Bitcoin has lately attracted a wave of consumers at a crucial assist space, driving a pointy rebound right into a short-term provide vary. Regardless of this restoration, the broader pattern stays bearish, and the most recent transfer ought to nonetheless be considered as a brief pullback until the worth can reclaim and consolidate above the $100K threshold.

Technical Evaluation

By Shayan

The Every day Chart

Bitcoin noticed significant buy-side curiosity across the $80K assist vary, triggering a powerful bounce. This response suggests ongoing accumulation at discounted costs whereas broader sentiment was dominated by worry and capitulation.

Nonetheless, a number of resistance layers stay overhead. The primary key stage sits close to the $96K pivot. If consumers set up acceptance above this area, a mid-range retest of $100K–$104K turns into doubtless.

Failure to reclaim this construction would maintain Bitcoin susceptible to a different deeper sweep of the $80K–$83K accumulation band, the place long-term consumers beforehand stepped in.

The 4-Hour Chart

Over current weeks, Bitcoin has been trending decrease, fueling widespread market worry. The newest surge, nonetheless, broke above the short-term descending trendline with conviction, signaling that demand is re-entering the market regardless of prior aggressive promoting.

But the restoration now meets a serious confluence of resistance:

– The $91K provide zone

– The descending yellow trendline, which has capped the worth all through the decline

This area is pivotal. A rejection right here might ship Bitcoin again towards the $80K assist. A profitable breakout, however, would doubtless drive the worth towards the $100K mark, shifting short-term momentum in favor of consumers.

On-chain Evaluation

By Shayan

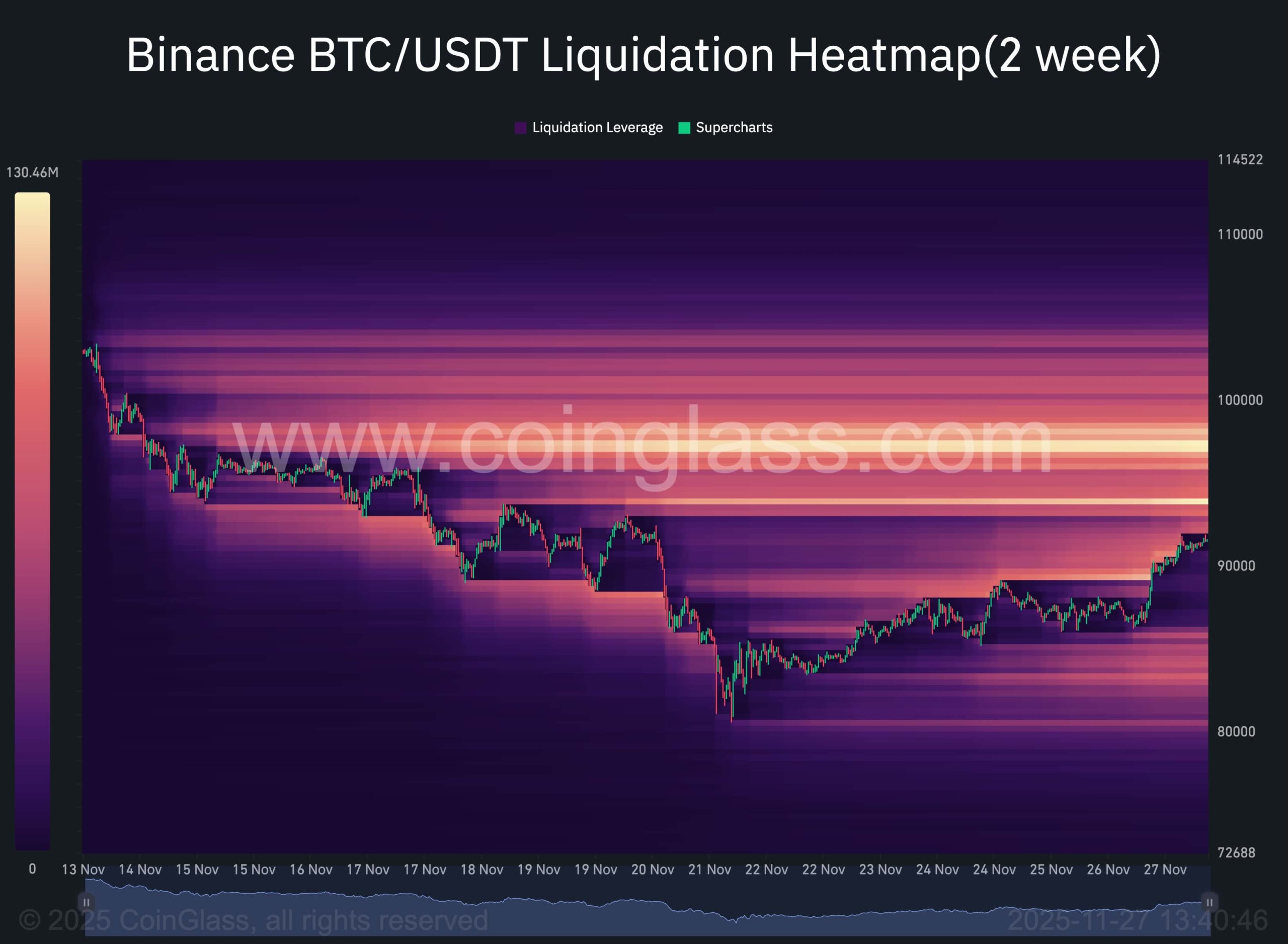

The two-week liquidation heatmap exhibits Bitcoin buying and selling instantly under a dense cluster of liquidation ranges, particularly beneath the $100K psychological zone. These pockets signify heavy concentrations of quick positions and compelled exits, created throughout the current unstable drop.

Traditionally, when the asset falls right into a deep liquidity vacuum under main clusters, the market usually overshoots to the draw back, solely to snap again aggressively as liquidity above value turns into the subsequent goal.

Under present ranges, the heatmap exhibits giant liquidity voids main into the $80K–$85K area, aligning with the main each day resolution zone. If Bitcoin revisits this space, how effectively the market absorbs these liquidity pockets will decide whether or not a sturdy macro low varieties.

With liquidity compressed above value and substantial unfilled pockets nonetheless sitting under, Bitcoin is approaching a crucial inflection level. A closing capitulation into the decrease demand zone stays potential, but traditionally, related liquidity-driven flushes have preceded highly effective restoration phases. As soon as exhausted, sellers are cleared from the market.

The put up Bitcoin Value Evaluation: Has BTC Flipped Bullish After Surging Previous $90K? appeared first on CryptoPotato.