Technique (previously MicroStrategy) has confirmed that its assets-to-debt collateral ratio would stay at 2.0x, even when Bitcoin (BTC) fell to $25,000, far under its $74,000 common buy worth.

This comes as the corporate’s inventory has declined by 49% and faces the potential for exclusion from MSCI indices, with a call anticipated by January 2026.

Sponsored

(Micro) Technique’s $16 Billion Legal responsibility Stack Backed 3.6x by Bitcoin

In a current X (previously Twitter) submit, the corporate emphasised the power of its steadiness sheet by highlighting what it calls the “BTC Score” of its convertible debt.

“If BTC drops to our $74,000 common value foundation, we nonetheless have 5.9x belongings to convertible debt, which we seek advice from because the BTC Score of our debt. At $25,000 BTC, it could be 2.0x,” the submit learn.

In response to the agency, even when Bitcoin have been to fall to $74,000, its common value foundation, the worth of its BTC reserves, would nonetheless be 5.9 instances larger than its convertible debt. In a deeper downturn, with Bitcoin at $25,000, the assets-to-debt ratio would stay at 2.0x.

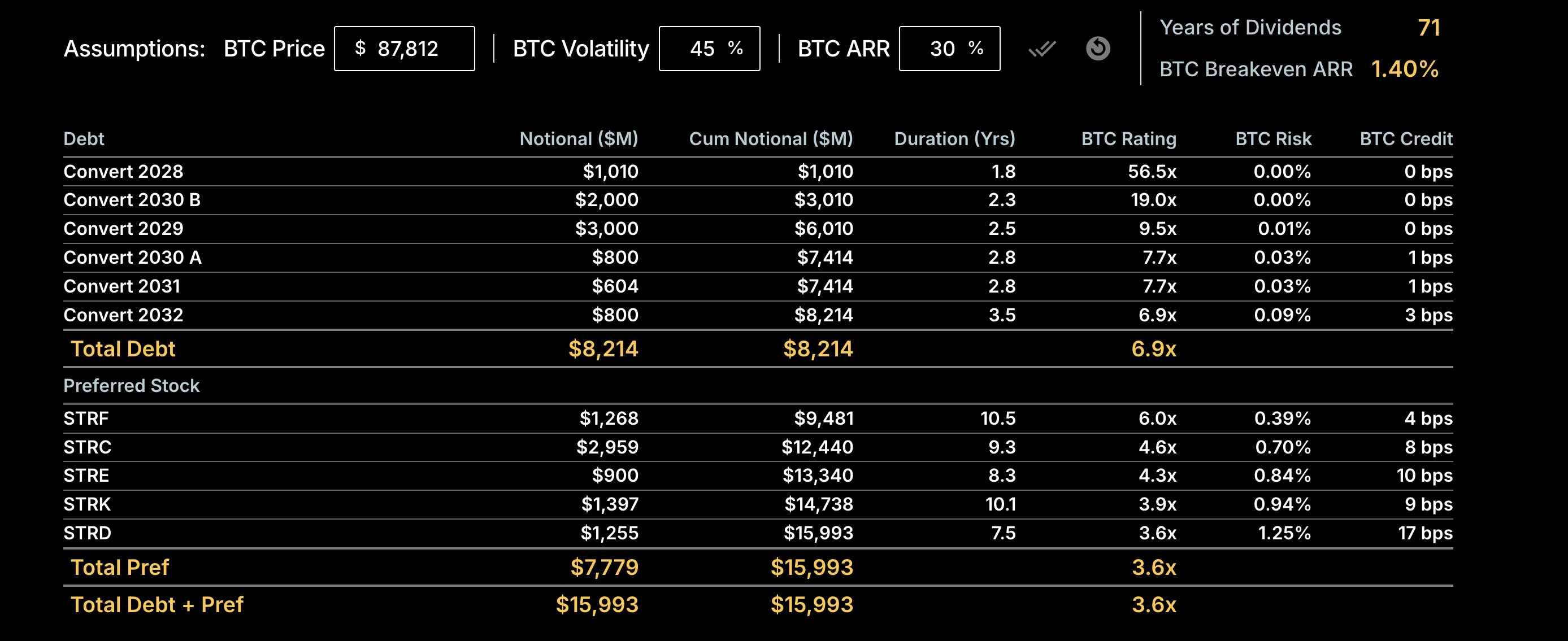

Based mostly on the present Bitcoin worth of $87,812, the corporate reveals a notably sturdy asset-to-liability profile. In response to the credit score dashboard, Technique carries $8.214 billion in whole convertible debt with maturities spanning 2028 to 2032.

Most of those convertible notes exhibit exceptionally excessive BTC Score, starting from 7x to greater than 50x. The BTC Score for whole convertible debt stands at 6.9x.

Sponsored

Beneath the debt layer, the corporate holds $7.779 billion in most well-liked inventory throughout 5 sequence (STRF, STRC, STRE, STRK, STRD). These have longer common durations, many operating 8 to 10 years or extra. Furthermore, they carry barely larger threat profiles than the senior debt stack.

The popular fairness carries a BTC Score of three.6x, indicating a stable, although thinner, collateral cushion relative to the corporate’s convertible debt. Mixed, the corporate’s whole obligations, debt plus most well-liked inventory, quantity to $15.993 billion.

On the present Bitcoin worth, these liabilities are supported by a consolidated BTC Score of three.6x, which means the corporate holds greater than three and a half instances the worth of its excellent obligations in Bitcoin-denominated belongings.

This means that the corporate is exceptionally well-capitalized, overcollateralized by a considerable BTC buffer, and extremely resilient to Bitcoin worth declines. This supplies it with important monetary stability and strategic flexibility.

In response to the information from SaylorTracker, Technique holds 649,870 BTC valued at $56.99 billion, making it the biggest company holder globally.

Sponsored

Technique Confronts Market Slide and Index Uncertainty

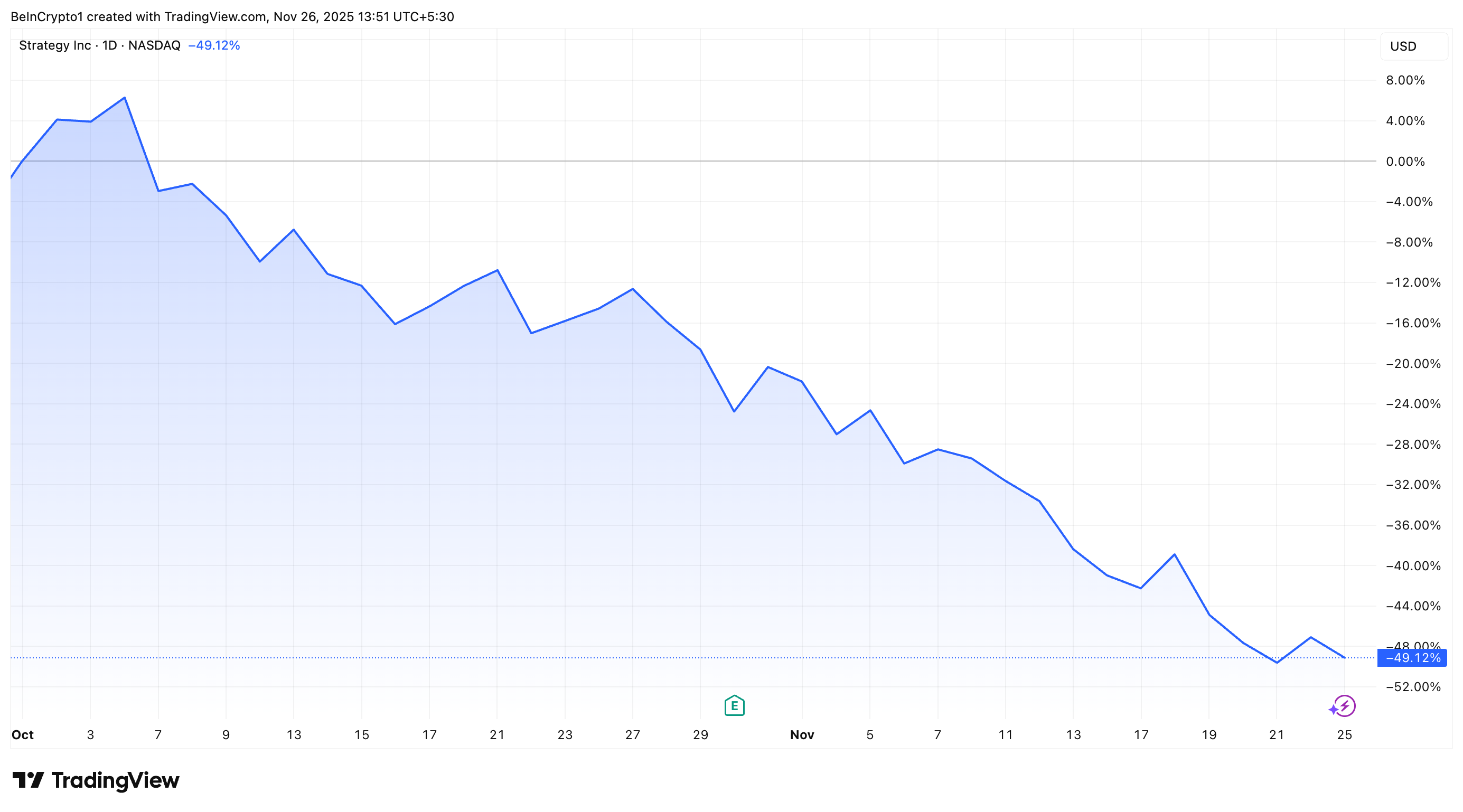

Notably, this revelation comes at a time when the agency has been underneath appreciable strain. MSTR shares have fallen by greater than 49% since early October, buying and selling at ranges final seen in late 2024.

Technique additionally faces heightened scrutiny from MSCI. It’s contemplating a criterion that may exclude firms the place digital belongings make up 50% or extra of whole belongings.

Sponsored

A call is predicted by January 15, 2026. JPMorgan analysis estimates potential outflows may surge as excessive as $8.8 billion if extra index suppliers undertake related guidelines. In response to the financial institution,

“With MSCI now contemplating eradicating MicroStrategy and different digital asset treasury firms from its fairness indices…outflows may quantity to $2.8bn if MicroStrategy will get excluded from MSCI indices and $8.8bn from all different fairness indices if different index suppliers select to comply with MSCI.”

The corporate was additionally overlooked of the S&P 500, lacking one other key alternative. Including to the challenges, after six consecutive weeks of Bitcoin purchases, the agency has damaged its shopping for streak. This comes because the mNAV premium has collapsed towards close to parity.

Nonetheless, the agency is making different strategic strikes. Blockchain intelligence agency Arkham reported that Technique transferred a few of its belongings from Coinbase to Constancy Custody. This displays a plan to separate custodial threat between a number of regulated suppliers.

“Technique (MSTR) has been diversifying custodians away from Coinbase, and has moved 58,390 Bitcoin (at the moment: $5.1 Billion) to Constancy Custody over the previous 2 months….with a complete of 165,709 BTC ($14.50 billion) despatched to Constancy Custody,” Arkham said.

Thus, regardless of mounting market strain, index uncertainty, and a pointy decline in its inventory worth, Technique stays closely overcollateralized and structurally resilient. Its Bitcoin-backed steadiness sheet continues to supply a considerable buffer towards volatility. On the identical time, ongoing efforts to diversify custodial threat sign an organization’s positioning for long-term stability, even in a difficult atmosphere.