Black Friday falls on November 29, and several other main altcoins are actually buying and selling at steep markdowns. These altcoins providing Black Friday reductions will not be simply low-cost — they every have a setup that would flip the low cost right into a restoration if market circumstances enhance. And even worsen!

One has an attainable path again towards its highs, one carries a deep reversal setup, and one other sits inside a powerful cycle narrative with heavy long-term discounting. All three supply various kinds of low cost narratives.

BNB (BNB)

BNB is without doubt one of the few large-cap tokens which have maintained robust long-term efficiency. Whereas Bitcoin is down about 6% year-on-year and Ethereum is down almost 15%, BNB stays up round 35%. That energy makes the present pullback a extra significant Black Friday low cost slightly than a symptom of weak spot.

Sponsored

Sponsored

Its present low cost? BNB is 37.1% beneath its all-time excessive, which was set roughly a month in the past. That makes the markdown extra related.

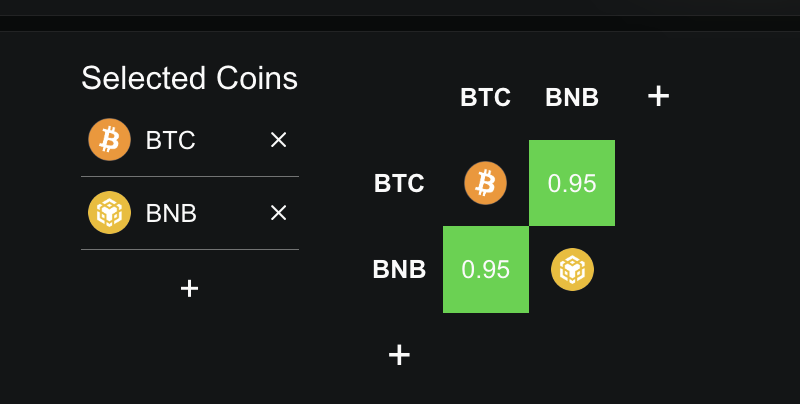

BNB can also be carefully tied to the broader market. Its +0.95 one-month correlation with Bitcoin exhibits it strikes nearly in sync with BTC. So, if the market turns, the BNB worth tends to reply shortly.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

On the chart, BNB exhibits a transparent continuation construction.

Between June 21 and November 21, the worth shaped the next low, whereas the Relative Energy Index (RSI) made a decrease low. RSI measures momentum, and this sample — worth rising whereas RSI falls — hints that promoting stress is fading. The same setup appeared earlier between June 22 and November 4, however the transfer stalled on the identical ceiling BNB faces now. That ceiling is $1,016.

BNB wants a clear day by day shut above this stage to verify momentum. If it breaks:

- $1,183 turns into the following goal

- Above that sits $1,375, very near its all-time excessive and sensible if market sentiment shifts.

On the draw back, shedding $791 exposes $730, however the broader uptrend stays intact.

Sponsored

Sponsored

BNB earns its place on the Black Friday low cost listing as a result of:

- Its low cost is latest and never structural

- Its RSI divergence hints that the pullback could also be ending

- Its path again to the highs is brief and achievable if Bitcoin stabilizes

Sei (SEI)

Sei additionally suits the listing of altcoins providing Black Friday reductions as a result of its markdown is deep, recent, and supported by a clear reversal setup. And the DeFi-narrative is also a powerful driver.

Its low cost is without doubt one of the steepest on this listing. Sei is down 54% previously three months and 88% beneath its all-time excessive, which was set in March 2024. That makes the markdown significant: the highest isn’t from 5 or 6 years in the past, so retesting greater zones isn’t unrealistic if circumstances enhance.

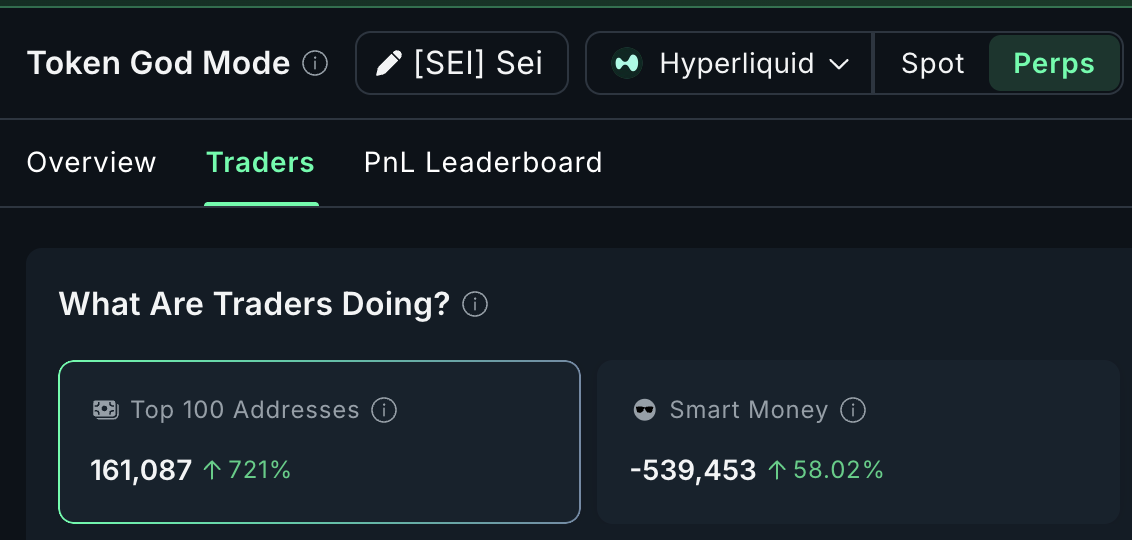

Perp merchants are additionally turning extra energetic. Prime 100 addresses elevated lengthy publicity by 721%, signaling renewed curiosity.

Sensible Cash remains to be net-negative (brief), however even right here, positioning improved by 58.02%, displaying that essentially the most environment friendly merchants are slowly easing off bearish bets.

Sponsored

Sponsored

The chart sends the clearest sign. Between October 10 and November 21, the worth made a decrease low, whereas the Relative Energy Index (RSI) made the next low. It is a classical bullish divergence and a doable reversal catalyst.

The same construction shaped between October 10 and November 4, when SEI bounced sharply earlier than getting rejected at key resistance.

That creates the following set of ranges. Sei should break $0.169 to verify an actual reversal. If it clears this, the trail opens towards $0.195 (earlier rejection stage), and above that sits the heavier ceiling at $0.240.

The draw back is simple. Shedding $0.127 weakens the reversal and exposes a clear breakdown, particularly if broader circumstances stay comfortable.

Sei earns its place on this Black Friday listing as a result of:

- Its low cost is deep however latest sufficient to be significant

- A transparent RSI reversal setup is energetic

- Early perp-side optimism helps the concept that the decline could also be ending

Sponsored

Sponsored

Sprint (DASH)

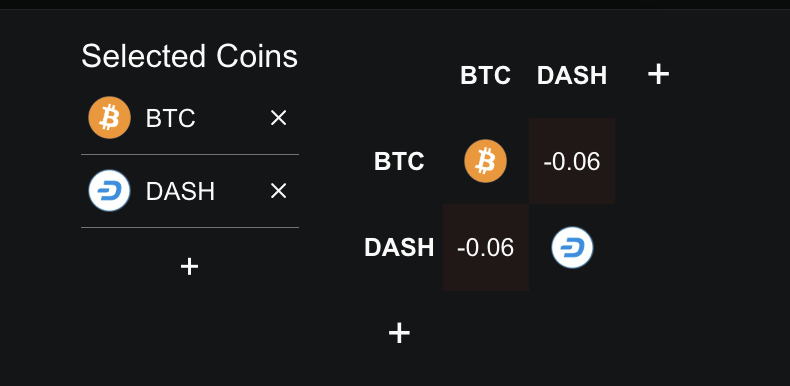

Sprint suits a really totally different a part of the altcoins providing Black Friday reductions theme as a result of it sits contained in the privateness token narrative, one of many few segments which have outperformed on this uneven cycle. Its one-year correlation with Bitcoin is –0.06, which suggests it will probably transfer the alternative method when the broader market falls.

The long-term markdown right here is big. DASH remains to be down greater than 96% from its all-time excessive. The near-term pullback provides one other layer to the low cost.

DASH has dropped 26% over the previous seven days, so patrons are nonetheless getting a marked-down entry even after the robust run earlier this quarter.

The chart now indicators that this pullback could also be fading. Between October 30 and November 25, the worth made the next low whereas the Relative Energy Index (RSI) made a decrease low. It is a continuation setup (hidden bullish divergence), and it typically seems when a broader uptrend pauses earlier than resuming.

For Sprint, trend-based Fibonacci extension ranges assist map the trail forward. The primary barrier is $78. A clear break above this stage clears the best way towards $107 and better. These targets are effectively inside attain if the cycle narrative stays robust.

A drop beneath $52 breaks the continuation construction and places $41 again on the chart. That is the extent that acted as the ground throughout the early-November surge.

Right here is why this low cost narrative works:

- Lengthy-term markdown is very large and nonetheless intact.

- Close to-term pullback provides a recent entry zone.

- Privateness narrative and adverse BTC correlation let DASH transfer by itself pattern