Ethereum has seen a light reduction bounce over the previous few days after discovering help close to $2,500. Whereas the worth motion stays technically bearish total, there was a slight enchancment in short-term construction. Nonetheless, warning remains to be warranted as macro resistance ranges loom overhead.

Technical Evaluation

By Shayan

The Every day Chart

On the Every day timeframe, it’s evident that ETH is at present buying and selling round $2,900 after bouncing off the $2,500 demand zone. This degree held as robust help, triggering a short-term rally that has now introduced the asset right into a minor provide zone close to $3,000. The RSI has additionally moved off oversold ranges and is now sitting close to 36, suggesting some cooling in bearish momentum.

Nonetheless, the worth is properly under the 200-day (Yellow) and 100-day (Blue) transferring averages, that are appearing as dynamic resistance. To shift the construction again to bullish, ETH must reclaim the $3,500 space and consolidate above it. Till then, upside strikes are thought of corrective. A failure right here may lead to one other drop towards $2,500 and even the essential $2,100 low.

The 4-Hour Chart

On the 4-hour chart, ETH has fashioned a bearish flag just under the $3,000 resistance. This sample typically alerts potential draw back upon breakdown. The worth has been unable to interrupt above the important thing provide zone at $3,000 and is now exhibiting indicators of stalling, with the RSI hovering close to the 50 degree.

If this flag breaks down, the instant draw back goal is the $2,600–$2,500 demand space. On the flip aspect, a breakout above $3,000 with robust quantity may invalidate the flag and open the door towards $3,500. Nonetheless, given the confluence of resistance, patrons have to be cautious right here and never chase longs into main zones.

Sentiment Evaluation

Open Curiosity

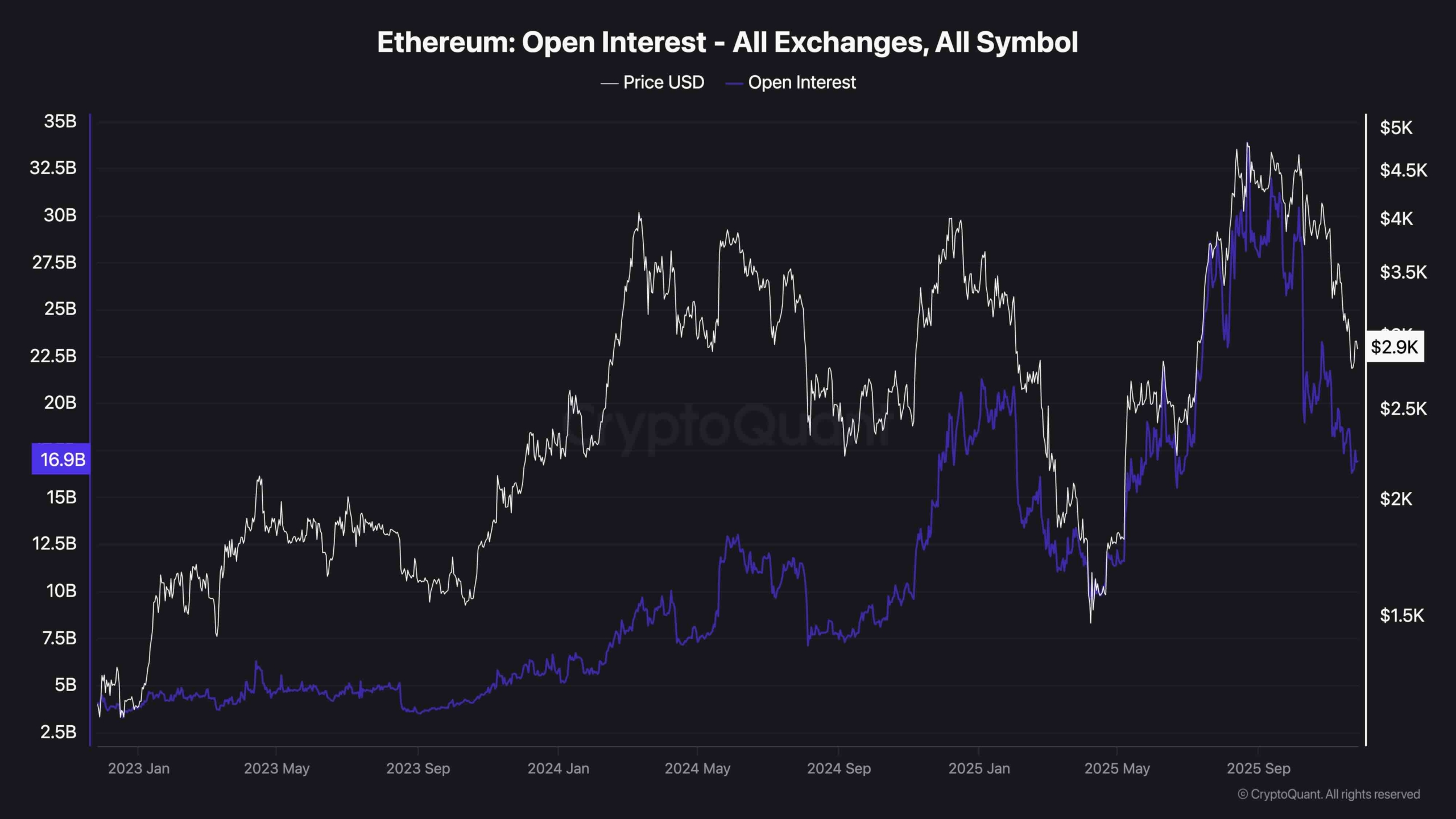

Trying on the broader sentiment and futures knowledge, open curiosity on Ethereum has dropped considerably over the previous week, now sitting close to $16.9B. This cooling OI, alongside decrease funding charges, suggests a decline in speculative positioning, which is usually an indication that the market is transitioning to a extra impartial state after a wave of pressured liquidations.

The drop in open curiosity additionally aligns with the current worth restoration, which was not closely supported by leverage, sometimes a more healthy kind of bounce. Nonetheless, the truth that OI has not picked again up but signifies hesitation from market individuals and an absence of conviction on this transfer.

Till each the open Curiosity and the worth begin climbing once more, the bias stays cautious. Many merchants are seemingly sidelined or de-risking forward of key resistance.

The submit Ethereum Value Evaluation: ETH Rebounds and Eyes $3K however Bearish Stress Persists appeared first on CryptoPotato.