- Powell is getting ready for a possible December charge lower, however divisions contained in the Fed stay sharp.

- Lacking October inflation and jobs knowledge are complicating the choice forward of the assembly.

- Markets now see a virtually 80 p.c probability of a charge lower, pressuring Powell to behave.

Federal Reserve Chair Jerome Powell is now quietly getting ready the bottom for a doable rate of interest lower on the December 9–10 FOMC assembly, in response to a brand new report from Nick Timiraos on the Wall Avenue Journal. The tone is shifting, however the state of affairs is messy, with Powell reportedly torn between slicing now or ready for extra readability early subsequent 12 months. Some insiders say he’s leaning towards easing as a part of the broader development that’s already produced two straight cuts, but others contained in the Fed are bracing for a struggle over whether or not inflation has cooled sufficient to justify one other transfer.

Williams Pushes for Motion as Fed Voices Conflict

Assist for a December lower picked up after New York Fed President John Williams stated he favored easing to forestall the labor market from weakening additional. That remark alone pushed expectations sharply larger. However not everyone seems to be satisfied. A number of Fed officers warn inflation pressures stay sticky, they usually’re uneasy making a significant coverage name with out October’s inflation and employment knowledge, each delayed by the lengthy authorities shutdown. With out these reviews, Powell enters the assembly with one of many thinnest knowledge image he’s confronted in years.

Merchants Increase Bets Regardless of the Information Void

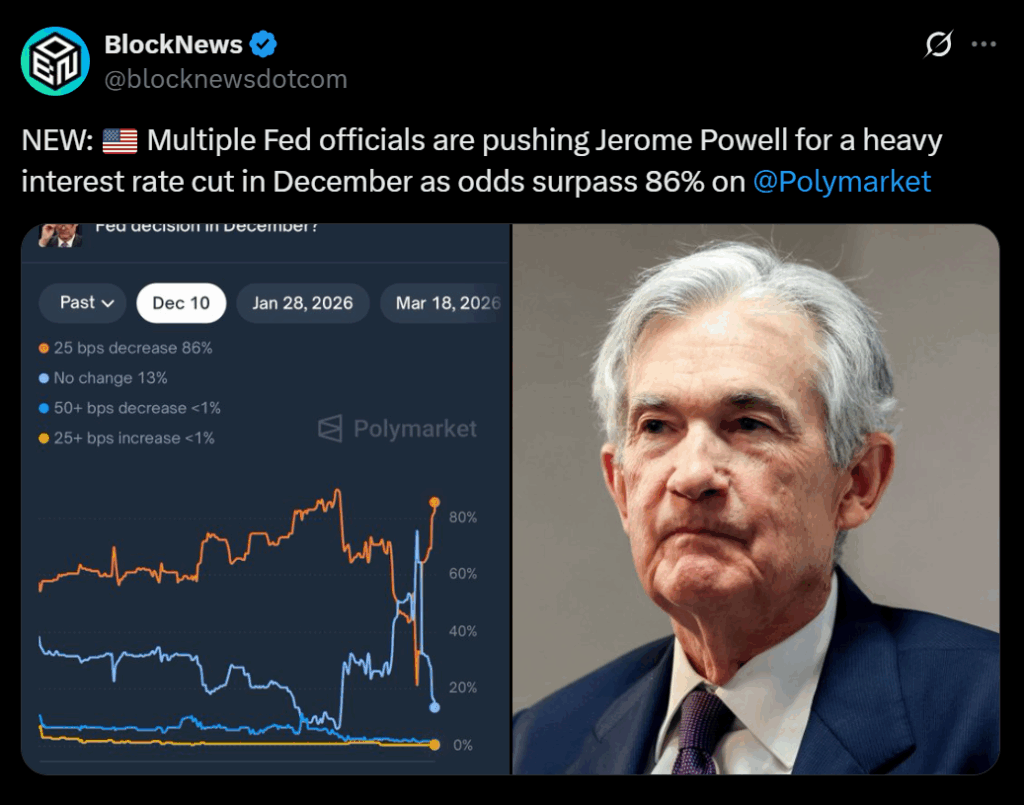

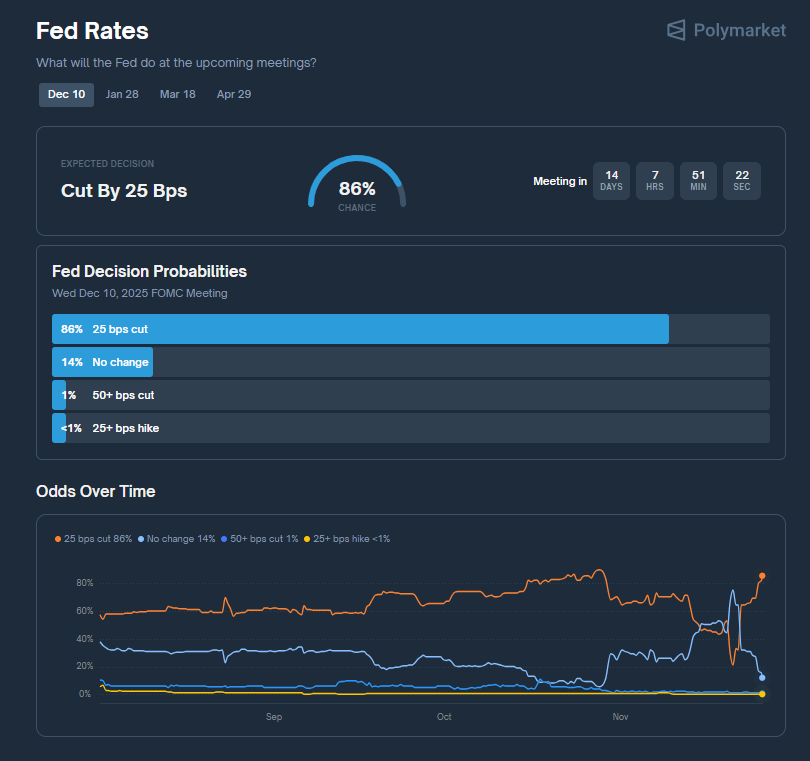

Markets, nevertheless, aren’t ready. Polymarket now exhibits merchants pricing a 86 p.c probability of a 25-bps lower in December. Traders seem satisfied Powell will act, regardless that the lacking knowledge usually would’ve been the final main enter earlier than the Fed’s last determination of the 12 months. In a wierd twist, much less data is definitely pushing rate-cut odds larger, as merchants assume Powell received’t danger tightening circumstances throughout a softening labor stretch.

Powell Should Steadiness Stress, Politics, and Expectations

Because the Fed heads into its last assembly of 2025, Powell faces one among his trickiest setups but: inside division, lacking metrics, and markets which might be virtually daring him to chop. He now has to resolve whether or not to ship easing sooner moderately than later, or maintain off and danger disappointing merchants who’ve already priced within the transfer. Both approach, the choice will set the tone for early 2026, shaping how the central financial institution responds if the financial system slows sooner than anticipated or if inflation surprises once more on the upside.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.