The crypto market is exhibiting its first significant restoration after a harsh November sell-off, and a number of other metrics now resemble the identical situations seen round Thanksgiving in each 2022 and 2023.

Bitcoin has reclaimed the $91,000 stage, ETH is again above $3,000, and the broader market has returned to a cautious inexperienced. This bounce comes as merchants enter an extended US vacation weekend that has traditionally set the tone for December.

Market Indicators Flip Constructive After Weeks of Worry

Worry and Greed Index knowledge reveals sentiment bettering from 11 final week to 22 as we speak, though it stays in “Excessive Worry.”

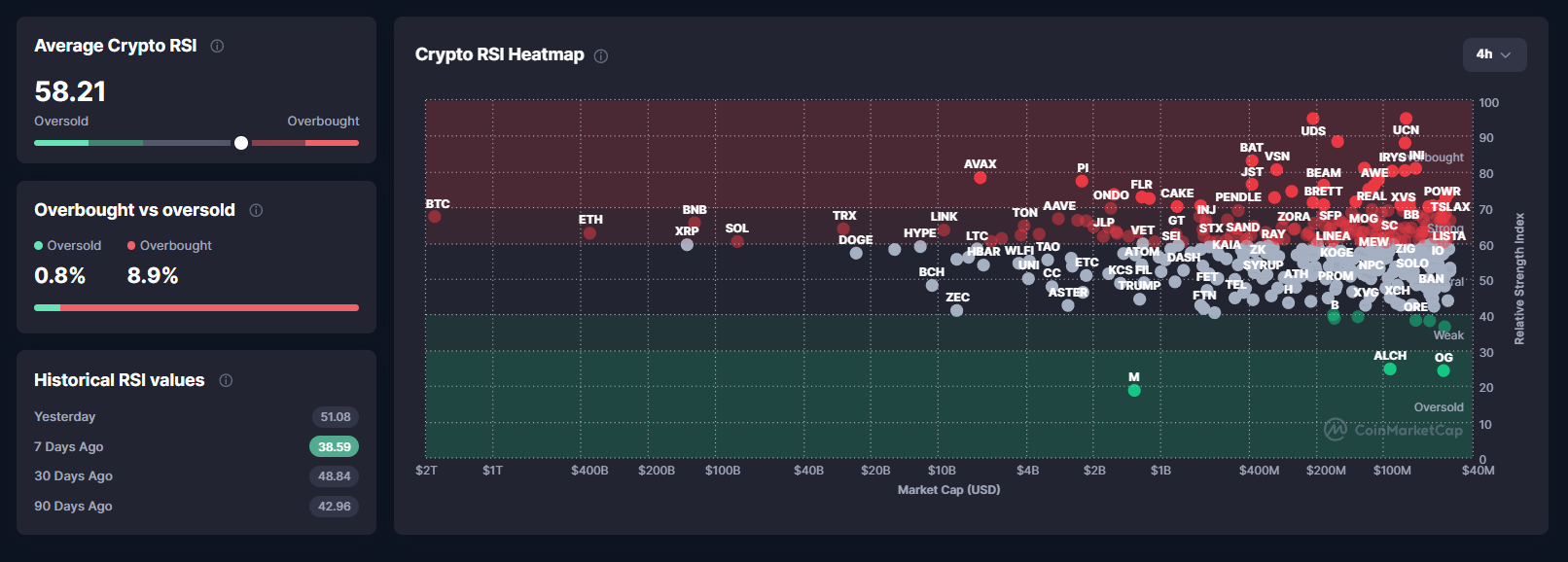

This shift aligns with a gentle rise in common crypto RSI, which climbed from 38.5 seven days in the past to 58.3 as we speak. The studying indicators rising power after deep oversold situations earlier within the month.

Sponsored

Sponsored

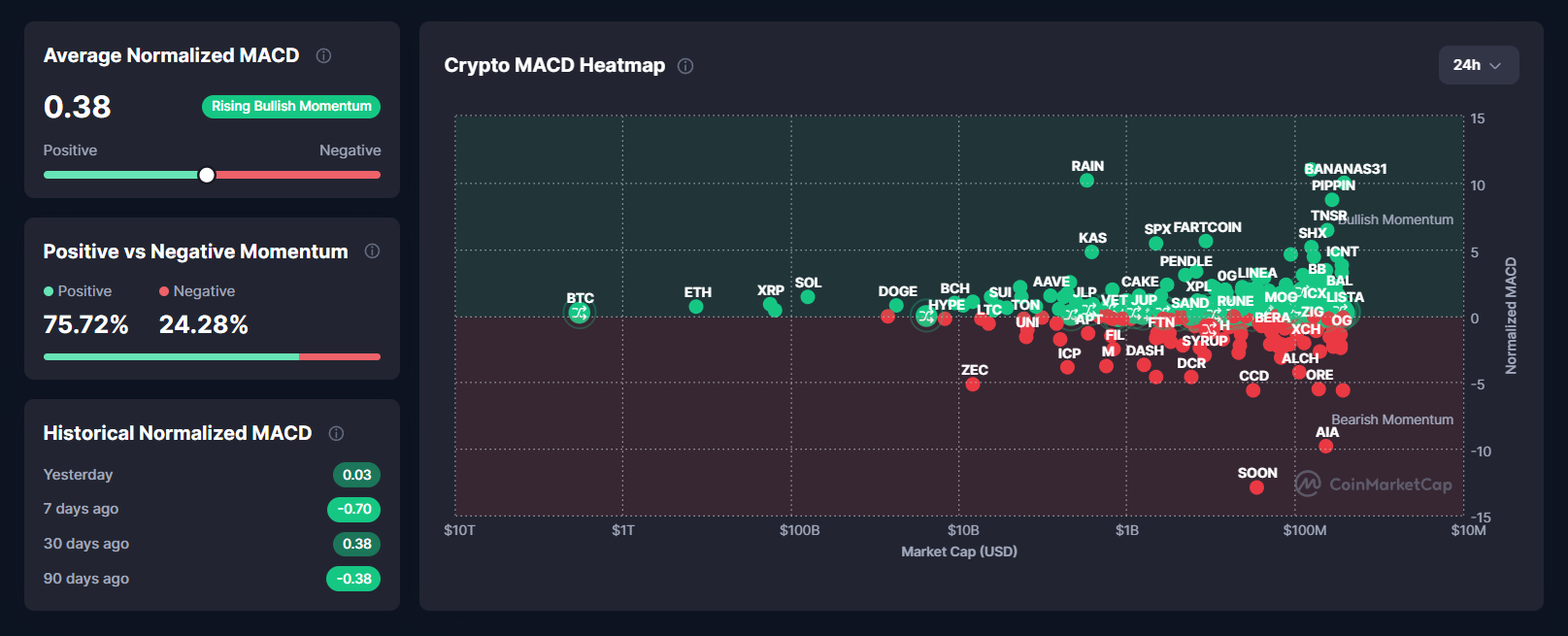

Momentum additionally flipped. The normalized MACD throughout main property has turned optimistic for the primary time since early November.

About 82% of tracked cryptocurrencies now present optimistic development momentum. Bitcoin, Ethereum, and Solana seem within the bullish zone of CoinMarketCap’s MACD heatmap.

Worth motion helps this shift. Bitcoin is up 6% on the week. Ethereum has gained practically 8%. Solana climbed virtually 8% in the identical interval.

The market cap has grown to $3.21 trillion, rising 1.1% over the past 24 hours.

A Acquainted Publish-Thanksgiving Setup Has Emerged

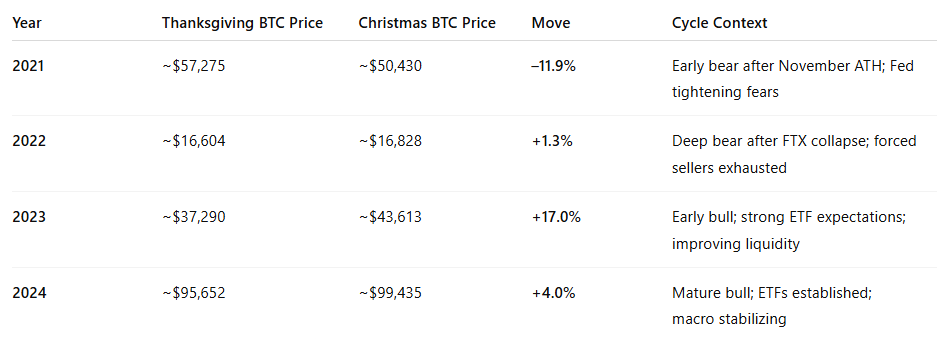

The present restoration mirrors a construction seen twice earlier than. In each 2022 and 2023, the market entered Thanksgiving after a pointy drawdown after which stabilized into December.

In 2022, Bitcoin fell to close $16,000 following the FTX collapse. By Thanksgiving, promoting stress had exhausted, and the market traded sideways into Christmas.

It was a deep bear consolidation part relatively than a rally.

Sponsored

Sponsored

In 2023, Bitcoin entered Thanksgiving at $37,000 after a steep September-October correction. Robust ETF expectations and bettering liquidity situations pushed BTC to $43,600 by Christmas. It was a basic early-bull December rally.

This 12 months, the sample once more repeats one acquainted ingredient: the November crash got here early, and by Thanksgiving, promoting momentum had eased.

Bitcoin’s 90-day Taker CVD has shifted from persistent promote dominance to impartial, signalling that aggressive sellers have stepped again. Funding charges and leverage knowledge assist the identical interpretation.

Liquidity Injury Nonetheless Shapes the Present Cycle

BitMine chairman Tom Lee described the market as “limping” after the October 10 liquidation shock.

He mentioned market makers had been compelled to shrink their stability sheets, weakening market depth throughout exchanges. That fragility persevered by means of November.

Sponsored

Sponsored

Nevertheless, Lee additionally argued that Bitcoin tends to make its largest strikes in brief bursts when liquidity recovers. He expects a robust December rally if the Federal Reserve indicators a softer stance.

On-chain knowledge aligns with this view. Nexo collateral figures present customers nonetheless choose borrowing towards Bitcoin relatively than promoting it.

BTC makes up greater than 53% of all collateral on the platform. This habits suppresses fast promote stress, serving to stabilize spot markets. But it surely additionally provides hidden leverage that might amplify future volatility.

We Could Be Coming into a Two-Yr Vacation Sample

Three elements now look much like the post-Thanksgiving situations of 2022 and 2023:

- Vendor exhaustion: Taker CVD shifting to impartial indicators the tip of compelled promoting for now.

- Momentum restoration: MACD and RSI metrics have reversed sharply after bottoming earlier in November.

- Liquidity stabilization: Market makers are nonetheless wounded, however volatility has cooled, and ETF outflows have slowed.

If this sample continues, December might produce one in every of two outcomes based mostly on the final two years:

Sponsored

Sponsored

- A sideways consolidation like 2022 if liquidity stays skinny.

- A brief, sharp rally like 2023 if macro situations flip supportive.

The deciding issue will doubtless be the Federal Reserve’s tone in early December and the habits of Bitcoin ETF flows. Skinny liquidity means even average inflows might transfer costs rapidly.

December Could Ship a Giant Transfer in Both Path

The market has entered a transition part relatively than a transparent development. Sentiment continues to be extraordinarily fearful, however worth and momentum indicators present restoration.

Bitcoin’s place above $91,000 suggests patrons are keen to defend key ranges, but order-book depth stays weak.

With promoting stress fading and technical momentum rising, the atmosphere now resembles the identical post-Thanksgiving setups that marked the final two end-of-year cycles.

If the sample holds, December won’t be flat. It should doubtless convey a decisive transfer as liquidity situations shift.

The course, nevertheless, will rely much less on crypto narratives and extra on macro indicators and ETF demand within the coming weeks.