- Technique moved greater than $5B in BTC from Coinbase to Constancy, sparking sell-off hypothesis in the course of the market downturn.

- Arkham confirmed these are custody migrations — not gross sales — with Technique nonetheless accumulating Bitcoin.

- Regardless of shrinking unrealized positive factors, Technique says its stability sheet stays sturdy with vital debt protection.

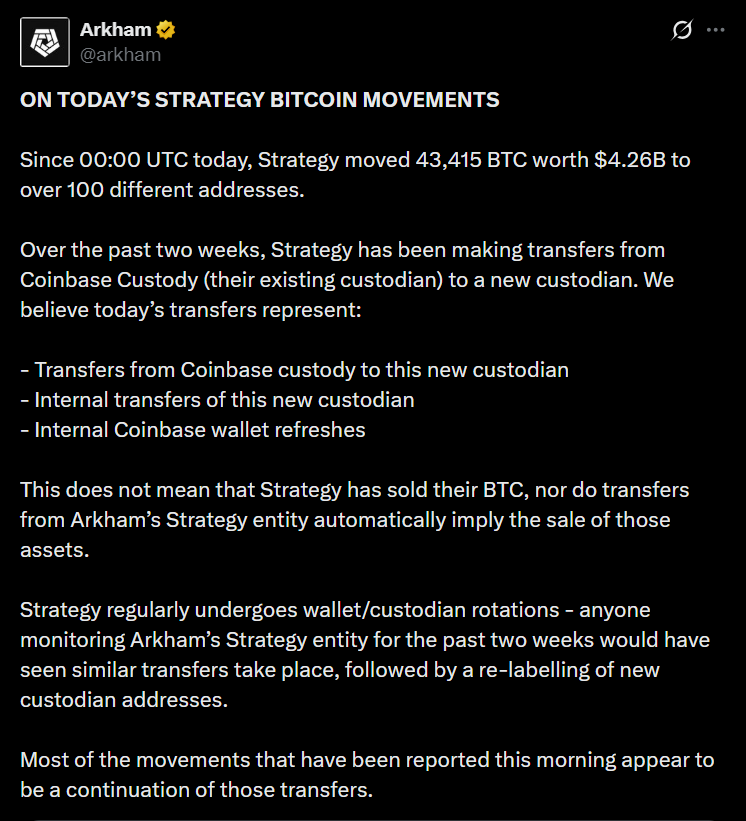

Arkham dropped a brand new replace confirming that Michael Saylor’s Technique has shifted 58,390 BTC — roughly $5.1 billion — from Coinbase to Constancy over the past two months. The transfer is an element of a bigger custody transition that has now positioned 165,709 BTC, value about $14.5 billion, below Constancy’s umbrella. As a result of Constancy makes use of an omnibus custody construction, many of those cash now seem below Constancy labels on Arkham moderately than Technique’s personal tags. Even so, Arkham says it continues to trace round 92% of Technique’s whole Bitcoin stack, which at the moment sits at 641,692 BTC valued at greater than $56 billion.

Considerations Rise as Transfers Coincide With Main Value Drop

The timing of those transfers created a wave of hypothesis all through crypto circles. Bitcoin has been below heavy stress, falling under $90K and shedding over 20% within the final month. As BTC slid towards $87K, Technique’s unrealized revenue shrank dramatically — right down to about 16.9% in comparison with 68.6% simply weeks in the past. After the primary large batch of transfers on Nov. 14, reporter Walter Bloomberg even prompt the actions would possibly sign gross sales, although he admitted the image wasn’t clear. This naturally fueled sell-off rumors throughout an already fragile market temper.

Arkham Confirms: These Are Custody Strikes, Not Gross sales

Arkham has now clarified a number of instances that none of those transfers symbolize promoting exercise. In response to their rationalization, the cash being moved fall into certainly one of three classes: direct transfers from Coinbase to Constancy, inside shifts inside Constancy’s system, or Coinbase refreshing pockets buildings. None of those point out liquidation. In truth, Technique has truly been shopping for into the dip — accumulating 9,839 BTC throughout six separate purchases since October, bringing its general whole to 649,870 BTC on the time of the replace.

Technique Reassures Traders on Leverage and Lengthy-Time period Place

Regardless of the shrinking unrealized revenue, Technique says its balance-sheet place stays well-protected. The agency defined that even when Bitcoin falls again to its $74,000 common buy value, it will nonetheless maintain 5.9x extra belongings than the worth of its convertible debt. Even in an excessive pullback to $25,000, protection stays at 2.0x, which Technique describes as a snug security margin. Saylor additionally straight dismissed rumors of promoting, saying the corporate continues to carry and accumulate whereas restructuring its custodial setup for long-term safety.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.