to 38, barely above its current low, indicating that promoting has slowed however not reversed.

Brief-term restoration would require an in depth above the 20-day EMA. Till then, the development stays downward with decrease highs nonetheless in place.

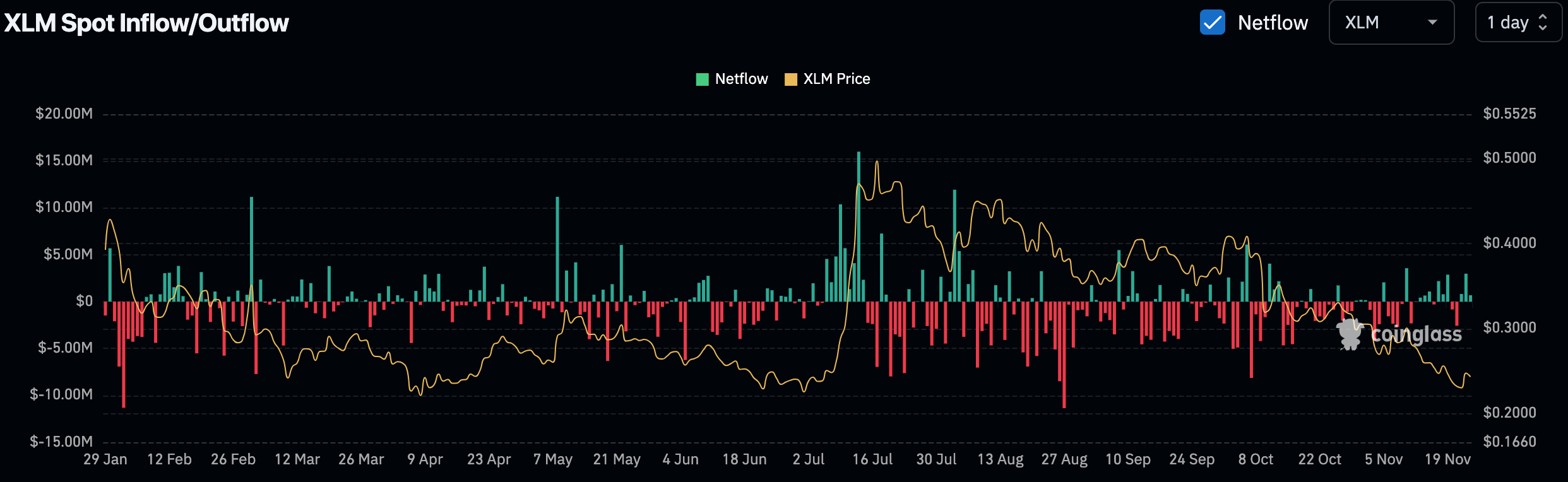

Alternate Movement Exhibits Small Influx

Knowledge from November 24 reveals a internet influx of $685.85K into spot exchanges. That is the primary optimistic circulate after an extended interval of outflows courting again to mid-year. These earlier outflows had matched the regular drop in value from $0.50.

The influx is small and will mirror merchants’ positioning within the brief time period. It doesn’t but recommend a transparent shift in sentiment.

The submit Triple-Digit Transfer Incoming? XLM Hits Key $0.23 Help Once more appeared first on CryptoPotato.