On-chain knowledge reveals trade inflows associated to Bitcoin and Ethereum have shot up alongside the current downturn available in the market.

Bitcoin & Ethereum Have Seen Excessive Trade Inflows Throughout Previous Week

In a brand new put up on X, on-chain analytics agency CryptoQuant has mentioned in regards to the newest pattern within the Trade Influx for Bitcoin and Ethereum. The “Trade Influx” right here refers to an indicator that measures the entire quantity of a given asset (in USD) that’s getting into into the wallets linked to centralized exchanges.

When the worth of this metric is excessive, it means buyers are making giant deposits to those platforms. Typically, holders switch their cash to exchanges after they wish to use one of many providers that they supply, which may embrace promoting. As such, a pointy spike within the metric could be a sign that there’s demand for buying and selling away the asset.

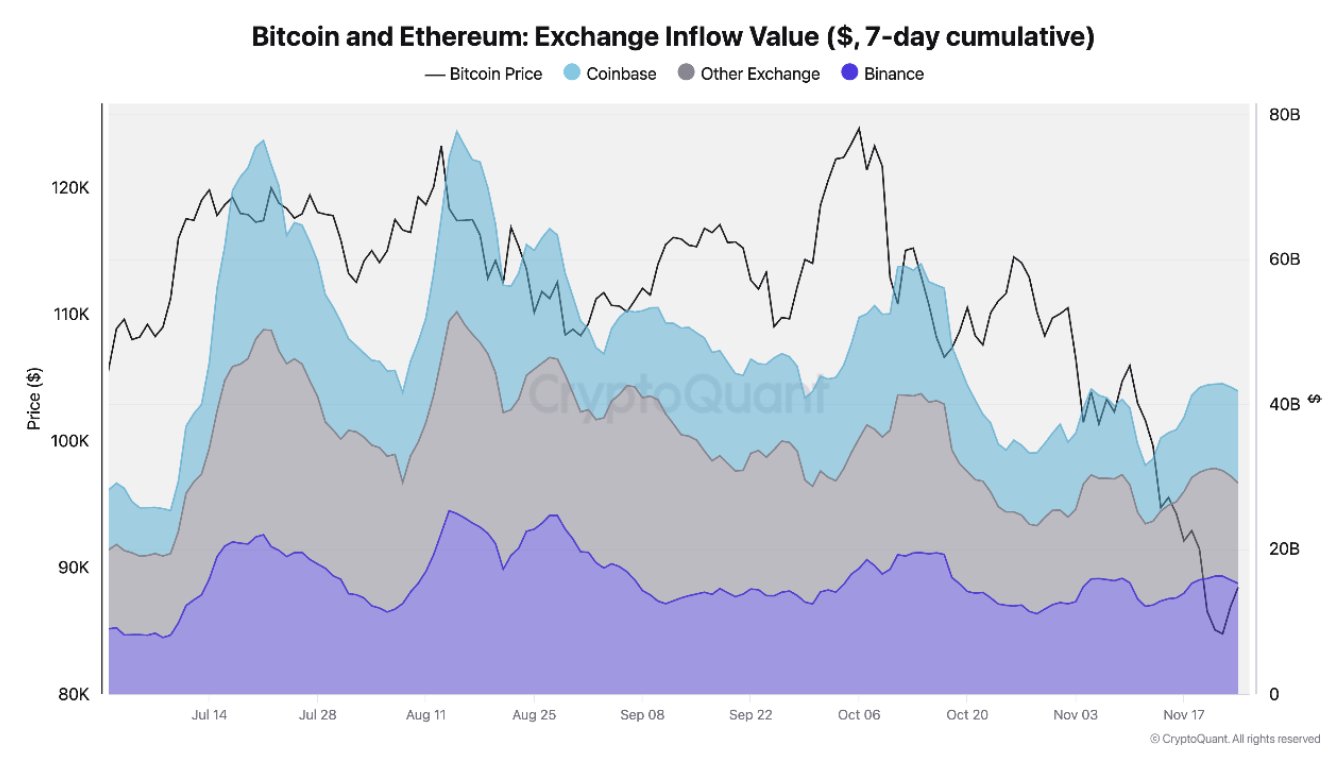

Now, right here is the chart shared by CryptoQuant that reveals the pattern within the mixed 7-day cumulative Trade Influx for Bitcoin and Ethereum over the previous few months:

The worth of the metric seems to have spiked on the totally different exchanges | Supply: CryptoQuant on X

As displayed within the above graph, the Bitcoin and Ethereum Trade Influx has seen its 7-day cumulative worth surge above $40 billion just lately. Given the worth motion of the previous week, these deposits have been seemingly made for distribution and contributed to the crash.

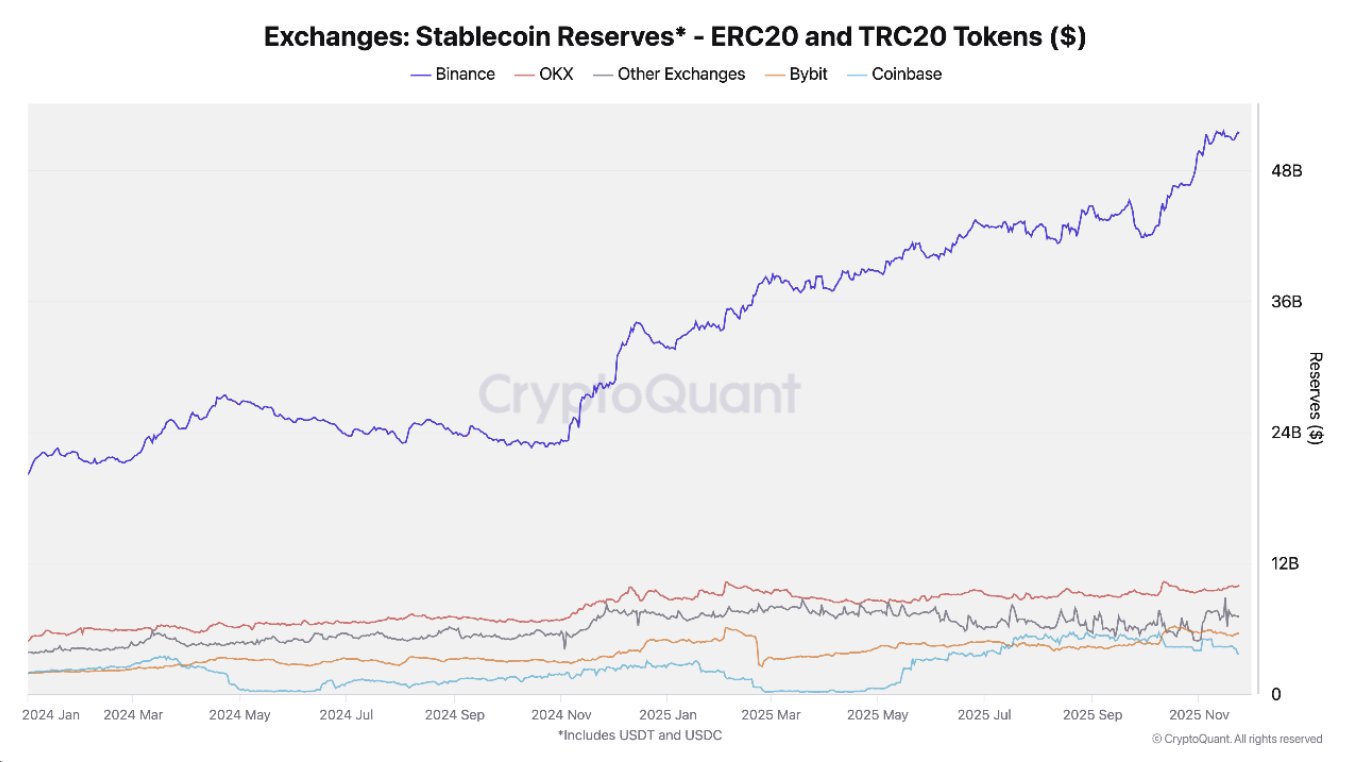

BTC and ETH aren’t the one cryptocurrencies which have seen inflows just lately, nevertheless; stablecoins have additionally entered into exchange-associated addresses. Not like BTC and ETH, although, these fiat-pegged cash haven’t witnessed a uniform pattern throughout the totally different platforms.

The pattern within the stablecoin Trade Reserve for the assorted exchanges | Supply: CryptoQuant on X

Within the above chart, knowledge for the stablecoin Trade Reserve is proven for the totally different centralized exchanges. This indicator retains monitor of the entire quantity of stables which might be presently sitting in trade wallets.

It could seem that this metric has damaged away from the remaining for Binance just lately, implying buyers have been selecting to deposit their cash to the platform over some other. “Binance’s stablecoin reserves simply hit a document $51.1B, the best in its historical past,” famous the analytics agency.

Like for BTC and ETH, stablecoin trade deposits additionally recommend that there’s demand for buying and selling away the property, however of their case, the implication for the market is a bit totally different. Merchants typically deploy these tokens on exchanges after they wish to swap them for a risky cryptocurrency like BTC.

Thus, whereas Bitcoin and Ethereum inflows could be bearish for the market, stablecoin deposits generally is a optimistic signal as a substitute.

BTC Value

On the time of writing, Bitcoin is buying and selling round $90,000, up greater than 2% during the last week.

Seems like the worth of the coin has shot up within the final 24 hours | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.