Bitcoin is holding above a trendline that has influenced its value motion for the previous 4 years. This stage, as soon as seen as resistance, is now being examined as assist following a confirmed weekly candle shut above it.

Lengthy-Time period Assist Holds After Weekly Shut

A chart shared by Ash Crypto reveals Bitcoin staying above a rising trendline that has been in place since 2021. This line beforehand rejected value on three totally different events over the previous three years. Now, with Bitcoin buying and selling above it, the extent is appearing as assist.

BITCOIN weekly candle closed above the 4-year Development Key stage

BTC is sitting proper on the macro long-term trendline that’s held the market collectively for 4 years.

This stage has acted as main resistance 3 instances during the last 3 years, now flipping as sturdy assist.

So long as… pic.twitter.com/Y6WuGu57Vk

— Ash Crypto (@AshCrypto) November 24, 2025

Ash Crypto famous that “so long as BTC holds above this trendline, the long-term outlook stays bullish.” This trendline stays a reference level for each bulls and bears.

Whereas the weekly chart alerts energy, the every day reveals resistance. Based on Titan of Crypto, BTC is testing the Tenkan-sen stage on the Ichimoku chart. The Tenkan-sen has capped value motion throughout the current bounce from the $82,000 space.

Titan famous that “a clear shut above it’s wanted to unlock increased ranges.” Till that occurs, the worth might keep inside a restricted vary. If Bitcoin does shut above the Tenkan-sen, it may open room for a transfer towards the Kijun-sen and probably the decrease boundary of the Ichimoku cloud.

Promoting Exercise Slowing Down

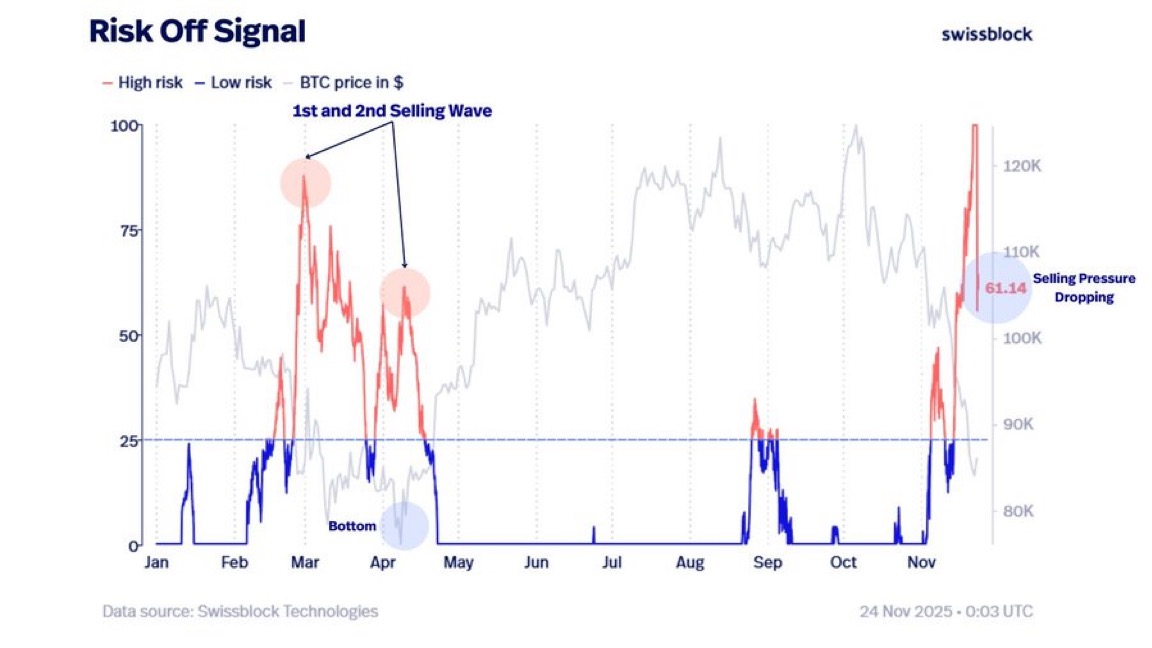

A chart from Swissblock Applied sciences reveals the “Threat Off Sign” peaking throughout the current drop, then falling from above 90 to round 61. This decline alerts that the heavy promoting seen earlier could also be easing. The chart additionally reveals two earlier spikes in March and April, adopted by a low-risk interval.

The reappearance of low-risk indicators on the identical chart means that the market could also be forming an area backside. That Martini Man commented,

“Bitcoin promoting stress is easing. BTC is beginning to kind a backside, as worry begins to drop.”

These modifications in danger stage usually happen close to the tip of main correction phases.

Whale Accumulation and Retail Exit

Santiment knowledge reveals the variety of wallets holding a minimum of 100 BTC has gone up by 91 since November 11. On the identical time, the variety of small wallets is falling, suggesting that retail traders are pulling again. In the meantime, some older wallets have additionally moved cash just lately, with long-time holders decreasing positions.

“Retail capitulation will typically play out effectively for crypto costs in the long term,” Santiment reported.

Whereas this might assist the case for a market backside, it additionally reveals blended habits amongst bigger holders as Bitcoin strikes by means of a unstable section.

The put up Bitcoin (BTC) Breakout Watch: Holding Sturdy at Crucial Trendline appeared first on CryptoPotato.