Ripple’s USD-backed stablecoin RLUSD has entered a brand new section of institutional development after being formally acknowledged by Abu Dhabi’s Monetary Companies Regulatory Authority (FSRA). This milestone unlocks regulated use inside the Abu Dhabi International Market (ADGM).

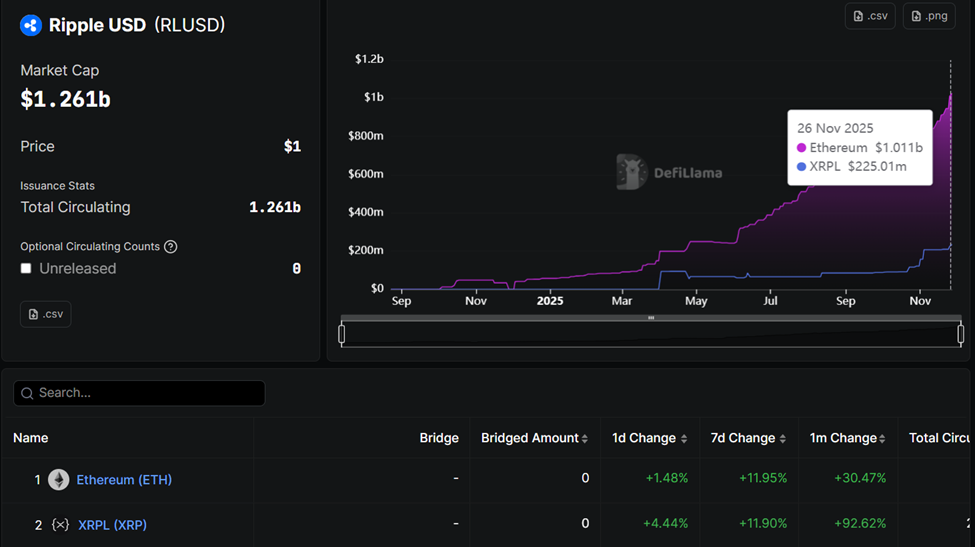

It coincides with RLUSD reaching a brand new all-time-high market capitalization of $1.261 billion in November, setting the stage for potential entry into the highest 5 international stablecoins.

ADGM Approval Unlocks Regulated Institutional Use for RLUSD

On November 27, Ripple introduced that RLUSD has been greenlisted by Abu Dhabi’s FSRA. This growth permits the stablecoin’s use as:

Sponsored

Sponsored

- Collateral on exchanges,

- For lending, and

- On prime brokerage platforms inside ADGM, which is Abu Dhabi’s worldwide monetary middle.

The popularity classifies RLUSD as an Accepted Fiat-Referenced Token, permitting any FSRA-licensed establishment to make use of it in regulated actions. Notably, nevertheless, that is contingent on the establishments assembly all firm-level compliance obligations.

The transfer follows the FSRA’s updates to its Digital Asset Regulatory Framework earlier this 12 months, designed to speed up institutional adoption whereas imposing strict oversight.

“The FSRA’s recognition of RLUSD as a Fiat-Referenced Token reinforces our dedication to regulatory compliance and belief – two non-negotiables relating to institutional finance,” learn an excerpt within the announcement, citing Jack McDonald, Senior Vice President of Stablecoins at Ripple.

With the brand new designation, RLUSD can now function regulated settlement collateral. It may well additionally assist lending flows and combine into prime brokerage channels working below ADGM oversight.

This positions the stablecoin for extra enlargement throughout one of many world’s most energetic digital-asset monetary hubs.

Sponsored

Sponsored

Market Cap Hits $1.261 Billion as Institutional Minting Accelerates

In the meantime, DefiLlama knowledge exhibits RLUSD’s market capitalization has surged previous $1.26 billion, with vital on-chain development throughout each Ethereum and the XRP Ledger (XRPL).

Ethereum hosts roughly 1.011 billion RLUSD, up over 30% this month, whereas XRPL issuance climbed 92.6% to 225 million RLUSD.

This development is especially notable given RLUSD’s institutional-only minting mannequin. Retail customers can not mint the stablecoin as issuance happens completely to certified establishments.

Whereas this development is notable, particularly on Ethereum, considerations rise about XRP’s function in stablecoin adoption. Regardless of Ripple’s framing of XRPL because the core infrastructure for RLUSD, new issuances since early 2025 have virtually completely launched on Ethereum.

To place it plainly, RLUSD’s Ethereum-heavy footprint challenges Ripple’s narrative that XRPL stays the spine of its ecosystem.

Sponsored

Sponsored

“An extended-time XRP holder found that RLUSD lives on Ethereum. He was in awe and puzzled what the purpose of Ripple was. He later swapped his XRP for LINK and ETH,” wrote person jfab.eth.

Nonetheless, the tempo of institutional adoption has not gone unnoticed. Analyst X Finance Bull highlighted that greater than 100 million RLUSD has been minted on the XRPL in November alone.

“These are actual transactions, actual settlements, and actual capital flows. On-chain. Permissionless. International,” they wrote.

The agency backing RLUSD, as issued below a New York DFS Restricted Function Belief Constitution, supplies full 1:1 USD backing by way of:

- Excessive-quality liquid belongings,

- Third-party attestations,

- Strict reserve segregation, and

- Outlined redemption rights.

Such constructions are important for approvals in tightly regulated markets just like the UAE.

Sponsored

Sponsored

Analysts Say Prime-5 Entry is Inside Attain

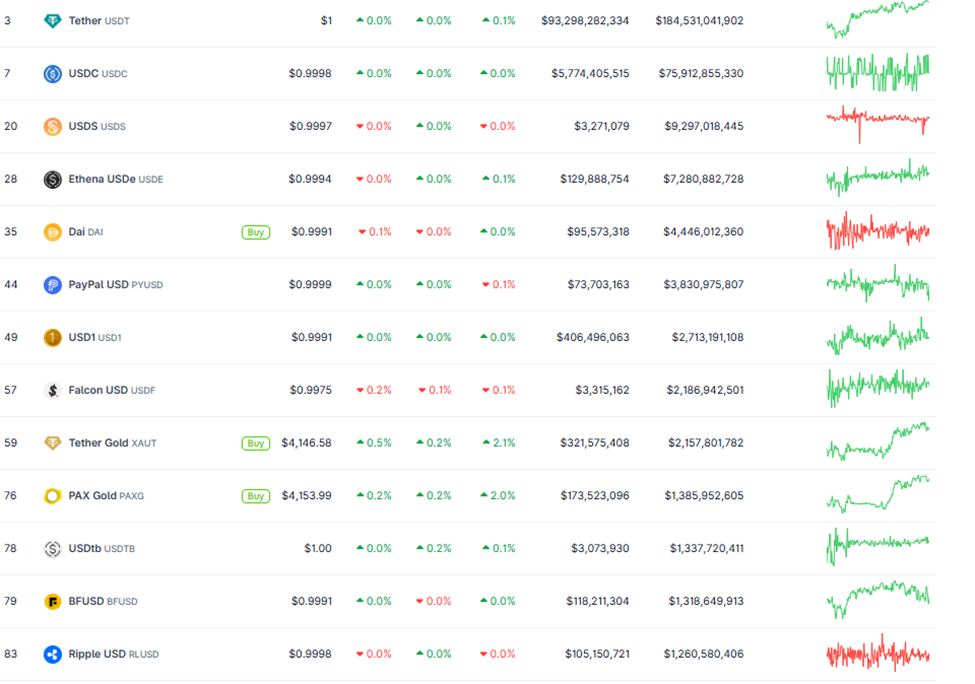

Towards this backdrop, analysts say top-five entry is inside attain for RLUSD amongst main stablecoins on market cap metrics.

RLUSD at present ranks thirteenth amongst stablecoins by market capitalization, based on CoinGecko. To interrupt into the higher tier, RLUSD would want to surpass MakerDAO’s DAI ($4.44 billion).

With institutional companions ramping up utilization and new approvals rising throughout the Center East, that milestone is more and more believable.