- VanEck CEO raised considerations about Bitcoin’s privateness, pushing longtime BTC holders to discover Zcash’s stronger encryption options.

- Zcash surged 930% in 2025, reaching a $9.43B market cap and gaining momentum forward of its OKX relisting.

- Business voices, together with Vitalik Buterin, warned that quantum computing might threaten present cryptographic programs, including strain to Bitcoin’s privateness debate.

Bitcoin’s privateness options had been thrown below the highlight this week after VanEck CEO Jan van Eck brazenly questioned whether or not BTC nonetheless offers sufficient encryption for at present’s requirements. Throughout a CNBC interview, van Eck mentioned the dialog contained in the Bitcoin group has shifted from value motion to deeper considerations about transparency and privateness. His feedback ended up steering quite a lot of consideration towards Zcash, a privacy-focused coin that has been ripping increased this yr with a reasonably unreal 930% surge. As Bitcoin traded round $86,204 on Sunday, down almost 8% year-to-date and nonetheless about 31% below its all-time excessive, the distinction between the 2 narratives grew to become exhausting to disregard.

Why Bitcoin Holders Are Exploring Zcash

Van Eck defined on Energy Lunch that some long-term Bitcoin holders at the moment are reassessing their assumptions, particularly as privateness turns into an even bigger precedence within the area. He famous that Bitcoin’s clear ledger, the place anybody can hint how cash transfer from one pockets to a different, goes in opposition to the rising expectation for transactional privateness. Zcash, alternatively, makes use of zero-knowledge proofs to defend sender, receiver and quantity — primarily providing the privateness many customers thought would ultimately emerge round Bitcoin however hasn’t but.

He additionally emphasised that VanEck evaluates Bitcoin the identical method it evaluates conventional belongings, saying the agency would “stroll away” if the underlying thesis ever grew to become basically damaged. After the interview, van Eck even posted on X that Bitcoin’s present bear market is partly tied to halving cycle dynamics, quantum encryption considerations, and the truth that Zcash offers stronger privateness ensures. Across the time of the interview, BTC hovered close to $84,643 earlier than recovering barely.

Zcash Turns into a Prime-15 Crypto as Exchanges Reopen Buying and selling

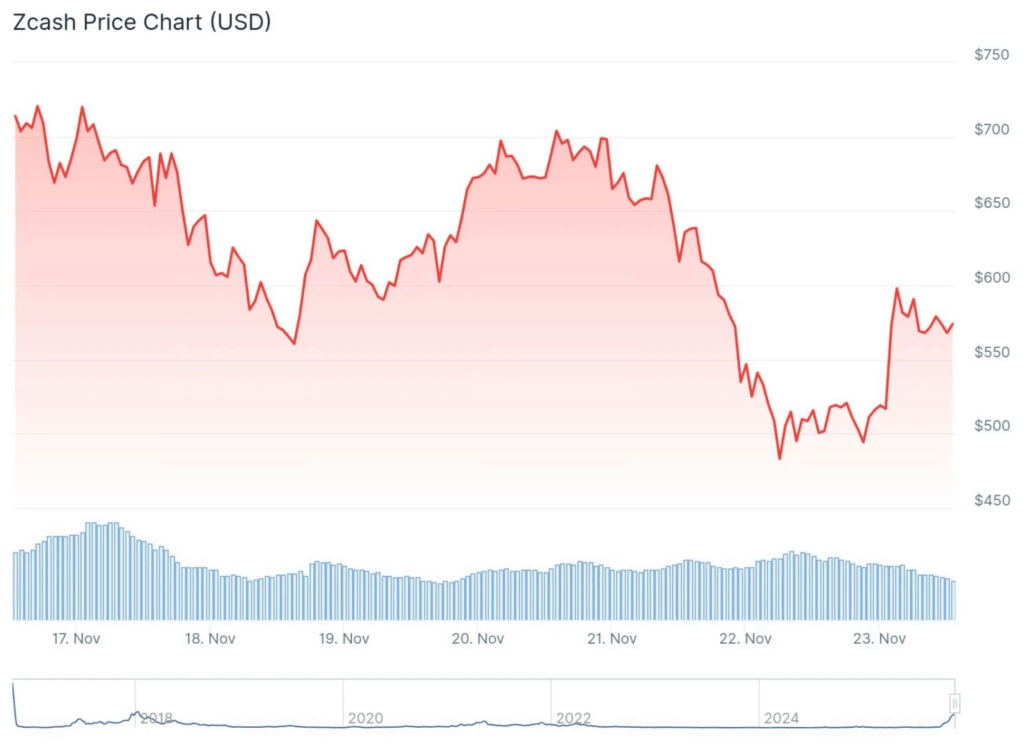

Zcash’s large rally has pushed it into the Thirteenth-largest cryptocurrency spot, with a market cap round $9.43 billion. ZEC was buying and selling close to $578 on the time of reporting, exhibiting simply how aggressively capital has rotated into privateness narratives these days. The momentum acquired one other enhance when OKX introduced it might relist Zcash, with ZEC/USDT spot buying and selling restarting on November 24 at 12:00 UTC. This relisting marks a big step since Zcash has usually handled regulatory considerations tied to privateness cash, making the comeback much more stunning.

Business Reacts to Privateness, Encryption, and Quantum Considerations

Van Eck’s feedback triggered loads of dialogue throughout the crypto area. Some merchants argued that Bitcoin’s transparency is a characteristic, not a flaw.

However others pointed to reliable long-term dangers, particularly as quantum computing advances quicker than anticipated. Vitalik Buterin spoke at a November 17 occasion in Argentina and warned that elliptic curve cryptography — the inspiration of each Bitcoin and plenty of blockchains — might be weak to quantum breakthroughs. These warnings, mixed with the rising demand for privacy-first know-how, have given Zcash a recent narrative tailwind at a second when Bitcoin is going through new scrutiny.

The submit Zcash Soars as Bitcoin Privateness Considerations Develop — Right here Is Why BTC Holders Are All of the sudden This 930% Gainer first appeared on BlockNews.