- Wintermute withdrew 24,124 AAVE, signaling sturdy whale accumulation across the demand zone.

- Spot Taker CVD and rising lengthy dominance present patrons gaining management throughout spot and derivatives.

- A break above $179 may verify AAVE’s rebound setup and open room towards larger targets.

Wintermute’s withdrawal of 24,124 AAVE — roughly $4.1 million — from Kraken on November 24 has stirred the market in a manner that feels extra intentional than reactive. This sort of off-exchange motion often alerts function, not hesitation, as a result of Wintermute hardly ever pulls measurement with out a cause baked in. And with AAVE sitting inside its demand zone, the motion finally ends up reinforcing a quiet however regular build-up of whale accumulation. Merchants are watching the momentum change carefully, since massive gamers are likely to outline the turning factors in a uneven market, even when worth motion nonetheless appears to be like trapped inside a broader downtrend.

Consumers attempt to take management as worth rebounds

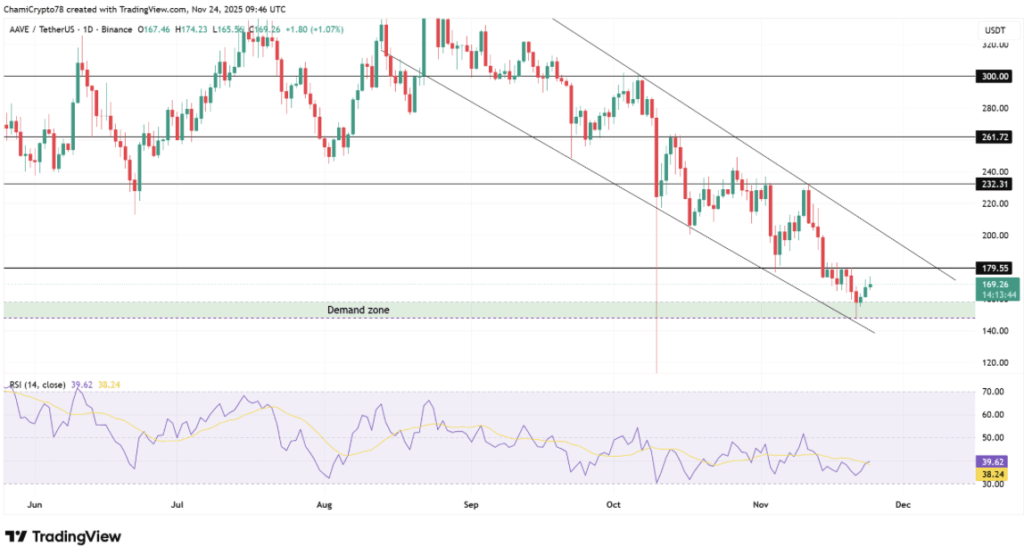

AAVE hovered close to $169 at press time, bouncing cleanly off its $150–$160 demand zone that held agency after weeks of strain. The chart nonetheless confirmed a descending channel weighing on worth, though the current response broke the sample’s rhythm simply sufficient to get consideration. Consumers now face their first actual check at $179, a cussed resistance that has acted like a ceiling earlier than. If worth reclaims it with conviction, the trail towards $232 opens up once more, the place earlier provide lower momentum quick. In the meantime, the RSI nudged up from 39 and moved nearer to its common — nothing dramatic, however sufficient to counsel early momentum returning. There’s no main divergence but, nonetheless the patrons’ exercise across the demand zone exhibits they’re defending worth areas with extra aggression.

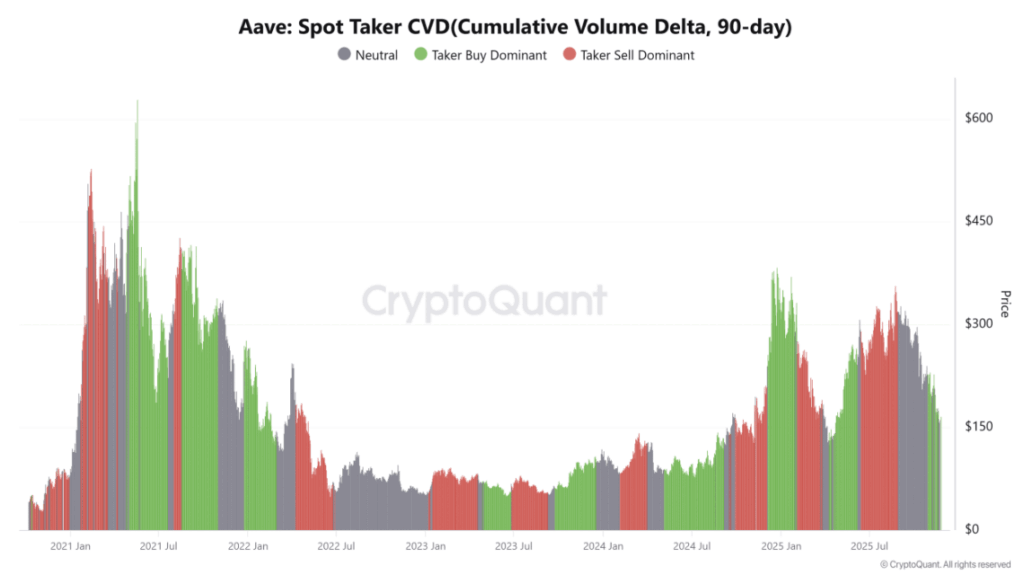

Purchaser aggression exhibits up clearly in CVD habits

Spot Taker CVD has been flashing sustained purchaser energy by way of the 90-day window, displaying that market buys outpace promote strain with some consistency. This indicator tends to focus on conviction extra precisely than passive order circulation, and proper now it’s tilting firmly towards patrons lifting presents and absorbing promote liquidity. That regular rise strains up virtually completely with the bounce off the demand zone, giving extra weight to the argument {that a} development shift could be forming below the floor. Whale entries usually seem when spot purchase strain begins beating reactive promoting — a rhythm that has been unfolding slowly. Whereas the true affirmation hinges on a break above $179, CVD is already sending an early, assured sign.

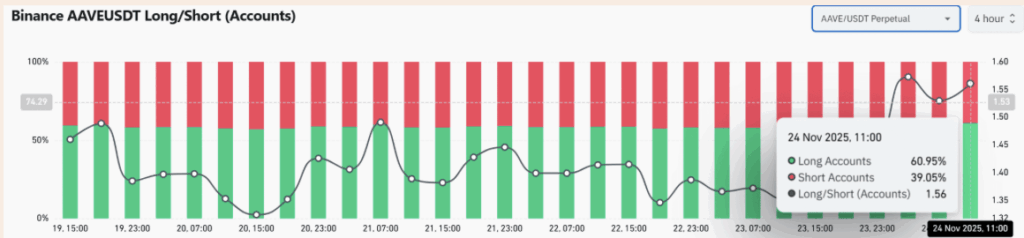

Lengthy merchants acquire management on Binance

Binance’s Lengthy/Brief Ratio jumped sharply to 1.56, that means lengthy accounts now management almost 61% of open positions. This can be a notable change from the closely bearish tilt that dominated your complete downtrend, and such shifts typically floor close to native bottoms. Liquidation knowledge added extra gasoline, displaying heavier quick losses over the previous few classes — the form of factor that forces merchants to unwind bearish positions shortly. If worth presses into the $179 resistance, the setup will increase the possibility of a brief squeeze. This rise in lengthy participation additionally lands proper in sync with the whale-side accumulation that Wintermute kicked off with its withdrawal. Now the query turns into whether or not this mixed weight can push AAVE into a correct breakout.

AAVE reaches a crucial second as alerts align

AAVE sits at a pivotal level the place whales accumulate, patrons management spot circulation, and lengthy merchants dominate derivatives positioning suddenly. These aligned elements strengthen the concept that AAVE is making ready for a bigger rebound from its demand zone. A clear break and maintain above $179 would verify the shift and open a clearer path towards larger ranges, doubtlessly reigniting momentum that has been lacking for weeks. Right here is the place the market decides whether or not this quiet buildup lastly transforms right into a stronger development reversal.

The put up Why the Wintermute Withdrawal Issues — Right here is Why AAVE Would possibly Be Setting Up for a Greater Transfer first appeared on BlockNews.