- Crypto noticed roughly US$300B in inflows as U.S. liquidity improved and Treasury circumstances eased.

- Oversold technicals and cleared-out leverage created a cleaner setup for a robust rebound.

- Institutional and whale participation returned, serving to Bitcoin reclaim $90K and Ethereum break above $3K.

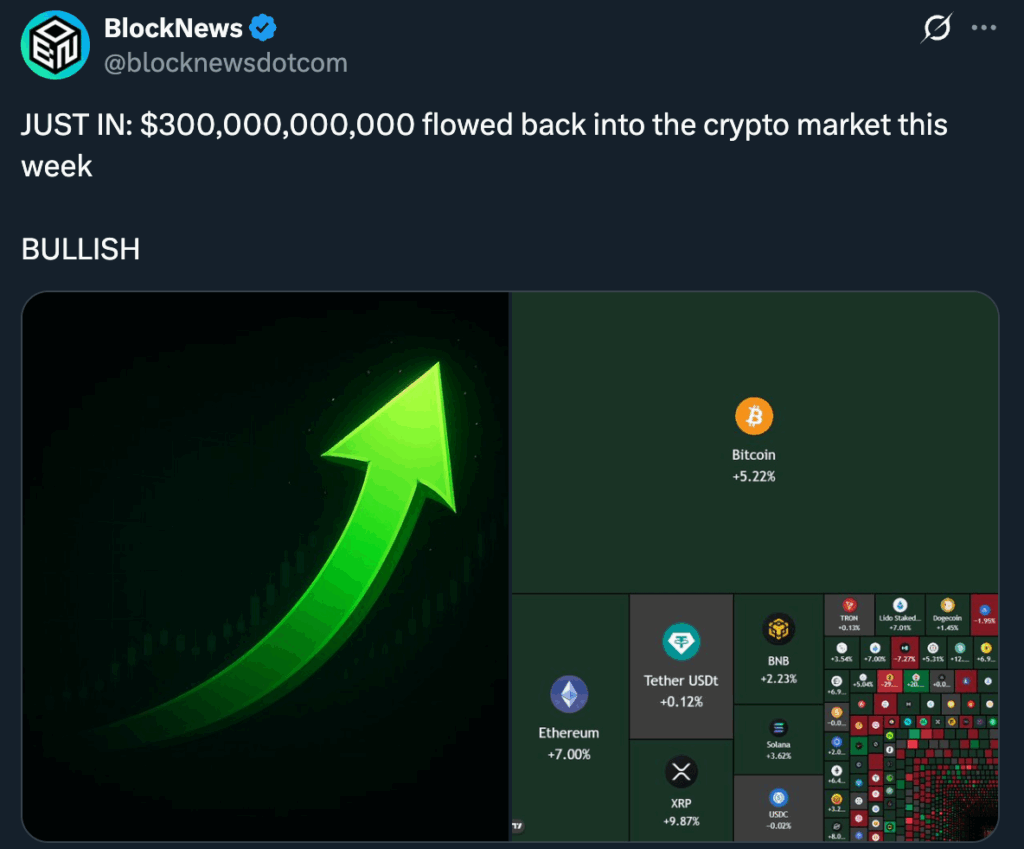

This previous week marked one of many strongest reversals the market has seen in months, with roughly US$300 billion flowing again into digital belongings. It got here proper after a number of weeks of aggressive promoting, leverage wipeouts, and panic-driven exits. The contemporary inflows helped stabilize costs that had been pushed far under fair-value zones, sparking a broader restoration throughout majors like Bitcoin and Ethereum. A giant a part of the turnaround got here from U.S. liquidity circumstances bettering — Treasury inflows and shifting expectations round financial coverage gave merchants confidence to rotate again into danger belongings, and crypto was one of many first beneficiaries.

Technical Reset + Oversold Circumstances

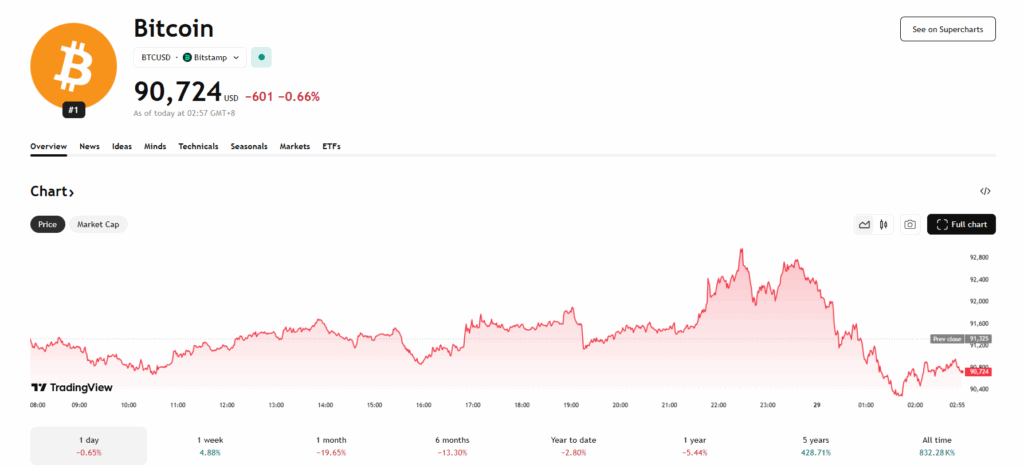

Momentum didn’t simply come from macro alerts. Many belongings had been deeply oversold, and the market had simply gone by way of one of many largest leverage flushes of the 12 months. Lengthy positions had been worn out, funding charges flipped deeply damaging, and compelled liquidations had cleared out numerous speculative extra. When Bitcoin pushed again above US$90,000 and Ethereum reclaimed the US$3,000 zone, it signaled that patrons had been lastly stepping in with out the burden of overwhelming leverage dragging costs decrease. With a cleaner backdrop, even reasonable shopping for was sufficient to set off robust upward strikes.

Establishments and Whales Step Again In

As soon as the preliminary rebound took form, bigger gamers started to re-enter the market. Institutional flows picked up, whale wallets turned energetic once more, and ETF demand returned after two tough weeks. This added gasoline to the restoration and helped reinforce the concept the downtrend could be shedding momentum. The transfer wasn’t explosive or euphoric — extra of a gradual return of strategic patrons who noticed engaging entries after the crash.

What Comes Subsequent

This bounce exhibits that crypto nonetheless has deep latent demand when circumstances shift, however sustaining it relies upon closely on macro stability. If liquidity retains loosening and main danger belongings stay supported, upside continuation could be very doable. If circumstances tighten once more or a macro shock hits, the rally might fade as rapidly because it arrived. For now, although, the market lastly has respiratory room — one thing it hasn’t had in weeks.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.