BNB is now buying and selling at a stage that beforehand marked a breakout in 2024. After pulling again from its current peak, the value is sitting proper at a former resistance that’s now being examined as assist.

Consequently, this space has held earlier than and is as soon as once more in play as merchants reassess short-term positioning.

BNB Returns to Channel Help

BNB is priced at $850 at press time, displaying a slight 24-hour acquire of over 1%, although it’s down 7% over the week. On the 2-week chart, it has tapped the higher boundary of an ascending channel, a stage that capped the value motion for many of 2024 and early 2025. After breaking out and reaching above $1,350, the asset has retraced to retest that very same trendline.

“BNB simply tapped an enormous confluence stage,” stated CryptoPulse.

Notably, the realm traces up with the earlier resistance-turned-support and sits in the course of the prior rally vary. If consumers step in right here, a push towards $950–$1,050 stays doable. Thus far, quantity has not proven indicators of main promoting, which retains the construction intact.

On the month-to-month timeframe, BNB has returned to a key trendline that has held since 2024. In keeping with Cryptocium, BNB has not closed a month-to-month candle under this line with robust draw back momentum.

“BNB again to the most important bullish trendline,” they famous, including that the value has revered this pattern for almost two years. As November’s month-to-month shut approaches, merchants are watching to see if bulls can defend this zone as soon as once more.

Person Exercise Continues to Develop

Whereas the value motion has pulled again, BNB Chain’s community exercise has grown steadily in 2025. Charts shared by TCC present a rising pattern in lively addresses. From underneath 1,000,000 every day customers in early 2025, the chain has maintained ranges above 1.5 million since July, sometimes peaking close to 3.5 million.

“BNB Chain is quietly climbing,” they posted, pointing to stronger utilization regardless of the current drop in worth. The continued rise in community engagement might recommend underlying demand stays stable.

As well as, knowledge from YZi Labs reveals that extra BNB is being saved in self-custody. Alternate balances are dropping as customers transfer tokens to non-public wallets. CryptoPotato reported this shift earlier in November, noting that possession is changing into extra dispersed throughout the community.

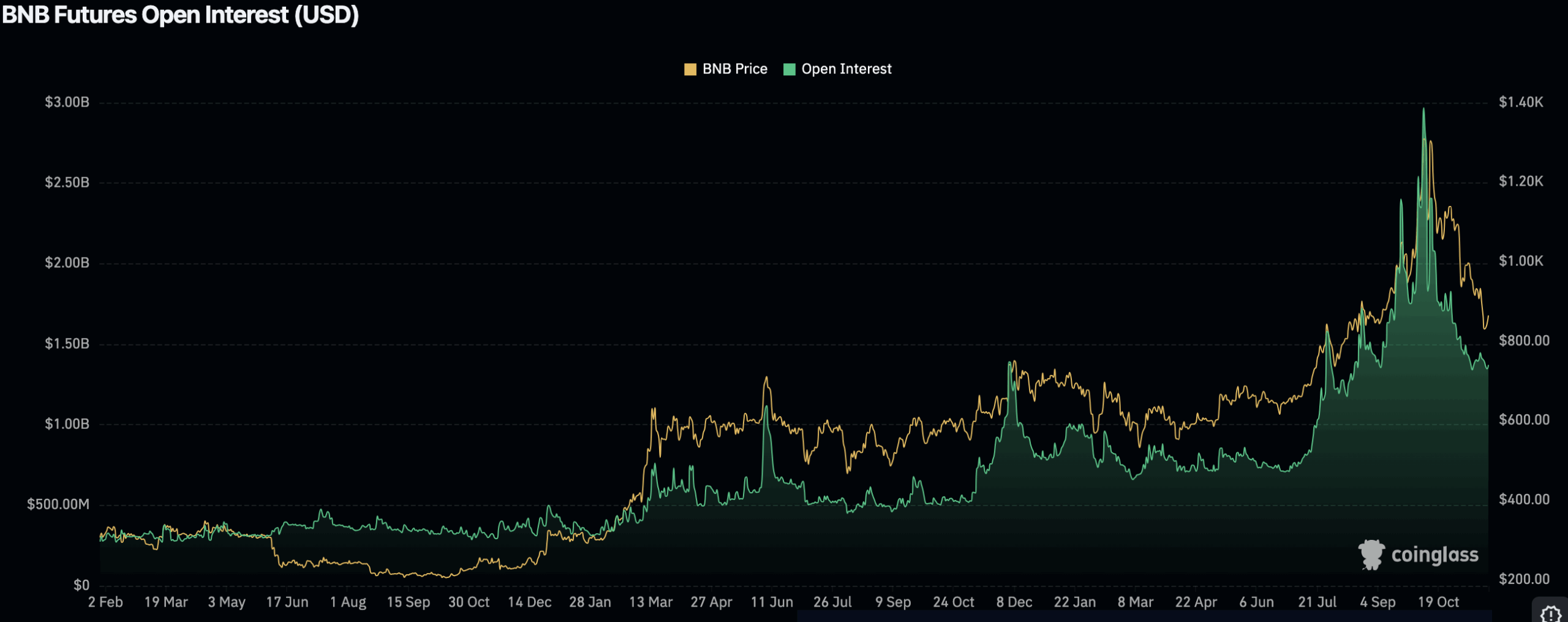

In the meantime, open curiosity on BNB futures is now at $1.34 billion, nicely under the September excessive close to $2.8 billion. The chart reveals that each the value and open curiosity have trended decrease since that peak, pointing to much less speculative exercise in current weeks.

Whereas the asset has discovered some footing within the $850–$900 vary, futures curiosity stays muted, suggesting merchants are nonetheless ready for stronger alerts.

The publish BNB Hits Main Purchase Zone After 2024 Breakout Retest appeared first on CryptoPotato.