- U.S. curiosity in ETH is recovering because the Coinbase Premium Index strikes towards impartial.

- Whales amassed 440K ETH whereas ETFs noticed practically $97M in new inflows.

- ETH hovers close to $3,000, needing a break above $3,100 to aim a stronger restoration.

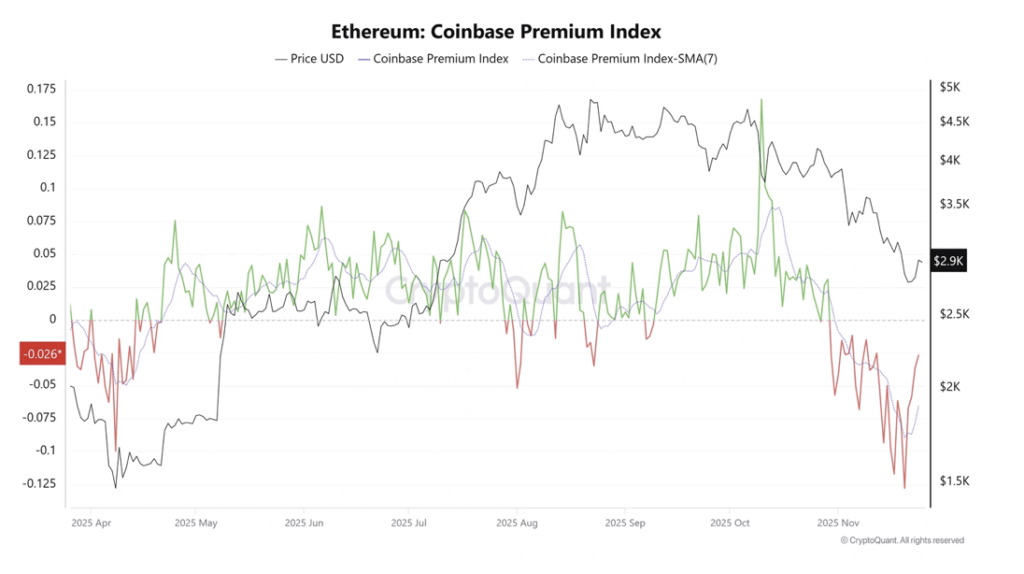

Ethereum has been exhibiting a quiet restoration in U.S. market sentiment these previous few days, even when the transfer feels a bit hesitant at instances. The Coinbase Premium Index — a metric merchants watch to gauge U.S. investor urge for food — inched up from -0.12 final Thursday to round -0.02 on Monday, per CryptoQuant knowledge. It’s nonetheless detrimental, yeah, however the shift suggests U.S. patrons are valuing ETH barely greater than they had been only a week in the past, which marks a small however significant change in tone.

Institutional flows creep again as ETFs stabilize

Institutional curiosity, which went chilly for a bit, has began trickling again into U.S. spot Ethereum ETFs as nicely. SoSoValue knowledge confirmed $96.67 million in internet inflows on Monday — the second straight day of optimistic motion after eight lengthy days of regular outflows. It’s not full-blown enthusiasm simply but, but it surely’s the sort of regular drip that always hints at renewed confidence returning beneath the floor.

Whale wallets attempt to carry ETH again above price foundation

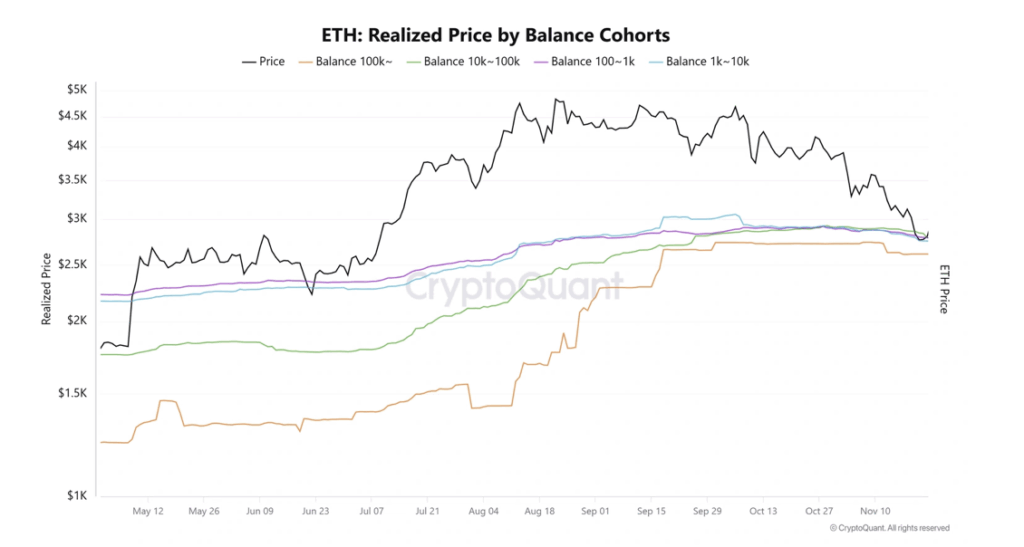

Sentiment shifts are additionally exhibiting up amongst whales holding between 10K and 100K ETH. After ETH dropped beneath their common price foundation, these massive wallets started accumulating once more, including roughly 440,000 ETH over the previous week. It nearly appears like they’re attempting to pressure value again above their break-even zone, or at the least defend it with some muscle. In the meantime, wallets holding 1K–10K ETH and 100–1K ETH moved in the other way, rushing up distribution as soon as ETH received near their price foundation ranges. These teams offloaded round 100K ETH and 120K ETH respectively, signaling warning as an alternative of conviction.

Futures market stays cautious regardless of slight inflows

ETH futures merchants are nonetheless treading flippantly. Coinglass knowledge reveals internet outflows of $4.31 billion over the previous week — an indication that leverage continues pulling again. Even so, the previous three days introduced inflows of about $735 million, suggesting some merchants are steadily dipping their toes again in. The sentiment shift additionally synced with a sudden surge in Fed rate-cut expectations. The percentages of a December reduce jumped from roughly 30% final Thursday to over 80% by Tuesday, in accordance with CME’s FedWatch instrument. Decrease charges usually increase threat urge for food, but it surely’s nonetheless unclear whether or not ETH has fashioned an actual backside right here or only a momentary ground.

ETH struggles for route close to the $3,000 stage

Ethereum noticed $80.8 million in futures liquidations during the last 24 hours, powered principally by $51.3 million briefly liquidations, per Coinglass. But regardless of that squeeze, ETH hasn’t chosen a route. Value is hovering close to the important thing $3,000 psychological zone after reclaiming help at $2,850. If patrons handle to push previous the resistance close to $3,100 — which sits slightly below the 20-day EMA — ETH may check the highest boundary of its descending channel. If not, and $2,850 breaks once more, the channel’s decrease boundary might act as the following help cushion. Indicators like RSI and Stoch are creeping upward however nonetheless caught beneath impartial, exhibiting bearish momentum fading… simply not gone but. Right here is the place sentiment both flips or stalls once more.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.