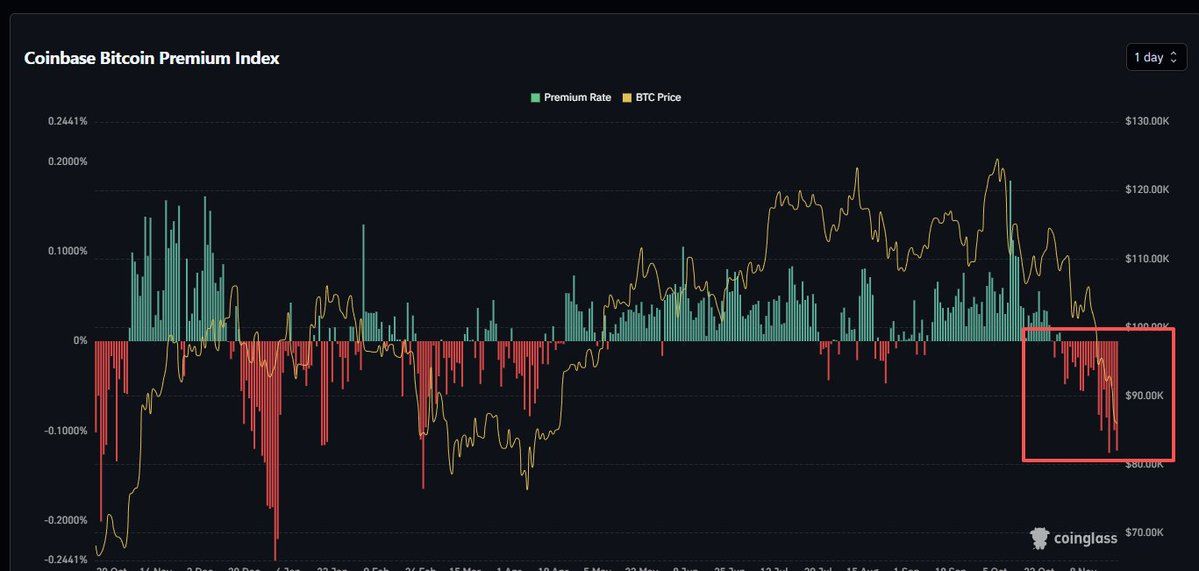

The Coinbase Bitcoin Premium Index has remained unfavourable for 21 consecutive days, the longest streak within the present cycle. Information from Coinglass exhibits the index has stayed beneath zero since early November, mirroring Bitcoin’s drop from close to $120,000 to round $84,000.

This unfavourable premium signifies ongoing promoting strain on US-based exchanges, reflecting US institutional investor sentiment. Analysts counsel the market might not discover a clear backside till this pattern reverses.

Sponsored

Sponsored

Understanding the Coinbase Premium Index

The Coinbase Premium Index tracks the proportion distinction between Bitcoin costs on Coinbase, a number one US change buying and selling in USD, and Binance, the place numerous retail merchants primarily commerce in USDT. When the premium is constructive, it highlights stronger US investor demand and institutional shopping for. In distinction, a unfavourable studying displays promoting strain or lowered US demand versus international markets.

The present 21-day unfavourable streak marks an unprecedented stretch. Often, the index fluctuates between constructive and unfavourable territory. The Coinglass chart exhibits persistent crimson bars, indicating sustained unfavourable readings throughout this cycle. This extended interval of negativity has mirrored Bitcoin’s worth weak point. BTC surpassed $120,000 earlier than sliding all the way down to $84,500 as of November 24, 2025.

Institutional Sentiment and Persistent Promoting Strain

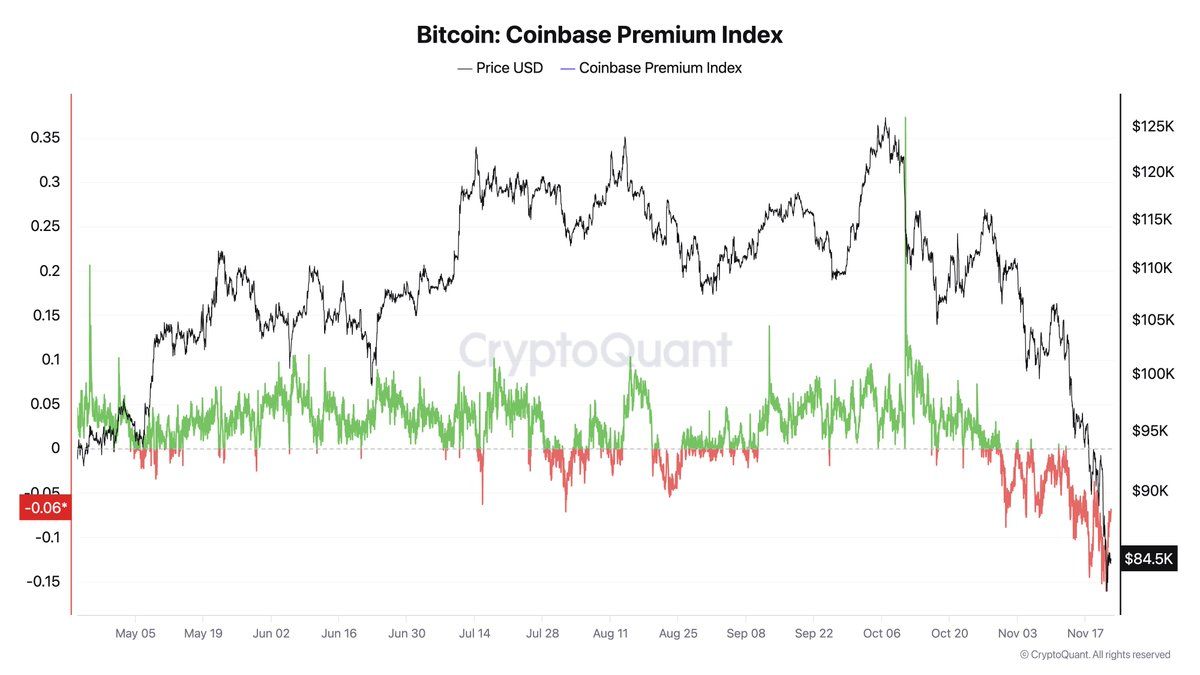

CryptoQuant CEO Ki Younger Ju emphasised that US institutional sentiment stays subdued. CryptoQuant information exhibits the hourly Coinbase premium at -0.06, highlighting continued warning from bigger home gamers. The corresponding chart illustrates a pointy latest decline after prior sideways motion.

In the meantime, analyst Giannis acknowledged that the latest decline is primarily attributable to aggressive institutional promoting on Coinbase relatively than retail panic. He famous that international consumers haven’t been capable of soak up the promoting strain, stopping Bitcoin from forming a base. Traditionally, reversals are inclined to comply with a return of the premium to impartial or constructive, suggesting continued draw back danger for now.

Sponsored

Sponsored

Open curiosity information reinforces this dynamic, rising from beneath 20,000 contracts in late October to about 70,000 by mid-November. Rising open curiosity alongside falling costs usually factors to rising quick positions and bearish market sentiment. These traits underscore issues about sustained promoting strain.

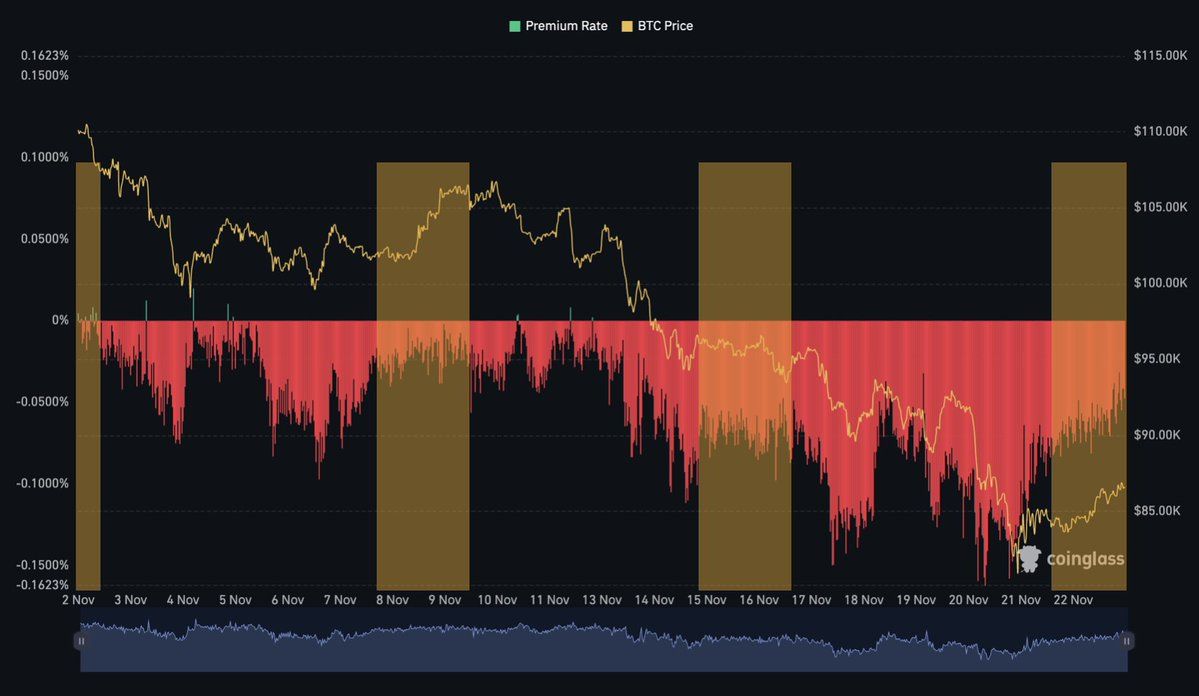

Weekend Results and Imply Reversion Patterns

Not all analysts see the unfavourable premium as solely bearish. Market observer CryptoCondom famous that weekends typically drive imply reversion within the Coinbase premium. When ETF exercise and US-based sellers pause over the weekend, the premium continuously strikes nearer to zero, supporting some worth stability or small positive aspects.

This recurring weekend sample has appeared in latest weeks, with shaded areas on charts indicating premium rises and worth upticks. The distinction between “weekend pumps” and “weekday dumps” highlights the impression of buying and selling flows on Bitcoin’s short-term volatility. Nonetheless, the broad weekday pattern stays unfavourable, as institutional exercise intensifies promoting strain.

These weekend results spotlight the affect of US establishments on Bitcoin’s construction. Once they pause, international demand gives transient aid. Nonetheless, when establishments re-enter the market within the week, promoting resumes, typically overwhelming international consumers and perpetuating the downward pattern.

Market Outlook and Backside Formation

The continuing unfavourable Coinbase premium indicators that Bitcoin has but to type a sustainable backside. Traditionally, pattern reversals are inclined to happen after the premium recovers, indicating shifting institutional habits. Till that occurs, rebounds could also be muted or rapidly reversed by renewed promoting from the US.

Market contributors face a difficult state of affairs. Present situations resemble previous capitulation phases, however the persistent unfavourable premium suggests promoting has not but exhausted itself. Merchants should resolve if these costs sign long-term accumulation or are merely pauses in a extra prolonged downtrend.

A impartial or constructive flip for Coinbase Premium would sign a turning level, indicating the tip of institutional promoting and renewed demand. Till then, warning is prone to dominate Bitcoin buying and selling methods.