Be part of Our Telegram channel to remain updated on breaking information protection

The Dogecoin value has jumped 3% within the final 24 hours to commerce at $0.1482 as of three.45 a.m. on a ten% improve in buying and selling quantity to $2 billion.

The DOGE value surge comes after Grayscale’s GDOG DOGE ETF went stay on NYSE Arca yesterday, marking the primary spot publicity to the meme coin within the US. The fund offers traders a brand new, regulated means to purchase Dogecoin with out holding it straight.

$DOGE about to set off the bullish reversal 🐶

Eyes right here because the #Grayscale #Dogecoin ETF went stay within the US 🇺🇸 right now. Ticker is $GDOG

From joke coin to Wall Road 👀 pic.twitter.com/98fIQg6awm

— Rand (@cryptorand) November 24, 2025

Early buying and selling for GDOG noticed volumes close to $11 million, exhibiting robust urge for food from each retail and institutional patrons.

The Dogecoin value rallied to $0.149 after the DOGE ETF debut, rebounding from early November lows. This pop follows a interval of weak efficiency because the broader crypto market fell practically 7% over the previous week.

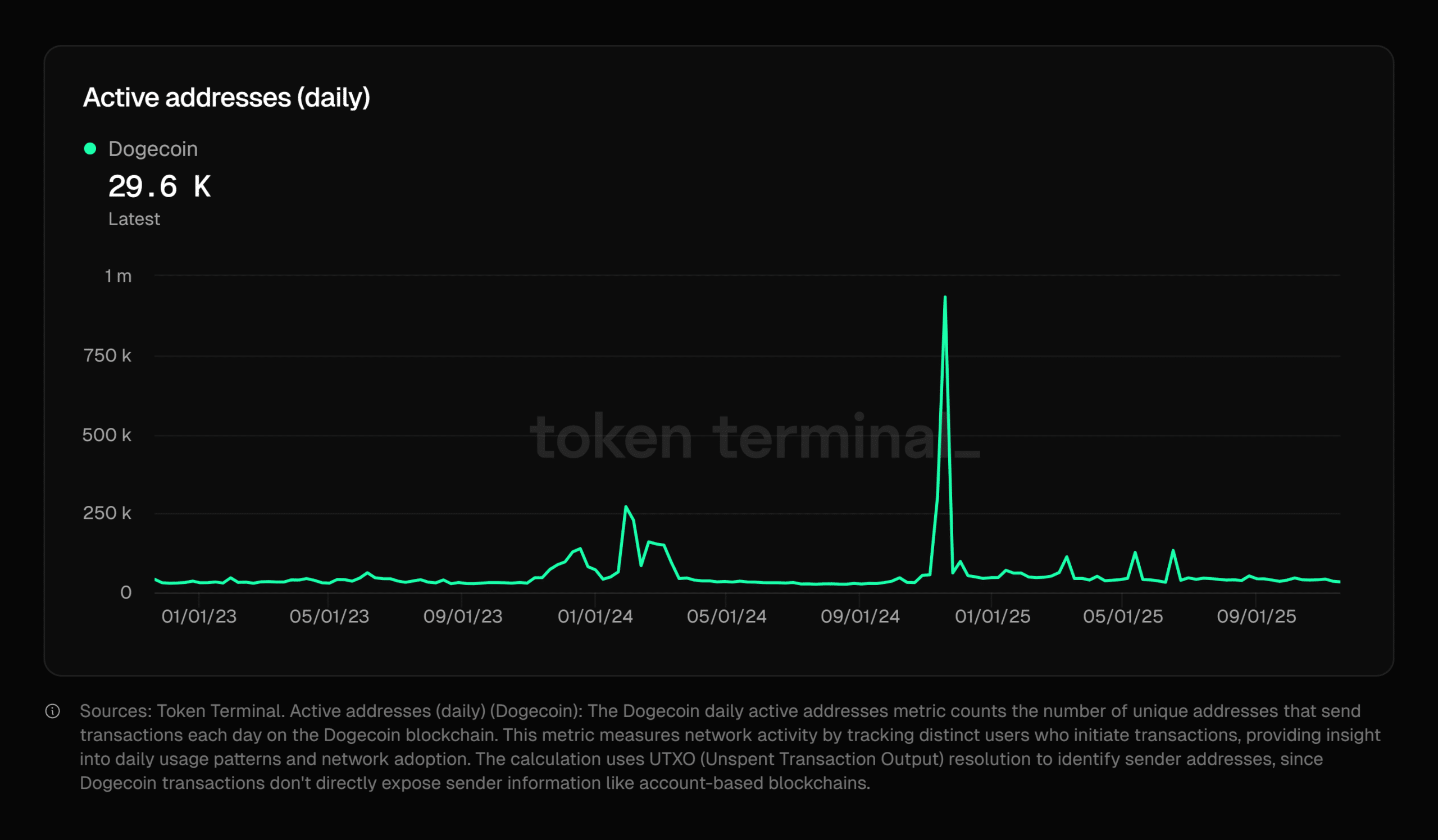

Dogecoin Day by day Energetic Addresses Present Regular However Sluggish Community Development

On-chain metrics for Dogecoin present rising energetic addresses and switch volumes round 29.6K, exhibiting regular use of the community even when costs transfer up and down. The chart reveals two huge spikes in exercise, one in early 2024 and one other in early 2025.

These jumps have been short-lived and have been probably attributable to main information or massive pockets actions. Other than these moments, exercise has stayed largely steady with small ups and downs. This regular pattern means Dogecoin nonetheless has an energetic group, however it isn’t rising rapidly. The community is holding its floor, however there isn’t robust proof of latest customers coming in.

Dogecoin Energetic Addresses: Supply: TokenTerminal

For DOGE to construct stronger bullish momentum, a constant rise in day by day energetic addresses could be wanted to sign rising utility and wider community participation. Dogecoin’s consumer exercise seems steady however will not be increasing quickly. Whereas its core group continues to transact frequently, there’s no robust pattern exhibiting rising long-term adoption.

Dogecoin Value Evaluation: Uptrend Or False Begin?

Dogecoin’s day by day chart signifies a robust rebound from the most important help zone round $0.088, with value now advancing towards the primary resistance at $0.164 and the secondary resistance at $0.207.

The upward transfer is supported by rising buying and selling quantity and optimistic ETF sentiment, but a number of indicators present combined alerts, suggesting that bullish momentum might face challenges as the value approaches these resistance ranges.

DOGEUSDT Evaluation Supply: Tradingview

DOGE has been buying and selling in a sideways vary for a number of weeks, however a pointy bounce from mid-range ranges is shifting short-term sentiment. The value remains to be beneath each the 50-day and 200-day transferring averages, indicating that bulls have work to do earlier than a full reversal is confirmed.

The Relative Power Index (RSI) sits at 39.81, which implies DOGE will not be overbought and nonetheless has room to climb if momentum improves.

The MACD indicator is barely optimistic, hinting at a attainable pattern change if shopping for continues. In the meantime, the Common Directional Index (ADX) is at 44.40, exhibiting that the present transfer has some energy however will not be but at breakout ranges.

Help At $0.088 Strengthens As Bulls Goal $0.164 Excessive

Current value motion reveals that the $0.088 stage stays a structurally robust help zone for Dogecoin, with patrons persistently absorbing promote stress at any time when the value approaches this space.

On the upside, resistance ranges are clearly outlined at $0.164 and $0.207, each of which have repeatedly rejected bullish makes an attempt in earlier rallies. A confirmed breakout and shut above the primary resistance at $0.164 would open the door for a possible transfer towards the secondary resistance close to $0.207, the place sellers have traditionally been energetic.

Nonetheless, failure to carry above the $0.149 mid-support may set off renewed draw back stress, rising the chance of one other retest of the $0.088 demand zone. For now, technical indicators lean barely bullish, with quantity enlargement supporting the most recent upswing, although combined oscillator alerts counsel warning remains to be warranted.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection