Be a part of Our Telegram channel to remain updated on breaking information protection

The Nasdaq Worldwide Securities Change (ISE) has filed a proposal with the US Securities and Change Fee (SEC) to boost the place limits for choices on BlackRock’s iShares Bitcoin Belief (IBIT).

In a Federal Register discover, the trade requested that the restrictions on place sizes be elevated from 250,000 contracts per aspect to at least one million. This is able to place the US spot Bitcoin ETF (exchange-traded fund) in the identical liquidity tier as main international fairness benchmarks comparable to iShares MSCI Rising Markets (EEM) and iShares China Giant-Cap ETF (FXI).

The request to extend the restrict to at least one million contracts follows Nasdaq’s request in January to boost the ceiling from 25,000 to 250,000 as IBIT was nicely above the buying and selling quantity minimal of 100 million shares to qualify.

The proposal additionally comes as BlackRock’s IBIT has develop into the biggest venue for Bitcoin choices open curiosity, even surpassing Deribit.

Good catch.. new proposal to boost place limits on IBIT optons to 1 million contracts. They only raised the restrict to 250,000 (from 25,000) in July. $IBIT is now the most important bitcoin choices market on the earth by open curiosity. https://t.co/oxaUtP9Kyc

— Eric Balchunas (@EricBalchunas) November 26, 2025

The SEC just isn’t soliciting public feedback on the rule change.

Nasdaq ISE Says Present IBIT Limits Prohibit Market Makers And Institutional Desks

Place limits exist to stop anybody investor from controlling too many possibility contracts on the identical inventory, which thereby reduces the danger of manipulative schemes that might impression inventory costs.

Nonetheless, ISE mentioned that IBIT has posted sturdy and accelerating choices volumes all through this 12 months, and added that the present ceiling now restricts market makers and institutional desks who depend on choices hedging and yield methods.

In its Federal Register discover, the trade mentioned that it “expects continued choices quantity development in IBIT as alternatives for buyers to take part within the choices market enhance and evolve.”

In its submitting, ISE included an in depth evaluation of a number of of IBIT’s market statistics comparable to its capitalization, common day by day quantity, and liquidity to ETFs that already help a million contract limits.

Close to the danger of market manipulation, ISE additionally famous that even a completely exercised a million contract place would solely equal round 7.5% of IBIT’s whole float. It additionally solely equates to about 0.284% of all Bitcoin in existence. ISE subsequently argued that this scale poses little threat of market disruption.

Along with the request for elevated limits on place sizes for IBIT, ISE is in search of to take away place and train limits for bodily settled FLEX IBIT choices as nicely. This is able to align the choices with commodity-based ETFs comparable to SPDR Gold Belief (GLD).

FLEX contracts are common amongst massive funds who use the devices for customized hedges and structured exposures.

JPMorgan Gives Buyers A Likelihood To Revenue Massive By means of IBIT

IBIT has develop into a well-liked car for conventional buyers to realize publicity to crypto by way of regulated funding merchandise. Whereas there are different US spot Bitcoin ETFs out there, IBIT is the biggest when it comes to cumulative inflows.

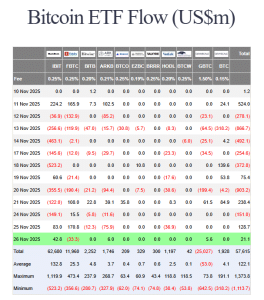

Farside Buyers knowledge reveals that IBIT has seen $62.680 billion in whole inflows since its launch in early 2024. The second-biggest fund on this regard is Constancy’s FBTC with $11.960 billion cumulative inflows.

Earlier this week, Wall Road banking large JPMorgan filed a prospectus with the SEC for a structured word that enables buyers to wager on the longer term worth of Bitcoin utilizing IBIT.

JPMorgan’s proposed instrument will set a selected worth stage for BlackRock’s IBIT fund subsequent month. In roughly a 12 months, if IBIT is buying and selling at a worth equal to or higher than the set worth, the notes can be robotically referred to as. Buyers will then additionally obtain a assured minimal return of 16%.

Nonetheless, if IBIT’s worth is decrease than the set worth a 12 months from when the benchmark worth is ready subsequent month, the notes won’t be referred to as. Collaborating buyers will then should trip the funding out till 2028.

Ought to IBIT surpass JPMorgan’s subsequent set worth by the top of 2028, buyers will earn 1.5x on their funding with no cap. Which means that if Bitcoin’s worth surges in 2028, buyers will stand to earn a hefty return.

JPMorgan will even supply buyers up 30% draw back safety up till 2028.

Within the newest buying and selling session, IBIT’s worth jumped over 2%, knowledge from Google Finance reveals.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection