Bitcoin could also be approaching a decisive December as liquidity situations tighten and on-chain metrics shift. BitMine Chairman Tom Lee says the market has been “limping” for the reason that October 10 liquidation shock, however argues the setup now helps a serious transfer earlier than year-end.

Current on-chain developments and exchange-collateral information level to related stress constructing beneath the floor.

Liquidity Harm Nonetheless Defines the Market

Lee advised CNBC that the October occasion severely broken market-maker stability sheets.

Sponsored

Sponsored

He described these corporations because the “central banks” of crypto, accountable for depth, spreads, and stock. When their stability sheets shrink, liquidity contracts for weeks.

This matches market efficiency since early October. Bitcoin has dropped nearly 30% from its $126,000 peak.

In the meantime, November has delivered one of many worst month-to-month performances for each value and ETF flows in years.

Market makers withdrew threat capital after the liquidation wave erased roughly $19 billion of leveraged positions.

Order-book depth fell sharply throughout main exchanges, creating air pockets that amplified draw back strikes. Beneath such situations, Bitcoin and Ethereum are likely to react earlier to macro stress than equities.

Regardless of this harm, Lee expects a robust December rally, citing a possible dovish shift from the Federal Reserve.

“Bitcoin makes its finest strikes in 10 days yearly, I feel a few of these days are nonetheless gonna occur earlier than 12 months finish,” mentioned Tom Lee.

Sponsored

Sponsored

On-Chain Metrics Present Sellers Dropping Management

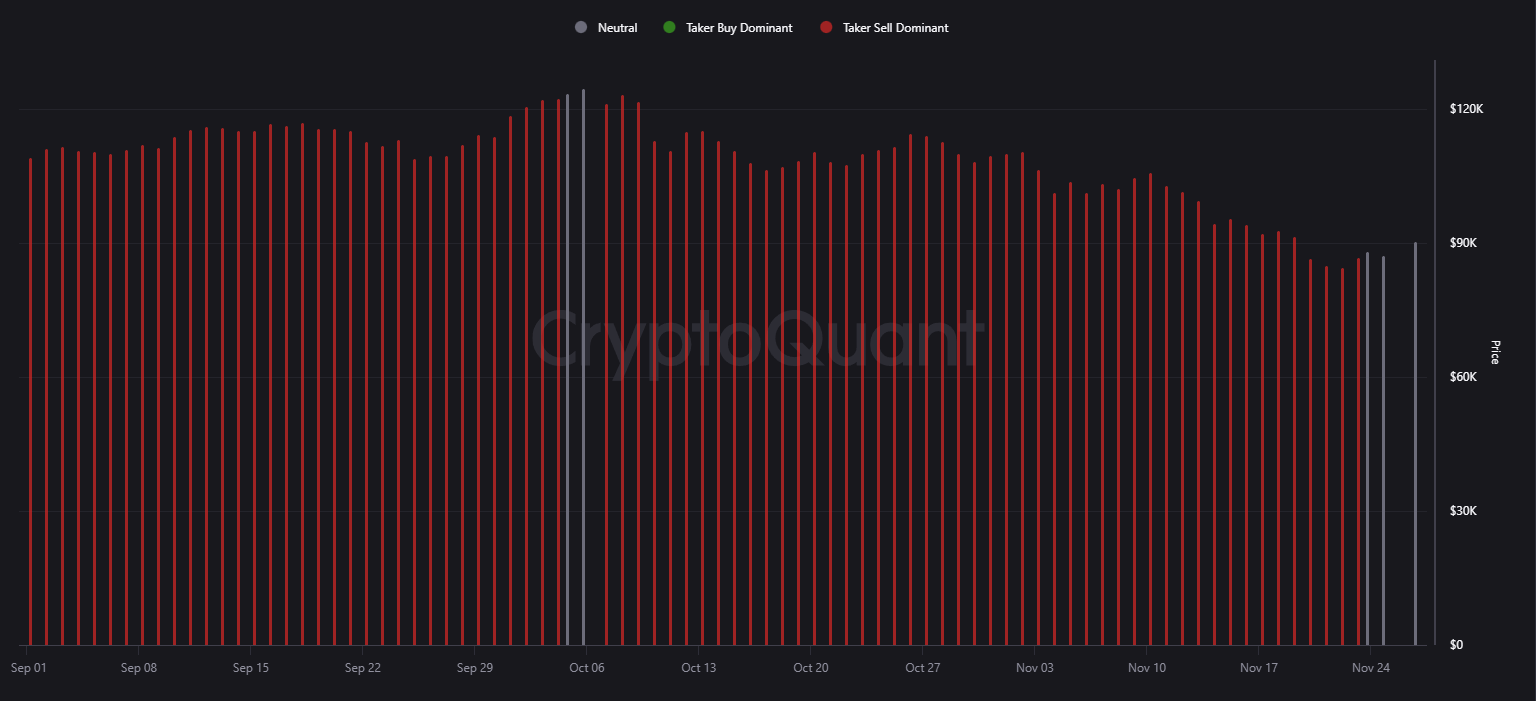

Bitcoin’s 90-day Spot Taker CVD has shifted from persistent promote dominance to a impartial stance. The indicator tracks aggressive market orders on spot exchanges.

Pink bars dominated from early September by mid-November, displaying sustained taker-sell stress.

The latest transfer to impartial marks a break in that sample. It suggests the aggressive promoting section has exhausted.

Nevertheless, it doesn’t present robust purchaser dominance. As a substitute, the market has entered a balanced section typical of late-cycle bear markets.

Value stays properly under October ranges, however the absence of persistent taker-sell stress indicators improved stability.

The shift aligns with the broader leverage reset seen in futures markets, the place funding charges have moved close to zero.

Sponsored

Sponsored

Borrowing Tendencies Level to Robust Fingers, however Fragile Leverage

CryptoQuant information exhibits Nexo customers desire borrowing towards Bitcoin slightly than promoting it. BTC accounts for 53% to 57% of all collateral on the platform. That vary has held for months regardless of the drawdown.

This conduct reduces instant promoting stress. It additionally confirms that long-term holders proceed to deal with Bitcoin as their main liquidity supply.

But it provides one other layer of vulnerability. If Bitcoin drops additional, collateralized positions face liquidation threat.

Mixed with skinny order books, any compelled promoting might produce outsized volatility. This dynamic displays late-bear fragility slightly than early-bull power.

Sponsored

Sponsored

A Market Caught Between Exhaustion and Low Liquidity

Present market construction displays a transition slightly than a clear reversal. ETF outflows, broken liquidity, and macro uncertainty hold stress on costs.

Nevertheless, on-chain promoting has cooled, and structural holders proceed to defend positions.

The result’s an atmosphere the place small catalysts can produce giant strikes.

A dovish Fed pivot would probably hit skinny order books and speed up a rebound. One other macro shock might set off renewed deleveraging.

Lee’s view aligns with this setup. The market has stopped bleeding, nevertheless it stays fragile. Bitcoin has a historical past of delivering double-digit strikes in compressed durations, particularly after aggressive liquidations.

As December approaches, each liquidity situations and on-chain information counsel the following giant transfer is close to.

The path will rely upon macro indicators and ETF flows slightly than sentiment alone.