Abstract

UNI is altering palms round 6.1 USDT, under all its key day by day shifting averages, which confirms a broadly bearish regime on the upper timeframe. Momentum is unfavourable however not capitulatory, with the day by day RSI hovering within the low 40s, suggesting cautious promoting slightly than panic. Furthermore, the MACD stays under its sign line, indicating that bulls haven’t but regained management of medium-term route. Volatility on the day by day chart is reasonable, whereas intraday readings present a tighter vary, pointing to a section of consolidation after current losses. On the identical time, liquidity throughout the crypto market stays sturdy, however threat urge for food is muted as merchants prioritize capital preservation. Total, UNI sits in a corrective setting the place any bounce nonetheless wants sturdy affirmation earlier than being handled as a long-lasting pattern change.

Uniswap crypto information: Market Context and Course

The broader crypto backdrop is blended, with whole market capitalization hovering close to 3.08 trillion {dollars}, down barely over the past 24 hours. That stated, Bitcoin dominance above 56% reveals that capital is clustering within the largest asset, a typical sample throughout uneasy phases for altcoins. This dynamic often leaves tokens like UNI extra weak to pullbacks and slower to get well when the market wobbles.

Sentiment knowledge reinforces this defensive stance. The Worry & Greed Index sits at 15, labeled as Excessive Worry, which indicators that traders are threat averse and fast to scale back publicity on rallies. Furthermore, when concern is that this elevated, even technically enticing setups can take longer to play out, as recent capital waits on the sidelines. For UNI, which means upside makes an attempt might initially encounter a wall of provide from short-term merchants desirous to exit breakeven positions.

Technical Outlook: studying the general setup

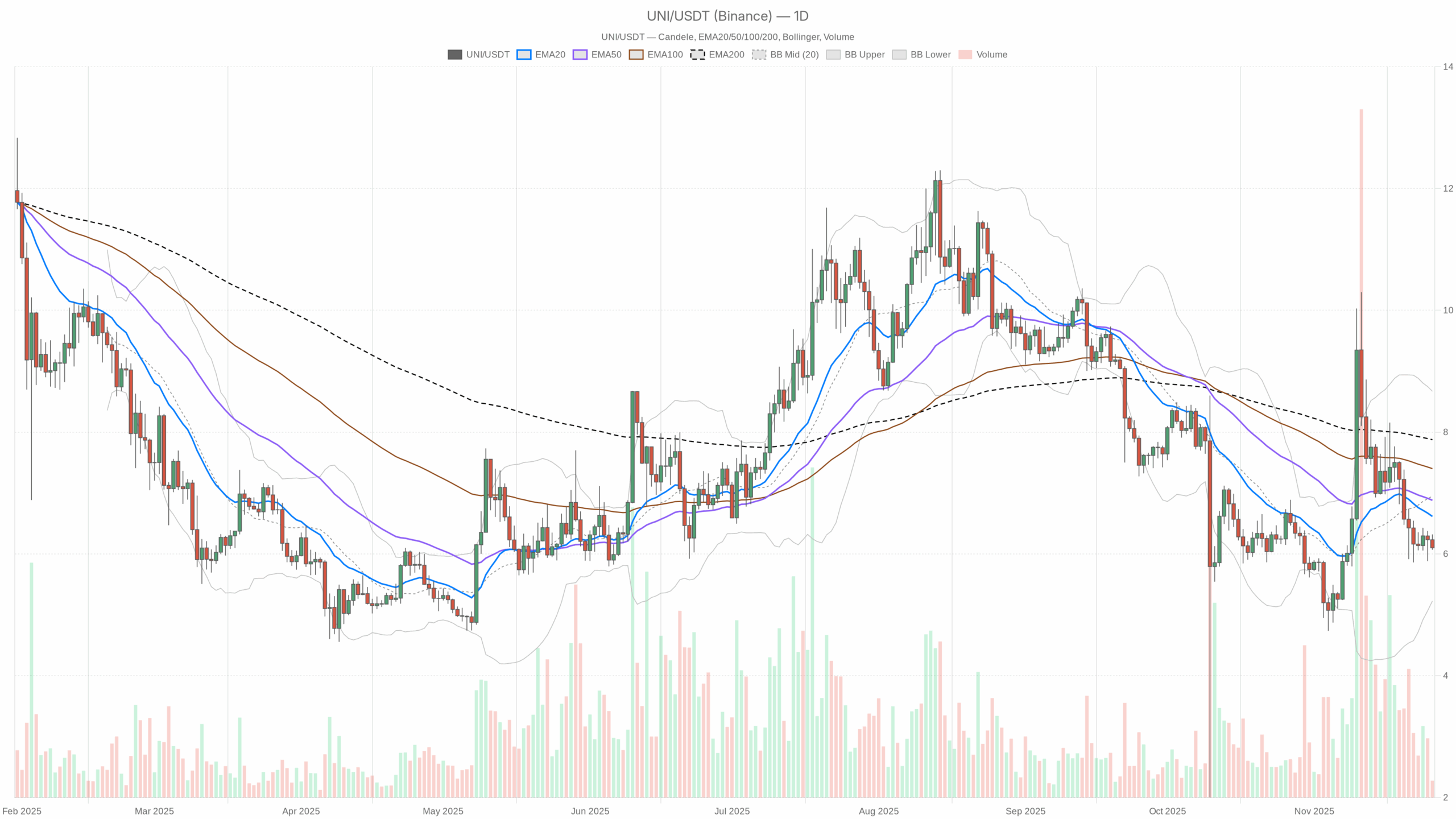

On the day by day timeframe, UNI trades round 6.1 USDT, clearly under the 20-day EMA at 6.62, the 50-day EMA at 6.88 and the 200-day EMA at 7.88. This alignment of shifting averages above spot worth is typical of a mature downtrend, the place rallies are sometimes offered into slightly than prolonged. Till worth can reclaim not less than the 20-day EMA, any bounce is best considered as a counter-trend transfer.

The day by day RSI at 43.48 confirms this image. It’s under the impartial 50 mark however removed from oversold territory, suggesting persistent however managed promoting strain. In different phrases, bears stay in cost, but there’s nonetheless room for the oscillator to rotate increased with out invalidating the broader corrective construction.

The MACD line sits at -0.11, below its sign line at 0.02, with a unfavourable histogram of -0.13. This configuration signifies that draw back momentum has not absolutely exhausted, even when the tempo of decline will not be accelerating dramatically. A future bullish crossover of the MACD above its sign can be one of many first indicators that the market is making an attempt to shift again into accumulation.

Bollinger Bands on the day by day chart present a midline at 6.95, with the higher band close to 8.67 and the decrease band round 5.23. Worth presently trades within the decrease half of this envelope, reflecting a bias towards the draw back inside a still-broad volatility channel. Nonetheless, the absence of a contact or break of the decrease band hints that promoting is agency however not but climactic.

The ATR(14) on the day by day timeframe is available in at 0.67, pointing to reasonable day by day swings relative to cost. This sort of volatility profile typically corresponds to a managed correction slightly than a disorderly flush, leaving room for each gradual continuation decrease or a sluggish, uneven reversal.

Intraday Perspective and UNIUSDT token Momentum

Zooming into intraday charts, the hourly timeframe paints an identical however extra nuanced story. The H1 shut round 6.11 USDT is fractionally under the 20-hour EMA at 6.16 and the 50-hour EMA at 6.19, whereas the 200-hour EMA at 6.52 stays far above, confirming a short-term downtrend nested contained in the broader bearish construction. In the meantime, this clustering of EMAs shut to cost reveals the market in a consolidation pocket after current declines.

The hourly RSI at 43.84 echoes the day by day sign, favoring sellers but not indicating exhaustion. Because of this, short-term bounces can emerge, however they’re extra prone to be offered till momentum readings reclaim the 50–55 space persistently. The MACD on H1 is barely unfavourable and virtually flat, suggesting waning intraday momentum and a market ready for a recent catalyst.

On the 15-minute chart, the image stays cautious. Worth trades shut to six.1 USDT, modestly below the 20 and 50-period EMAs and likewise under the 200-period EMA at 6.19. The RSI at 39.14 factors to delicate short-term oversupply, however with out a spike that will sign capitulation. Bollinger Bands on this timeframe are pretty tight, aligning with an ATR(14) close to 0.03, a mixture that often displays compressed volatility earlier than the subsequent directional transfer.

Key Ranges and Market Reactions

Each day pivot ranges present a helpful roadmap for merchants. The central pivot level lies close to 6.16 USDT, simply above present worth, making this zone a right away battleground. If consumers can push and maintain above this space, consideration would probably shift to the primary resistance band round 6.26 USDT, the place short-term sellers might look to reassert management. A decisive break and consolidation above that pocket would improve the percentages of a extra significant quick squeeze towards the 20-day EMA.

On the draw back, the primary assist area sits round 6.01 USDT. A transparent lack of this ground, particularly on sturdy quantity, would sign that bears are urgent for a deeper extension towards the decrease Bollinger Band area nearer to five.23. Nonetheless, if worth repeatedly exams however holds round 6.0, it may mark the early section of a base, doubtlessly getting ready the bottom for a medium-term reversal.

Future Eventualities and Funding Outlook

Total, the technical panorama favors a cautious stance, with a main bearish situation nonetheless dominant whereas early indicators of stabilization start to seem on decrease timeframes. Conservative members might desire to attend for clear proof of pattern reversal affirmation, reminiscent of a day by day shut again above the 20-day EMA mixed with bettering RSI and a bullish MACD crossover. Extra lively merchants, in distinction, would possibly look to use the outlined intraday vary between 6.0 and 6.26, holding tight threat controls in a market that also trades below the shadow of utmost concern. Within the coming classes, how worth behaves round these pivot zones will probably decide whether or not this section evolves into a chronic grind decrease or the primary chapter of a restoration story for UNI.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making funding selections.