Galaxy Digital CEO Mike Novogratz says the October tenth crash in crypto was excess of a routine shakeout, claiming that roughly a 3rd of market makers in elements of the ecosystem have been successfully worn out.

“We had a flash crash and it did plenty of injury to the material of the market,” Novogratz informed Anthony Scaramucci on the first-ever episode of “All Issues Markets,” recorded November 26. “Even on Hyperliquid, the market makers, you already know, 30 % of them went out of enterprise. Acquired zeroed.”

Scaramucci framed the final 20 buying and selling days as one other brutal reminder of crypto’s structural volatility. “I do know I’ve a entice door on my portfolio,” he stated. “Infrequently I’ll be strolling throughout the lounge feeling lovely about myself. After which, growth, a entice door opens and I’ve fallen into the basement of the home.”

Associated Studying

In line with Novogratz, this explicit entice door opened at Binance. “It began actually by, you already know, at Binance, that they had an oracle which set value misfunction,” he stated. That error hit an artificial stablecoin and “created a cascade the place folks have been getting stopped out as a result of there was the flawed value.” The dislocation then bled into levered perpetual markets “like Hyperliquid, like Uniswap,” the place “as costs went down, folks began getting liquidated.”

He argued that the way in which crypto members use leverage turned a technical glitch right into a systemic occasion. “What folks don’t perceive about crypto is that the crypto investor doesn’t play for 10, 11, 12 % returns,” he stated. “Crypto investor name themselves degens with satisfaction. They need to flip one into 15. And they also commerce a really risky asset with plenty of leverage.”

Perpetual futures make that leverage notably harmful for liquidity suppliers. “Perpetual futures usually are not regular futures,” Novogratz stated, crediting “the genius that Arthur Hayes and his group of individuals” for a design the place “as longs get liquidated, they’re paired off towards shorts.” In a quick collapse, “you possibly can be quick and also you lose your quick place. Effectively, in case you’re lengthy on one other trade towards that quick place, you’re shit out of luck. And that occurred to plenty of market makers.”

Will The Crypto Market Get better?

The outcome, he stated, was a pointy lack of liquidity and retail capital. “We misplaced plenty of liquidity out there. We misplaced plenty of retail punters who misplaced their stack,” he famous, including that after such a wipeout “it takes some time for Humpty Dumpty to get put again collectively once more.”

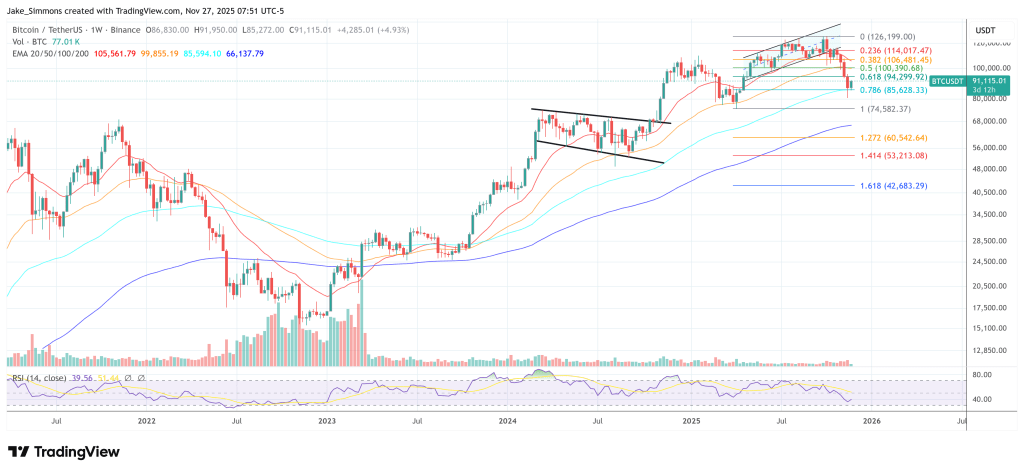

Novogratz stated he initially anticipated larger ranges to carry. “I really, to be truthful, thought we have been going to carry at larger ranges at $90,000,” he admitted. “And we went all the way in which to $80,000. $80,000 was a most ache level… Acquired to $1.80 on XRP. We acquired to $125 on Solana. Actual ache factors.”

He hyperlinks the next rebound to macro tailwinds, not healed sentiment. “Now we bounce up. We bounce due to the Fed. However we’re not out of the woods,” he stated. “I do suppose Bitcoin will climb again in the direction of $100,000 by the tip of the yr, however there’ll be sellers ready there. We’ve completed some medium-term injury to the psychology of the market.”

Associated Studying

On the spot facet, he highlighted huge profit-taking by early holders towards ETF-driven inflows. “We had one $9 billion vendor,” he stated. “That’s one-third of all of IBIT’s flows of the yr.” As US wealth channels transfer “from a zero weighting to a 3 to 4 % weighting” in Bitcoin, that “was met with OG sellers.” “In the long term, that’s wholesome,” he stated. “Within the quick run, that’s painful.”

Novogratz additionally argued that crypto is being repriced as an actual enterprise ecosystem fairly than a pure story. “It’s a transition from simply being a narrative — ‘we’re a very powerful business… we’re going to decentralize the world’ — to ‘present me what crypto really does,’” he stated. “Some companies are creating wealth. Some companies aren’t. There are some token ecosystems that make frequent sense to an investor and there’s some that each one really feel like they’re simply an affiliation.”

Overlaying all of it is a macro backdrop he views as more and more supportive. He known as the Fed’s latest indicators and plans to ease financial institution money necessities in repo “a monstrous liquidity growth that’s coming,” including that “they’re going to carry charges all the way down to 2 % within the subsequent 16 months” and that inflation will “creep larger,” implying destructive actual charges.

For crypto, the message is double-edged: structurally de-levered, with fewer market makers and wounded sentiment, however nonetheless tied to a world liquidity cycle that Novogratz believes is popping in its favor — as soon as Humpty Dumpty will get put again collectively once more.

At press time, Bitcoin traded at $91,115.

Featured picture from YouTube, chart from TradingView.com