Kevin Hassett, head of the White Home Nationwide Financial Council, has all of the sudden turn into the market’s base case for the following Fed chair – and crypto buyers are already gaming out what a “Hassett Fed” would imply. In response to Bloomberg-sourced reporting, Hassett has “emerged because the frontrunner” for President Donald Trump’s selection to guide the Federal Reserve, seen because the candidate most aligned with Trump’s desire for decrease rates of interest. Earlier disclosures confirmed Hassett beforehand served as an adviser to Coinbase and holds not less than $1 million in Coinbase inventory.

How Will Hassett Influence The Crypto Market?

For crypto allocators, that mixture of macro dovishness and direct publicity to a significant US change is the core of the bull case. Bitwise senior funding strategist Juan Leon put it bluntly on X: “If Kevin Hassett turns into Fed Chair, the implications for crypto are strongly bullish.” He calls Hassett an “aggressive ‘dove’ who has publicly criticized present charges for being too excessive and advocated for deeper, quicker cuts,” highlighting that he “served on Coinbase’s advisory board and owns massive stake in COIN,” and that he “led the White Home digital asset working group to form pro-crypto regulation.”

Associated Studying

However the potential Hassett regime can’t be separated from Treasury Secretary Scott Bessent’s rising blueprint for the Fed. Bessent has been overtly questioning the post-crisis working framework. As Walter Bloomberg relayed from his CNBC look, “BESSENT ON FED: ‘AMPLE RESERVES REGIME’ MIGHT BE FRAYING.”

Ahead Steering host Felix Jauvin summarized the course of journey in a put up: “Bessent needs a fed chair that will get us out of stability sheet shenanigans and simplifying issues to how they had been pre-ample regime. Dovish FFR, hawkish stability sheet.” He added: “I don’t know if I can emphasize sufficient simply how far-off we’re from any form of QE copium.”

That framing issues for crypto. A Hassett Fed that cuts the coverage charge quicker in downturns is one factor; a return to full-blown quantitative easing is one other. A “dovish FFR, hawkish stability sheet” combine would nonetheless be a friendlier macro atmosphere than the post-2022 tightening cycle, however it’s not a assured repeat of the 2020–2021 liquidity wave that lifted each danger asset concurrently.

Fee cuts with out large-scale asset purchases assist danger urge for food and decrease low cost charges, but they don’t routinely recreate the intense “every thing rally” circumstances that many in crypto implicitly affiliate with Fed dovishness.

The political logic behind Hassett’s rise has been described most clearly by macro commentator EndGame Macro (@onechancefreedm). In a thread, he argues that “Hassett isn’t main as a result of he’s probably the most educational or probably the most central bankerish. He’s main as a result of he checks the packing containers Trump truly cares about.”

Associated Studying

Trump, he writes, needs somebody he already trusts, who has “spent years defending Trump publicly,” and who has been “overtly important of the Fed for being too gradual, too cautious, and too political.” In that framework, “markets hear dovish. Trump hears I can ship development once more. And crypto of us hear considered one of us.”

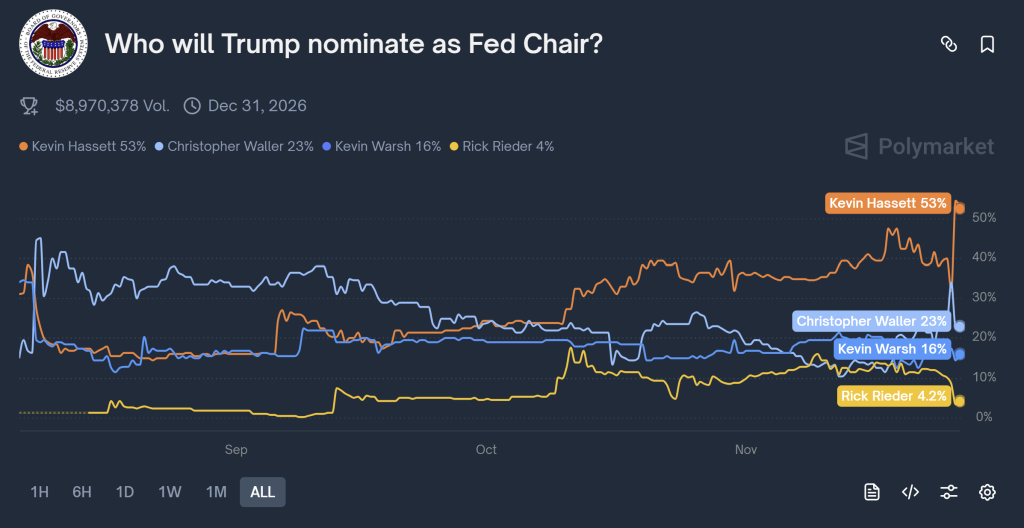

Markets are beginning to agree. On Polymarket, contracts monitoring the Fed chair race present Hassett round 53% at press time, reinforcing that shift from hypothesis to probabilistic base case.

Whether or not that interprets into a real “explosion” in crypto will rely much less on personalities than on the interplay of three forces: how aggressively a Hassett Fed truly cuts, how far Bessent is prepared to go in shrinking or simplifying the stability sheet, and the way markets reassess inflation, time period premia and monetary danger below a extra overtly political central financial institution.

The percentages market is signaling that crypto is transferring nearer to the middle of US financial energy. The dimensions of any transfer in 2026 will likely be decided by the cycle – and by how a Hassett-led Fed balances “dovish charges” with “hawkish stability sheet” in follow.

At press time, the whole crypto market cap stood at $2.96 trillion.

Featured picture created with DALL.E, chart from TradingView.com