- ADA trades round $0.41 and stays beneath main EMAs, signaling sturdy bearish momentum.

- Key helps sit at $0.33, $0.28, and $0.20, whereas resistance stays heavy close to $0.70–$0.75.

- A reversal might type provided that ADA reclaims the mid-$0.60s and closes above the 20-week EMA.

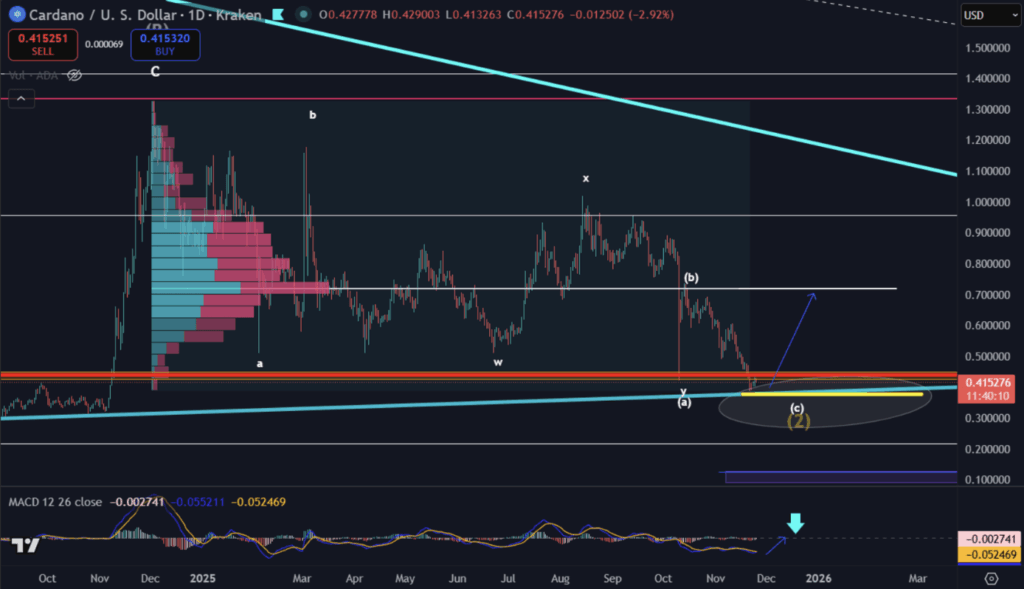

Cardano continues combating heavy bearish stress as ADA trades close to $0.41 — sitting method beneath the 20-, 50-, 100-, and 200-week EMAs. The weekly chart reveals that ADA couldn’t maintain the mid-2024 restoration alive, dropping again into the identical corrective construction that’s lingered since its post-2021 peak. Current value candles sliced beneath a cluster of EMAs and even the center Bollinger Band, hinting that sellers have tightened their grip once more. Proper now the decrease Bollinger Band is virtually hugging the value, suggesting compressed volatility and oversold vibes, though an actual reversal nonetheless hasn’t appeared but.

Momentum indicators stay weak as sellers keep in management

Momentum indicators don’t paint a reasonably image both. The 14-day RSI is sitting close to 34 — not fairly excessive oversold, however deep in damaging territory. There’s no bullish divergence forming, which suggests sellers nonetheless maintain many of the momentum. The weekly MACD can also be firmly bearish: the MACD line sits beneath the sign line, and people crimson histogram bars maintain printing, displaying continued downward stress with no actual signal of aid. It’s a type of charts the place every little thing leans the identical path… and never the path bulls need.

Key helps, Fibonacci ranges, and the hazard zones beneath

If this bearish temper retains rolling, ADA might slip additional. Primarily based on the Auto-Fibonacci construction from the earlier chart, main help zones sit at $0.33 and $0.28, with the 1.618 extension down round $0.20. Traditionally, these ranges have been accumulation zones — locations the place merchants watch carefully for even the smallest trace of a reversal spark. On the upside, resistance between $0.70 and $0.75 traces up with the higher Bollinger Band and a number of other long-term EMAs, creating heavy overhead stress anytime ADA tries to bounce. With the Bollinger Bands compressing and value caught close to the decrease boundary, this complete vary seems to be extra like a build-up part than a breakout try. However for something significant to shift, weekly closes above the 20-week EMA must occur… and momentum has to enhance, not simply stabilize.

A doable catalyst emerges — if ADA clears key ranges

Some analysts are watching early December for a possible bullish set off. Mr. Brownstone famous on X that ADA’s largest weekly buying and selling quantity vary in 2025 sits round $0.72 — a spot that would develop into essential if value ever pushes up once more. There’s additionally the Midnight occasion scheduled for December 8, which might stir consideration again towards Cardano’s ecosystem. If ADA manages to interrupt above the 20-week EMA within the mid-$0.60s, it’d lastly halt the bearish development and begin shaping a restoration construction as a substitute of one other grind downward. However for now, ADA remains to be dealing with sturdy promoting stress and momentum indicators lean towards both sideways drifting or extra decline. Anybody fascinated with lengthy positions would want to attend for a correct bullish engulfing candle on the weekly chart — one thing that reveals patrons stepping again in with precise energy. Right here is the place persistence issues, even when sentiment feels exhausted.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.