- XRP analyst BD predicts a daring $10 goal by end-2025, citing unseen catalysts and rising institutional momentum across the asset.

- A number of spot XRP ETFs — together with Canary’s XRPC with a $58M debut — are drawing contemporary institutional curiosity and reshaping market expectations.

- Ripple’s growth into prime brokerage, stablecoins, and institutional settlement pipelines strengthens the long-term case for XRP regardless of weak market circumstances.

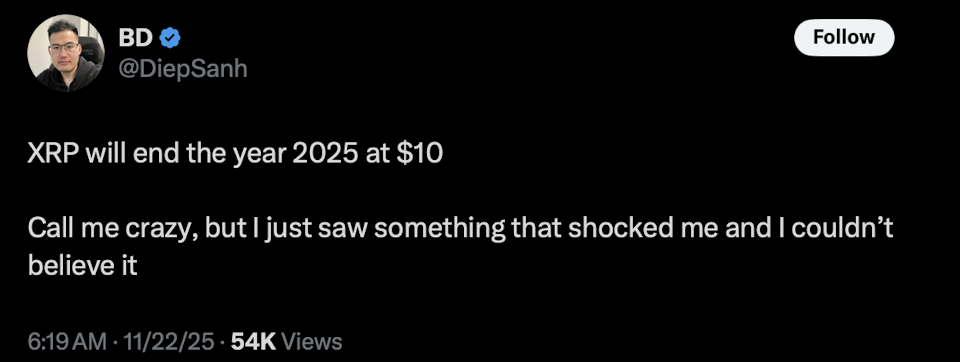

Crypto markets have been slogging by way of a type of gradual, heavy stretches the place nothing appears to catch an actual bid, and most main tokens have bled greater than anybody anticipated. Even so, pockets of the group are nonetheless holding onto some fairly daring conviction — particularly round XRP. One of many loudest voices this week got here from BD (@DiepSanh), a widely known determine within the area, who dropped a fairly stunning prediction: XRP at $10 by the tip of 2025.

Yeah… $10. In a market that may’t appear to seek out its footing. Daring doesn’t even start to cowl it.

A Daring Goal for XRP in a Bleak Market

BD didn’t totally break down the precise catalyst he found — solely stated he “noticed one thing that shocked” him and pushed him towards this double-digit goal. However his message matched the tone of many long-time XRP supporters who see the present downturn as extra of a brief shakeout than a structural failure.

And actually, whenever you zoom out, there are a number of ongoing developments that might find yourself feeding into an even bigger liquidity wave for XRP. Institutional traction has quietly been constructing all month, even when value hasn’t caught up but.

XRP ETFs Are Beginning to Shift Expectations

A large a part of this new bullish narrative revolves across the contemporary wave of spot XRP ETFs that launched in November. The largest splash to this point got here from Canary Capital’s XRPC ETF, which pulled in about $58 million in quantity on its very first day.

That’s not small — particularly contemplating XRP has by no means precisely been Wall Avenue’s favourite asset.

Different gamers have jumped in too, together with the Rex Osprey XRP ETF and Bitwise’s product, with extra funds getting ready to launch. Every new itemizing provides one other regulated pipeline for institutional cash to move into XRP, which is precisely the kind of construction that helped Bitcoin rally earlier within the yr.

The extra ETF doorways that open, the louder the expectation grows that demand might ramp arduous heading into This fall and past.

Ripple’s Institutional Growth Strengthens the Thesis

Away from the charts, Ripple has been busy reshaping its institutional footprint. The massive headline was its buy of Hidden Highway, a transfer that pushes Ripple deeper into prime-brokerage territory.

That acquisition helped spin up Ripple Prime, which pulls institutional settlement features instantly onto the XRP Ledger — tightening the loop between enterprise adoption and XRP utility.

Ripple additionally expanded its stablecoin presence by way of RLUSD, creating one other bridge to conventional finance and giving establishments extra causes to work together with the ecosystem.

Once you join all of those dots — ETF momentum, institutional pipelines, enterprise growth — you may sort of see the define of the argument BD was leaning on. Possibly not an ideal roadmap to $10, however positively sufficient gas for a significant sentiment shift.

Ultimate Takeaway

XRP isn’t precisely “thriving” proper now, however the foundations beneath it are getting busier, deeper, and extra institutionally linked. BD’s prediction of a $10 XRP by late 2025 displays a perception that XRP is sitting proper on the middle of a number of industry-shaping transitions — and that after the market stops bleeding, that groundwork would possibly lastly begin exhibiting up in value.

No ensures, in fact. However the narrative momentum is constructing, even when the charts haven’t caught up but.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.