Coinbase Ventures outlines 4 strategic themes it expects to drive crypto innovation in 2026. The funding arm shared its outlook in a brand new weblog submit, figuring out the precedence areas by which it goals to speculate.

These embrace Actual-World Asset (RWA) perpetual contracts, specialised buying and selling infrastructure, next-generation decentralized finance (DeFi), and synthetic intelligence (AI) and robotics.

Sponsored

Sponsored

1. RWA Perpetuals Unlock Artificial Market Publicity

The primary theme facilities on Actual-World Asset (RWA) perpetual derivatives. These present artificial publicity to off-chain belongings.

In contrast to conventional tokenization, perpetual futures present a sooner and extra versatile solution to ship on-chain publicity with out requiring groups to custody the underlying asset.

“As a result of perpetuals don’t require securing an underlying asset, markets can kind round nearly something, enabling the ‘perpification’ of every little thing,” the weblog learn.

Coinbase Ventures expects progress in two instructions:

- On-chain macro exposure, which supplies merchants a solution to place round power costs, inflation expectations, credit score spreads, and volatility with out touching conventional monetary rails.

- New classes of markets, together with personal firms, area of interest datasets, and various metrics which can be tough to tokenize however straightforward to copy synthetically.

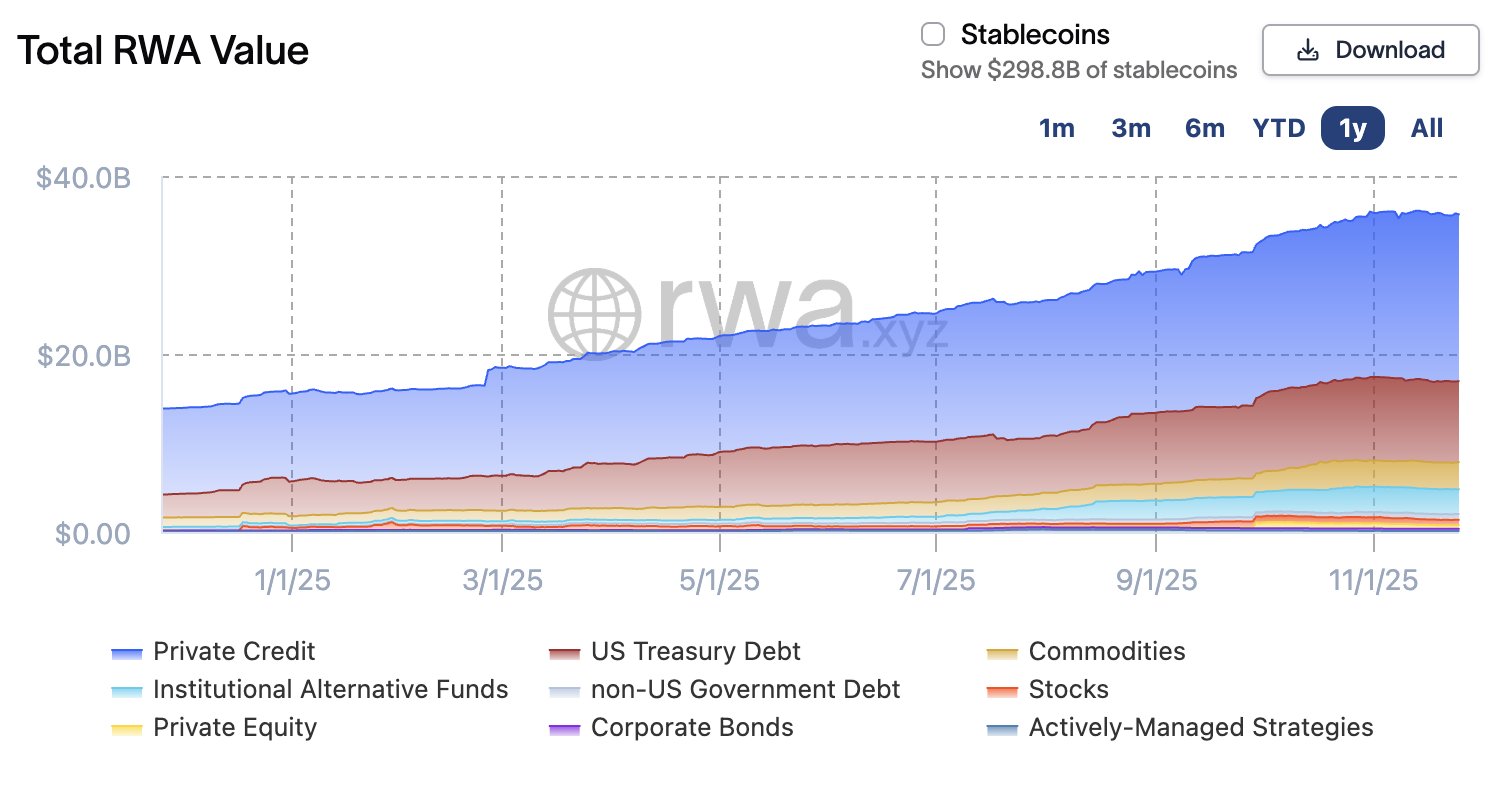

It’s price noting that RWAs have skilled outstanding progress this 12 months, rising from roughly $13.8 billion to round $36 billion in on-chain worth. On the similar time, the variety of asset holders has risen to 550,194, a 7.58% enhance over the previous month.

Sponsored

Sponsored

2. Specialised Buying and selling Infrastructure

The second theme focuses on specialised exchanges and buying and selling terminals, with Proprietary Automated Market Makers (Prop-AMMs) rising throughout Solana. These fashions defend liquidity suppliers from dangerous flows.

Based on Messari, proprietary AMMs dealt with 13% to 24% of Solana’s whole DEX quantity by means of 2025. Furthermore, in September, they surpassed conventional AMMs in Solana’s DEX quantity for the primary time. HumidiFi alone generated practically 50% of all SOL–stablecoin DEX buying and selling quantity that month.

“This prop-driven strategy may meaningfully advance market construction innovation forward of base-layer enhancements and has potential purposes past Solana’s spot markets,” Coinbase Ventures added.

In the meantime, the agency emphasised that prediction market aggregators may emerge as a “dominant interface layer,” combining fragmented liquidity. They might provide instruments at present lacking from the sector, comparable to superior orders, cross-venue routing, arbitrage insights, and unified analytics. These developments mark better market sophistication.

Sponsored

Sponsored

3. Subsequent-Gen DeFi Elevates Composability and Privateness

DeFi’s subsequent chapter, in keeping with Coinbase Ventures, revolves round deeper integration between protocols and extra subtle monetary tooling. Perp platforms are starting to attach with lending markets, permitting collateral to generate yield whereas additionally backing leveraged positions.

With month-to-month on-chain derivatives quantity reaching $1.4 trillion, the agency expects extra techniques that permit customers hedge, earn, and leverage concurrently with out fragmenting capital. Unsecured lending is one other space with vital potential, doubtlessly tapping into the $1.3 trillion US credit score market.

“Unsecured credit-based cash markets are DeFi’s subsequent frontier, and 2026 might even see breakthrough fashions that mix onchain status with offchain information to unlock unsecured lending at scale. For builders on this sector, the problem is designing sustainable danger fashions that scale. Success right here turns DeFi into real monetary infrastructure that may outcompete conventional banking rails,” Coinbase wrote.

For wider institutional adoption of DeFi, privateness is essential. Coinbase Ventures highlighted the necessity for cryptographic instruments that allow confidential transactions. The agency sees momentum behind applied sciences like zero-knowledge proofs, absolutely homomorphic encryption, multiparty computation, and specialised privateness chains.

Sponsored

Sponsored

4. AI Integration Positions Crypto for Subsequent-Gen Coordination

The ultimate class expands past finance, exploring how crypto could help the following technology of AI and robotics. Robotic techniques endure from a scarcity of real-world interplay information, particularly for duties involving precision or deformable objects.

Coinbase Ventures instructed that crypto-native incentive fashions, just like Decentralized Bodily Infrastructure Networks (DePIN), may assist accumulate the amount of information wanted to coach embodied AI at scale.

Proof-of-humanity protocols are additionally gathering traction. As AI-generated content material spreads, it’s extra essential than ever to differentiate people from machines.

“We consider a mix of biometrics, cryptographic signing, and open supply developer requirements might be essential to establishing a “proof of humanity” resolution that enhances AI within the new human/laptop interface mannequin. Worldcoin (portfolio firm) has been forward of the curve on seeing and dealing towards this downside,” the weblog acknowledged.

Lastly, the agency additionally anticipates that AI brokers will turn into central to on-chain growth, writing contracts, checking them for vulnerabilities, and monitoring them after deployment. This might dramatically cut back the barrier to launching new on-chain tasks and speed up experimentation throughout the ecosystem.

“As we sit up for 2026, we’re energized by the builders taking huge swings and pushing the onchain economic system ahead. These concepts mirror the place we see large potential,” the group remarked.

Whereas the 4 classes mirror present conviction, the agency stresses that lots of crypto’s most transformative concepts typically emerge from sudden instructions.