Ethereum continues to commerce beneath the important $3,000 stage as promoting strain intensifies and concern dominates sentiment throughout the crypto market. The broader downturn has pushed ETH almost 40% beneath its August all-time excessive, elevating considerations that the asset could also be getting into a protracted bearish part. Analysts who have been as soon as assured in a continued rally at the moment are shifting their tone, warning that market construction, volatility, and liquidity situations are starting to resemble early-stage bear market habits.

Associated Studying

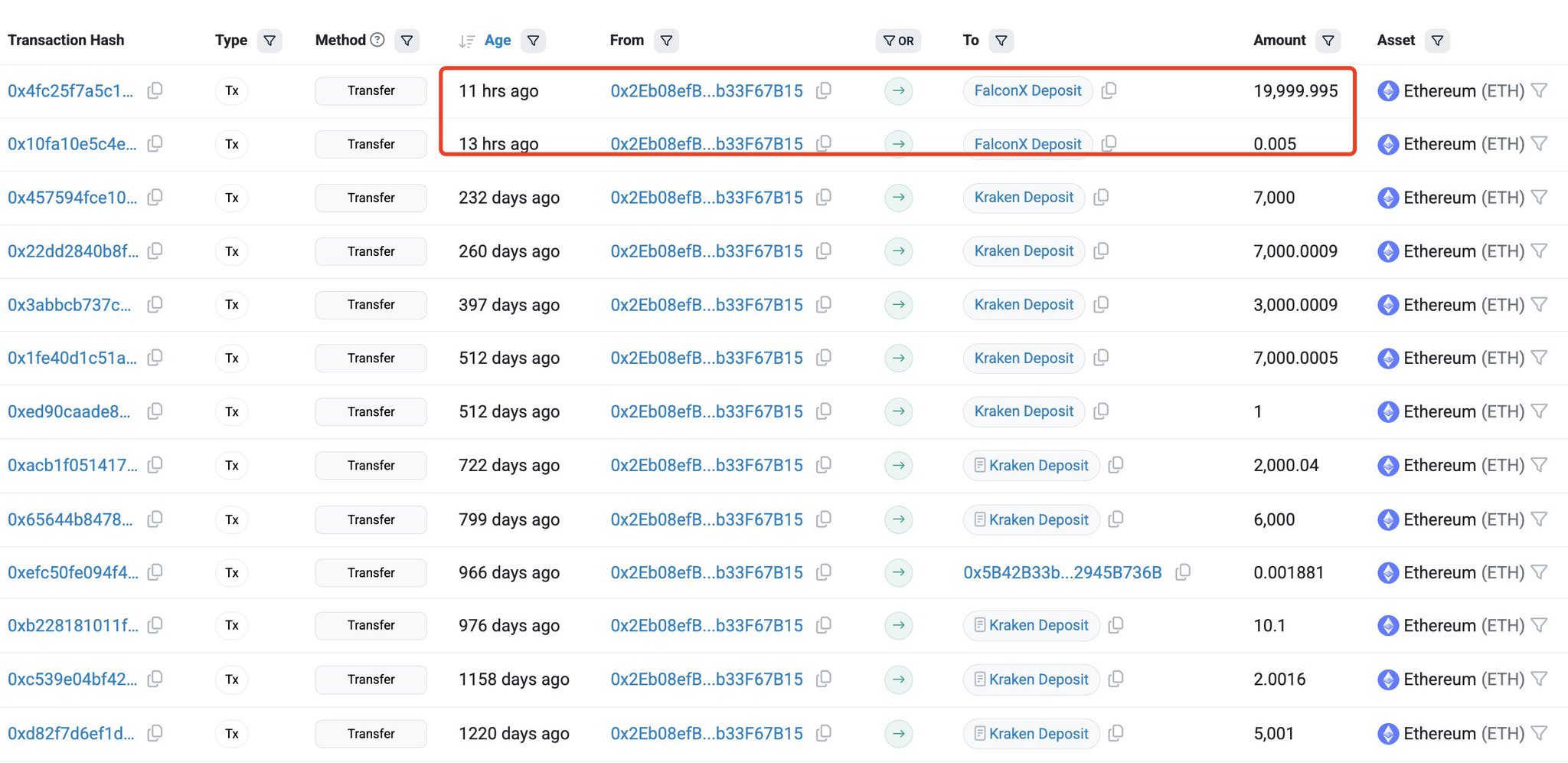

On the similar time, investor confidence is being additional examined by contemporary on-chain exercise exhibiting giant holders lowering publicity. In accordance with knowledge from Lookonchain, an Ethereum ICO participant has offered one other 20,000 ETH, valued at roughly $58.14 million, by FalconX only a few hours in the past.

With promoting strain accelerating, derivatives sentiment weakening, and long-term holders starting to cut back positions, Ethereum now sits at a pivotal second. Bulls should reclaim the $3,000 area to stabilize momentum, whereas bears argue {that a} deeper correction may unfold if help continues to erode.

ICO Whale Promoting Raises Stress as Ethereum Awaits Path

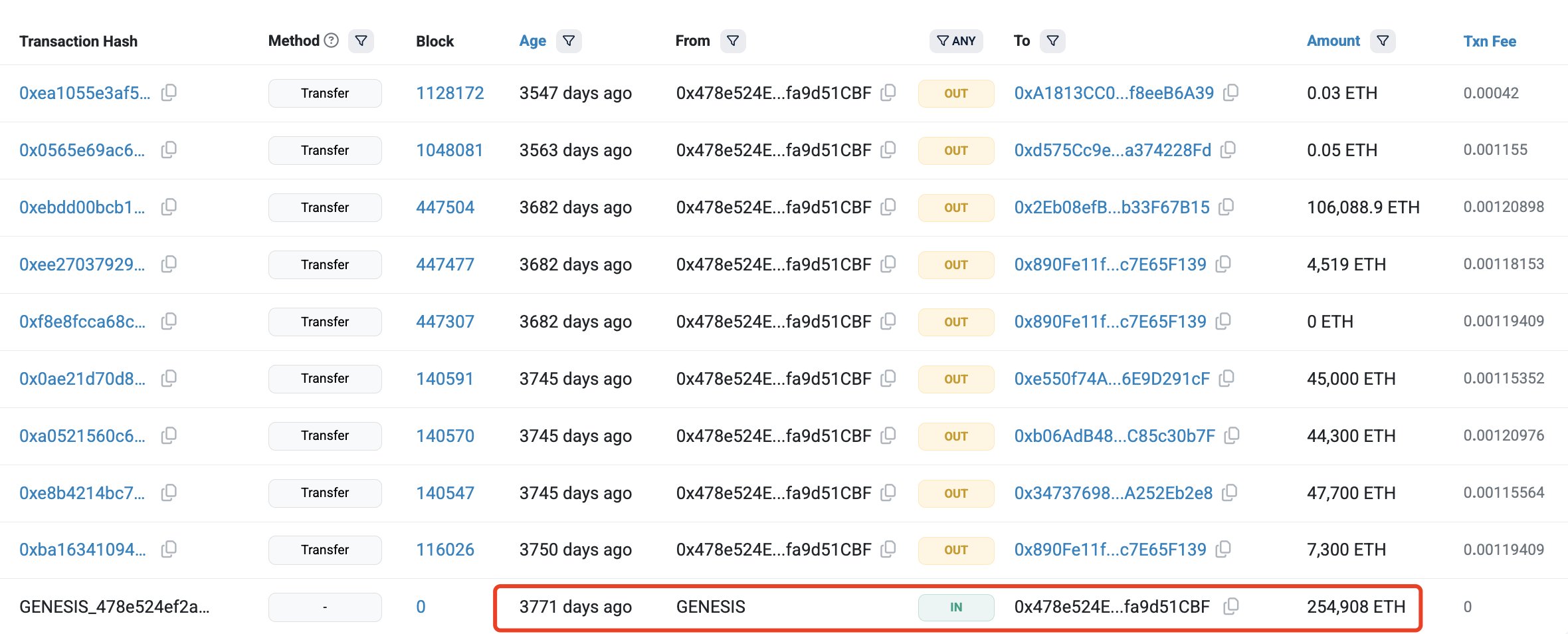

In accordance with Lookonchain, the pockets behind the most recent sale — recognized as tackle 0x2eb0 — isn’t any strange holder. This Ethereum OG acquired 254,908 ETH through the ICO, paying simply $79,000 on the time. At at this time’s costs, that allocation is value roughly $757 million, highlighting the dimensions of unrealized positive aspects nonetheless held by early members. The latest sale of 20,000 ETH means that even long-standing holders with substantial revenue cushions are starting to dump cash, including to the already fragile market atmosphere.

This promoting exercise is especially impactful given the present sentiment. Ethereum has already fallen sharply from its highs, leverage has unwound throughout derivatives markets, and retail confidence has thinned. When an early participant with a price foundation close to zero begins distributing, it sends a psychological sign that additional draw back is feasible. But, some analysts argue that these gross sales might merely symbolize portfolio rotation somewhat than a long-term bearish stance.

The approaching days shall be decisive, as traders watch whether or not Ethereum can stabilize and rebound or if promoting strain accelerates. A restoration above $3,000 may revive optimism and reset momentum, whereas continued weak point dangers confirming a deeper downtrend for each ETH and the broader market.

Associated Studying

Breakdown, Weak Construction, and Fragile Bounce Try

Ethereum’s weekly chart reveals a transparent deterioration in pattern construction following the sharp rejection from the $4,400 area and the following breakdown beneath the $3,200 help zone. The selloff pushed ETH towards the mid-$2,700s earlier than a modest rebound, however the value stays beneath key shifting averages, signaling that momentum continues to favor sellers.

The 50-week shifting common has rolled over, whereas the 100-week and 200-week shifting averages now sit overhead, forming layered resistance that would cap any restoration makes an attempt within the quick time period.

Associated Studying

Quantity through the decline expanded noticeably, indicating energetic distribution somewhat than passive drifting. The latest candle exhibits a small bounce, however with no sturdy quantity follow-through, suggesting hesitation and lack of conviction amongst consumers.

For Ethereum to regain bullish construction, reclaiming the $3,000–$3,200 space is crucial, as this zone acted as a pivotal help all through earlier phases of the cycle and now threatens to flip into resistance.

Featured picture from ChatGPT, chart from TradingView.com