Abstract

TRX is buying and selling round 0.27 USDT, clearly under its key every day transferring averages, which confirms a dominant bearish development regime. The broader crypto market remains to be strong, with a complete capitalization above 3 trillion {dollars} and a gentle 24-hour enhance, but threat urge for food is restricted. Bitcoin instructions about 56.5% of worldwide market worth, indicating capital focus within the benchmark asset. In the meantime, sentiment gauges present a Worry & Greed Index at 20, deep in “Excessive Worry” territory. Each day RSI near 27 alerts oversold circumstances, however and not using a sturdy momentum reversal sign from MACD. Bollinger Bands are tight and ATR is low, so volatility stays compressed whilst worth assessments assist.

Tron crypto: Market Context and Route

The macro context is paradoxical: the crypto market cap hovers round 3.05 trillion {dollars}, modestly up over the past 24 hours, but buyers behave defensively. With Bitcoin dominance above 56%, capital is clustering into the perceived safer aspect of the spectrum; in distinction, altcoins like TRX are left to digest prior rallies. Furthermore, the Worry & Greed Index firmly in “Excessive Worry” means that merchants are nonetheless keen to promote into energy fairly than chase upside.

For this asset, that setting reinforces the prevailing downtrend. The every day regime is tagged as bearish, and worth sitting under the 20, 50, and 200-day exponential transferring averages underlines persistent draw back stress and lack of development affirmation on the upside. That mentioned, excessive pessimism typically precedes turning factors, so sentiment alone can’t be learn as a one-way bearish sign.

Technical Outlook: studying the general setup

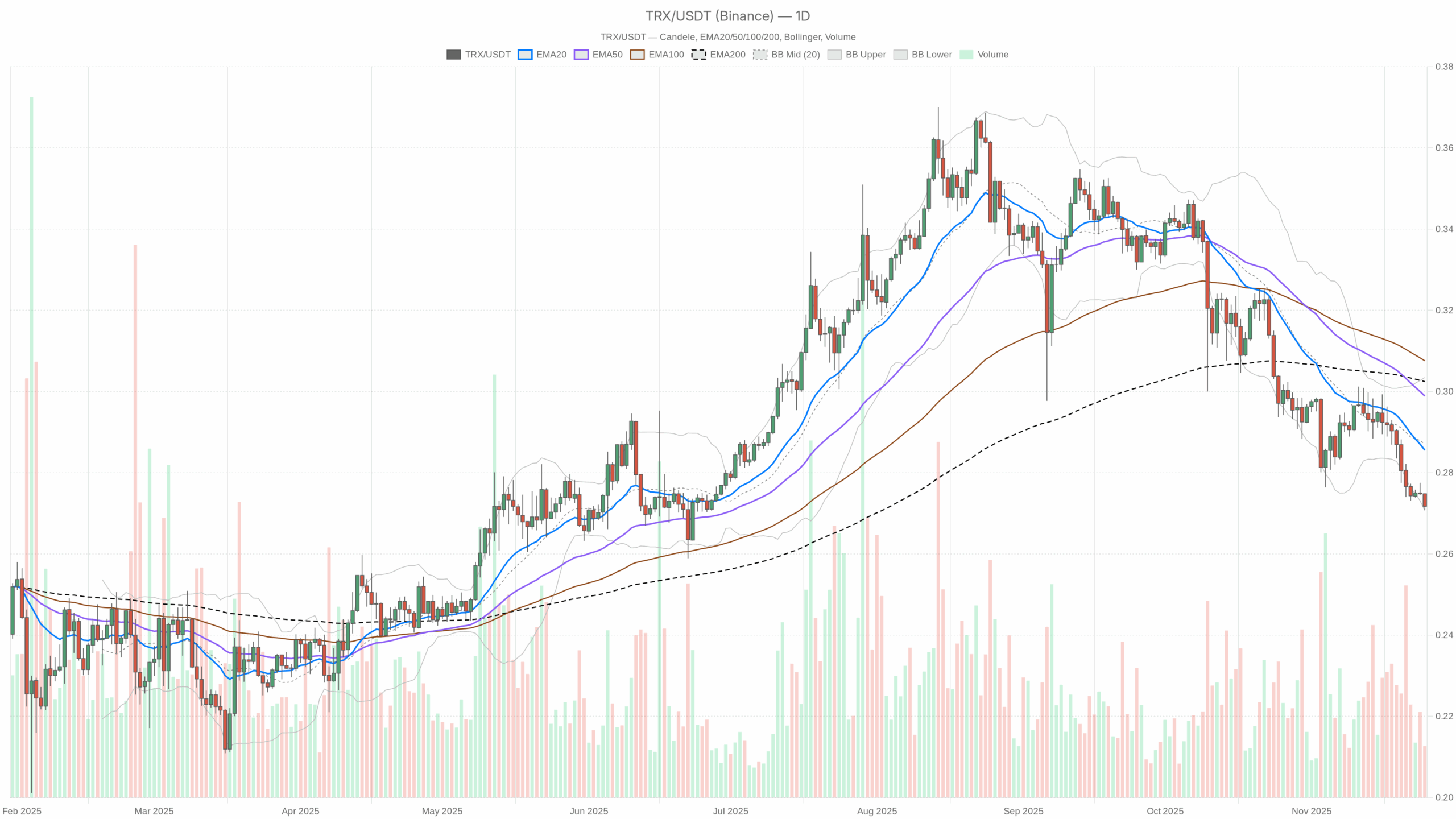

On the every day chart, TRX trades at 0.27 USDT, under the 20-day EMA at 0.29 and the cluster of the 50- and 200-day EMAs round 0.30. This alignment, with shorter EMAs underneath longer ones, depicts a well-established downtrend construction the place rallies usually tend to be bought. Nevertheless, the space between worth and these averages just isn’t excessive, hinting at fatigue fairly than a waterfall sell-off.

The RSI at 27.12 locations the token in oversold territory. Such readings continuously precede not less than a pause or a countertrend bounce, as promoting energy reveals indicators of momentum exhaustion. Nonetheless, oversold circumstances can persist in sturdy bearish phases, so the oscillator alone doesn’t assure a reversal.

MACD on the every day timeframe provides nuance: each the MACD line and the sign line sit close to -0.01, with a flat histogram near zero. This factors to weak draw back momentum fairly than aggressive promoting. Bears seem in management, but they’re now not accelerating, which regularly foreshadows a consolidation band the place the market reassesses worth.

Bollinger Bands focus on 0.29, with the higher band close to 0.30 and the decrease band round 0.27, the place worth presently sits. Buying and selling close to the decrease band means that the token is hugging assist, however the comparatively slender band width alerts volatility contraction as an alternative of a disorderly breakdown. ATR at 0.01 additional confirms subdued every day ranges, reinforcing the concept that this can be a contained downtrend fairly than a capitulation spike.

Lastly, the every day pivot level, first resistance, and first assist all cluster round 0.27. This uncommon overlap highlights a short-term equilibrium zone the place each consumers and sellers are testing one another’s conviction. Any decisive transfer away from this pivot will probably outline the following tactical route.

Intraday Perspective and TRXUSDT token Momentum

Whereas the every day image stays unfavorable, intraday timeframes present early indicators of stabilization. On the hourly chart, the token trades at 0.27, nearly aligned with the 20- and 50-hour EMAs and solely barely under the 200-hour EMA at 0.28. This flattening of transferring averages displays short-term consolidation inside a broader bearish context.

In the meantime, hourly RSI hovers close to 31, nonetheless weak however now not deeply oversold. MACD on each the hourly and 15-minute charts is flat at zero, hinting that intraday momentum has cooled. Because of this, short-term merchants are dealing with a range-bound market the place fast swings are restricted, and directional conviction is low.

On the 15-minute timeframe, the RSI round 43 underlines an nearly impartial stance, in step with a micro-range at 0.27. The intraday regimes are nonetheless categorised as bearish, but the shortage of contemporary lows and the compressed volatility profile level towards a potential base-building part fairly than a direct continuation of the slide.

Key Ranges and Market Reactions

Essentially the most rapid battleground lies round 0.27 USDT, the place every day and intraday pivots converge. Sustained buying and selling under this space would verify that sellers retain management and will drag the token towards new native lows, even when the trail stays sluggish and uneven. Conversely, a rebound that reclaims 0.29 first, after which the 0.30 area the place the 50- and 200-day EMAs sit, would problem the present construction.

Ought to worth handle a every day shut again above the mid-Bollinger band close to 0.29, it might sign early bullish validation inside an in any other case bearish market. Till then, each check of 0.29–0.30 is prone to appeal to provide from trapped longs and opportunistic shorts. Merchants will watch how quantity and volatility react round these zones to guage whether or not the transfer is only a reduction rally or one thing extra sturdy.

Future Eventualities and Funding Outlook

General, the steadiness of proof favors a cautious stance: the development is down, sentiment is fearful, and the asset sits beneath its main averages. But oversold oscillators, flat MACD, and tight bands collectively argue for consolidation with bounce threat fairly than an imminent collapse. For directional merchants, the extra enticing setups might emerge on a transparent break above the 0.29–0.30 resistance band or, alternatively, on a decisive failure of 0.27 with increasing ATR.

Longer-term members would possibly interpret the present weak point as a part of a traditional cycle in a market nonetheless dominated by Bitcoin, particularly whereas decentralized exercise on Tron-based DEXs like SUNSwap continues to generate substantial cumulative charges. Nevertheless, with excessive concern nonetheless prevalent, threat administration stays paramount: scaling entries, avoiding leverage underneath compressed volatility, and respecting invalidation ranges are important to navigating the following chapter for this community’s native asset.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding choices.